Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company TechGear Ltd. is a technology company that manufactures and sells smartphones. They are currently analyzing their financial structure to understand how changes in sales

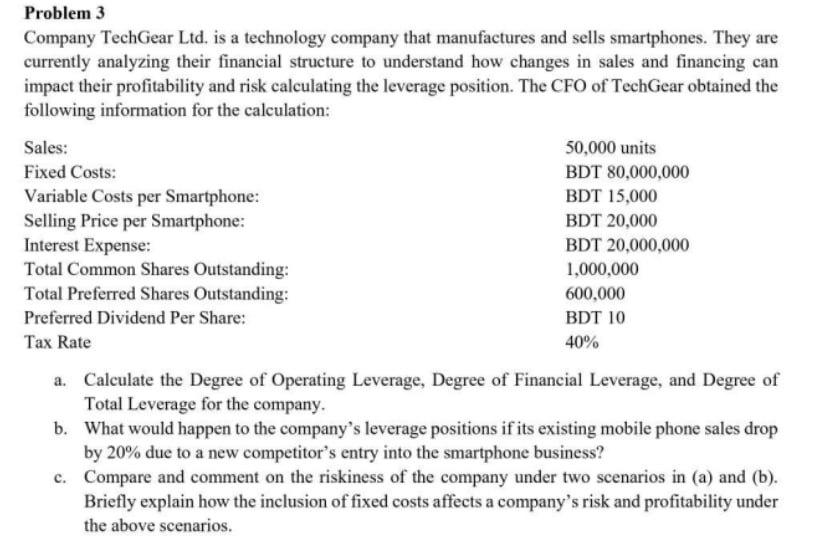

Company TechGear Ltd. is a technology company that manufactures and sells smartphones. They are currently analyzing their financial structure to understand how changes in sales and financing can impact their profitability and risk calculating the leverage position. The CFO of TechGear obtained the following information for the calculation: , , a. Calculate the Degree of Operating Leverage, Degree of Financial Leverage, and Degree of Total Leverage for the company. b. What would happen to the company's leverage positions if its existing mobile phone sales drop by 20% due to a new competitor's entry into the smartphone business? c. Compare and comment on the riskiness of the company under two scenarios in (a) and (b). Briefly explain how the inclusion of fixed costs affects a company's risk and profitability under the above scenarios

Company TechGear Ltd. is a technology company that manufactures and sells smartphones. They are currently analyzing their financial structure to understand how changes in sales and financing can impact their profitability and risk calculating the leverage position. The CFO of TechGear obtained the following information for the calculation: , , a. Calculate the Degree of Operating Leverage, Degree of Financial Leverage, and Degree of Total Leverage for the company. b. What would happen to the company's leverage positions if its existing mobile phone sales drop by 20% due to a new competitor's entry into the smartphone business? c. Compare and comment on the riskiness of the company under two scenarios in (a) and (b). Briefly explain how the inclusion of fixed costs affects a company's risk and profitability under the above scenarios Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started