Question

Roche has recently set up a small business, which manufacturesthree different types of chair to customer order. Each type is producedin a single batch per

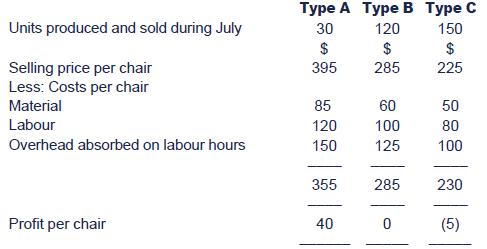

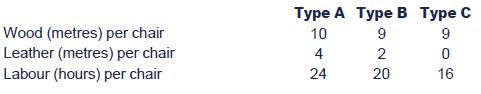

Roche has recently set up a small business, which manufacturesthree different types of chair to customer order. Each type is producedin a single batch per week and dispatched as individual items. The sizeof the batch is determined by the weekly customer orders. The threedifferent types of chair are known as the Type A, the Type B and theType C. The Type A is a fully leather-upholstered chair and is the mostexpensive of the range. The Type B is the middle-of-the-range chair, andhas a comfortable leather seat. The cheapest of the range, the Type C,is purely a wooden chair, but Roche feels it has great potential andhopes it will provide at least 50% of the sales revenue.

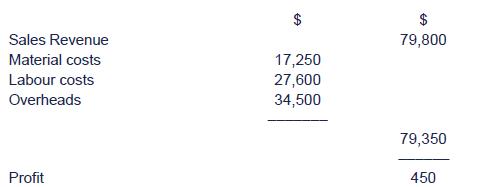

Roche has employed Mr F, an experienced but unqualified accountant,to act as the organisation's accountant. Mr F has produced figures forthe past month, July 2010, which is considered a normal month in termsof costs:

Profit statement for July 2010:

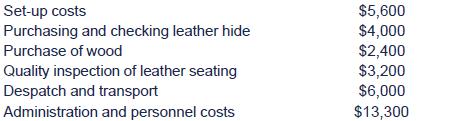

Roche hopes to use these figures as the basis for budgets for thenext three months. The managers are pleased to see that the organisationhas made its first monthly profit, however small it might be. On theother hand, they are unhappy with Mr F's advice about the loss-makingType C, which is, either to reduce its production or to increase itsprice. Roche's managers are concerned because this advice goes againstits marketing strategy. After much discussion Mr F says that he hasheard of a newer type of costing system, known as activity-based costing(ABC), and that he will recalculate the position on this basis. Inorder to do this, Mr F has extracted the following information:

The overheads included in July’s profit statement comprised:

Required:

(a) Use the ABC technique to prepare a revised product cost statement for July 2010 such as Mr F might produce.

(b) Drawing upon the information form Roche toillustrate your answer, explain why the use of ABC provides an adequatebasis for Roche's managers to make decisions on the future productionvolume and price of the Type C.

$ Sales Revenue Material costs Labour costs $ 79,800 17,250 27,600 Overheads 34,500 79,350 Profit 450

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The total exclusive properties to be included in the gross estate are those properties solely owned ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started