Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company X is evaluating the following project. The initial investment in physical assets (to be made at the end of year 0) costs 100m. The

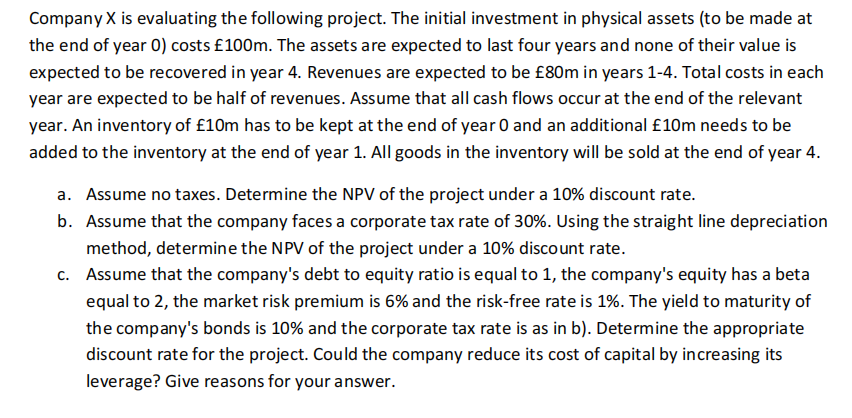

Company X is evaluating the following project. The initial investment in physical assets (to be made at the end of year 0) costs 100m. The assets are expected to last four years and none of their value is expected to be recovered in year 4 . Revenues are expected to be f80m in years 14. Total costs in each year are expected to be half of revenues. Assume that all cash flows occur at the end of the relevant year. An inventory of 10m has to be kept at the end of year 0 and an additional 10m needs to be added to the inventory at the end of year 1 . All goods in the inventory will be sold at the end of year 4 . a. Assume no taxes. Determine the NPV of the project under a 10% discount rate. b. Assume that the company faces a corporate tax rate of 30%. Using the straight line depreciation method, determine the NPV of the project under a 10% discount rate. c. Assume that the company's debt to equity ratio is equal to 1 , the company's equity has a beta equal to 2 , the market risk premium is 6% and the risk-free rate is 1%. The yield to maturity of the company's bonds is 10% and the corporate tax rate is as in b). Determine the appropriate discount rate for the project. Could the company reduce its cost of capital by increasing its leverage? Give reasons for your

Company X is evaluating the following project. The initial investment in physical assets (to be made at the end of year 0) costs 100m. The assets are expected to last four years and none of their value is expected to be recovered in year 4 . Revenues are expected to be f80m in years 14. Total costs in each year are expected to be half of revenues. Assume that all cash flows occur at the end of the relevant year. An inventory of 10m has to be kept at the end of year 0 and an additional 10m needs to be added to the inventory at the end of year 1 . All goods in the inventory will be sold at the end of year 4 . a. Assume no taxes. Determine the NPV of the project under a 10% discount rate. b. Assume that the company faces a corporate tax rate of 30%. Using the straight line depreciation method, determine the NPV of the project under a 10% discount rate. c. Assume that the company's debt to equity ratio is equal to 1 , the company's equity has a beta equal to 2 , the market risk premium is 6% and the risk-free rate is 1%. The yield to maturity of the company's bonds is 10% and the corporate tax rate is as in b). Determine the appropriate discount rate for the project. Could the company reduce its cost of capital by increasing its leverage? Give reasons for your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started