Answered step by step

Verified Expert Solution

Question

1 Approved Answer

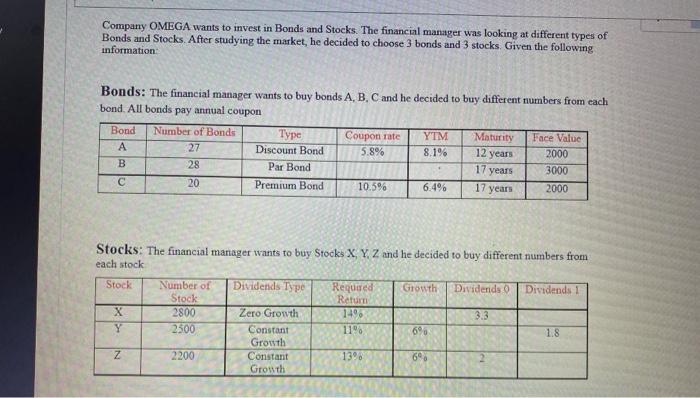

Company OMEGA wants to invest in Bonds and Stocks. The financial manager was looking at different types of Bonds and Stocks. After studying the

Company OMEGA wants to invest in Bonds and Stocks. The financial manager was looking at different types of Bonds and Stocks. After studying the market, he decided to choose 3 bonds and 3 stocks. Given the following information: Bonds: The financial manager wants to buy bonds A, B, C and he decided to buy different numbers from each bond. All bonds pay annual coupon Bond A B C Number of Bonds 27 28 20 X Y Z Number of Stock 2800 2500 Type Discount Bond Par Bond Premium Bond 2200 Dividends Type Coupon rate 5.8% Zero Growth Constant Growth Constant Growth 10.5% Stocks: The financial manager wants to buy Stocks X, Y, Z and he decided to buy different numbers from each stock Stock YTM 8.1% Required Return 14% 11% 13% 6.4% Growth 6% Maturity 12 years 17 years 17 years 6% Face Value 2000 3000 2000 Dividends 01 Dividends 11 1.8 Calculate the total amount of investment the company needs to buy the 3 bonds and the 3 stocks. Total Amount =

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Total amount 185385223200 408019 Calculated as Price of bonds Present value of coupon paid YTM par v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started