Answered step by step

Verified Expert Solution

Question

1 Approved Answer

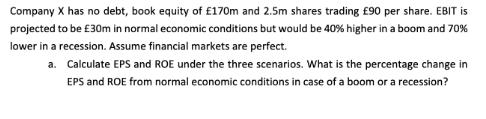

Company X has no debt, book equity of 170m and 2.5m shares trading 90 per share. EBIT is projected to be 30m in normal

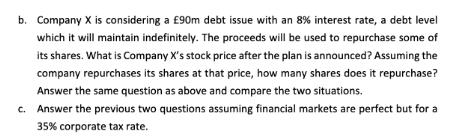

Company X has no debt, book equity of 170m and 2.5m shares trading 90 per share. EBIT is projected to be 30m in normal economic conditions but would be 40% higher in a boom and 70% lower in a recession. Assume financial markets are perfect. a. Calculate EPS and ROE under the three scenarios. What is the percentage change in EPS and ROE from normal economic conditions in case of a boom or a recession? b. Company X is considering a 90m debt issue with an 8% interest rate, a debt level which it will maintain indefinitely. The proceeds will be used to repurchase some of its shares. What is Company X's stock price after the plan is announced? Assuming the company repurchases its shares at that price, how many shares does it repurchase? Answer the same question as above and compare the two situations. c. Answer the previous two questions assuming financial markets are perfect but for a 35% corporate tax rate.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Normal Economic Conditions EBIT 30 million Number of shares 25 million Book Equity 170 million Calculate EPS Earnings Per Share EPS EBIT Number of shares 30m 25m 12 per share Calculate ROE Return on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started