Answered step by step

Verified Expert Solution

Question

1 Approved Answer

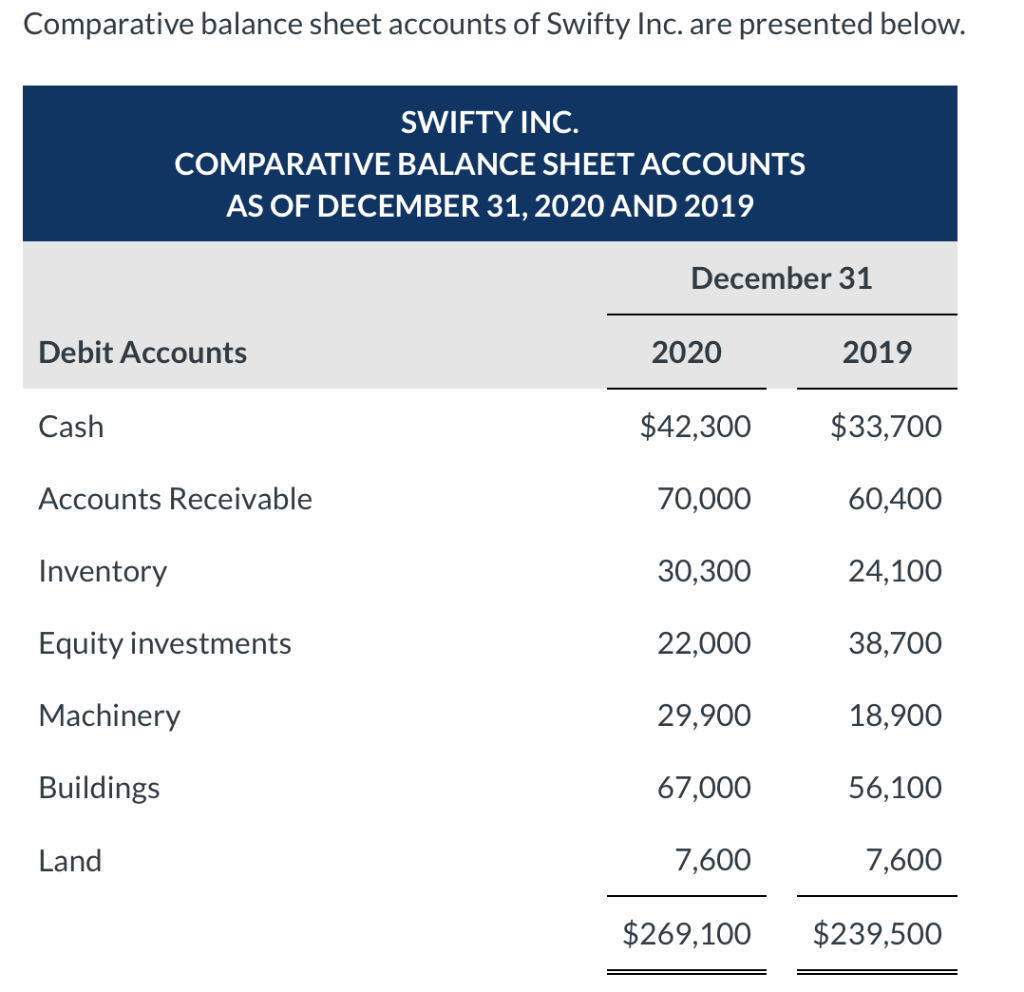

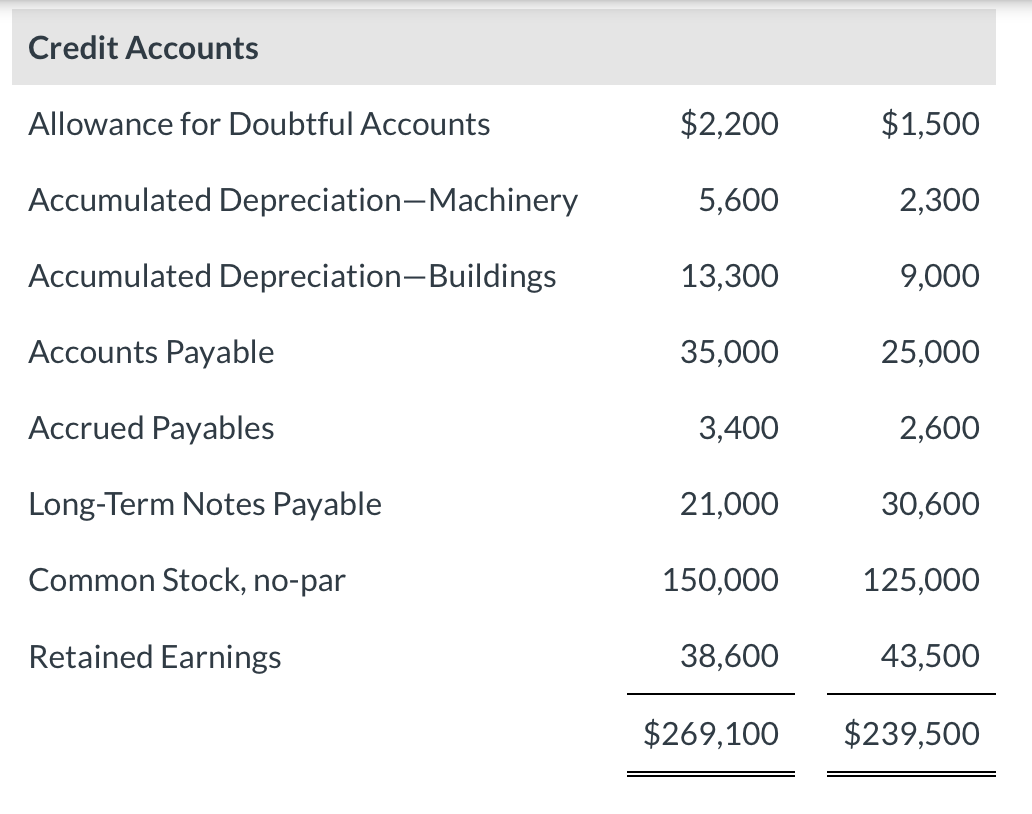

Comparative balance sheet accounts of Swifty Inc. are presented below. Credit Accounts Allowance for Doubtful Accounts Accumulated Depreciation-Machinery Accumulated Depreciation-Buildings Accounts Payable Accrued Payables Long-Term

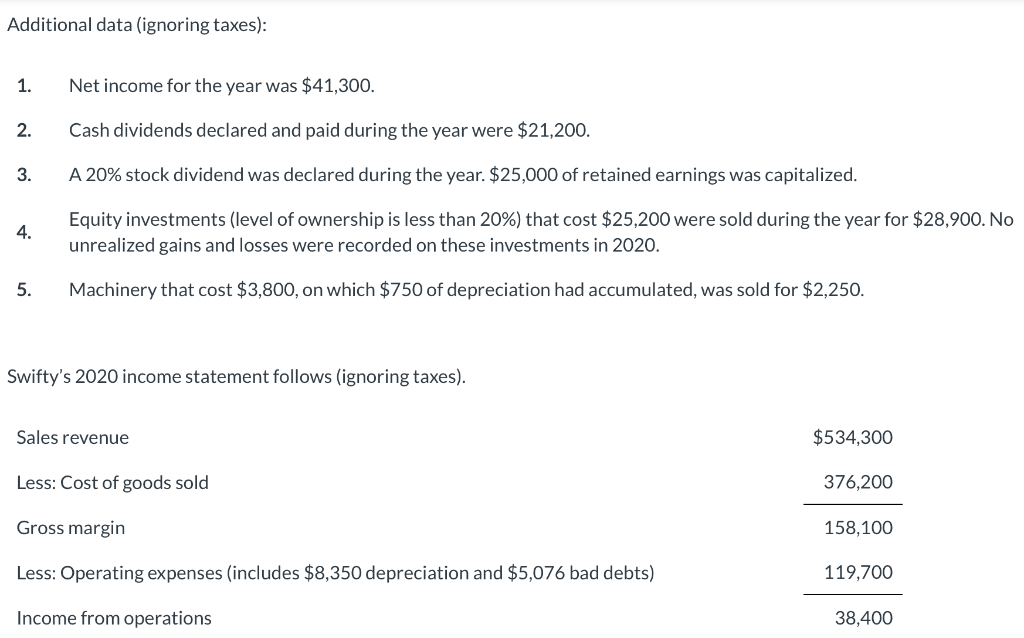

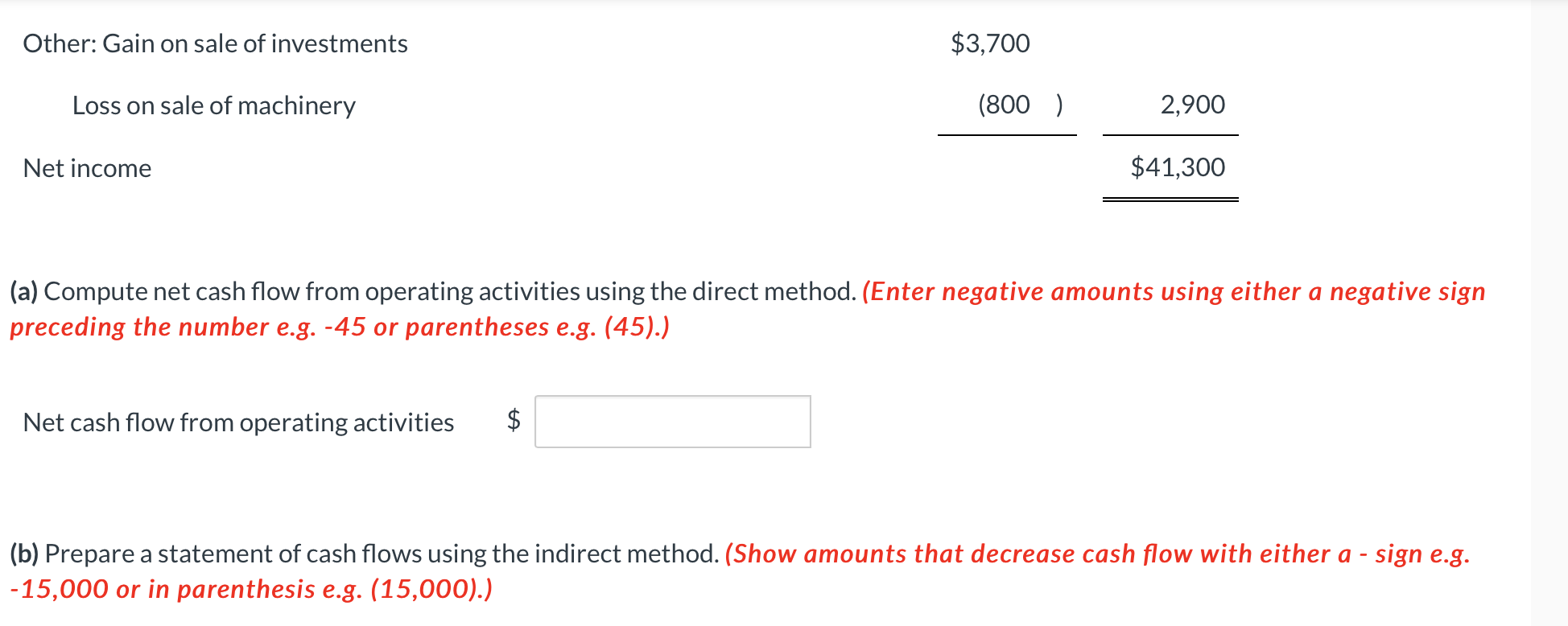

Comparative balance sheet accounts of Swifty Inc. are presented below. Credit Accounts Allowance for Doubtful Accounts Accumulated Depreciation-Machinery Accumulated Depreciation-Buildings Accounts Payable Accrued Payables Long-Term Notes Payable Common Stock, no-par Retained Earnings \begin{tabular}{llr} $269,10038,600 & & $239,500 \\ \hline \end{tabular} Additional data (ignoring taxes): 1. Net income for the year was $41,300. 2. Cash dividends declared and paid during the year were $21,200. 3. A 20% stock dividend was declared during the year. $25,000 of retained earnings was capitalized. 4. Equity investments (level of ownership is less than 20% ) that cost $25,200 were sold during the year for $28,900. No unrealized gains and losses were recorded on these investments in 2020. 5. Machinery that cost $3,800, on which $750 of depreciation had accumulated, was sold for $2,250. (a) Compute net cash flow from operating activities using the direct method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net cash flow from operating activities $ (b) Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. 15,000 or in parenthesis e.g. (15,000). SWIFTY INC. Statement of Cash Flows (Indirect Method) Adjustments to reconcile net income to $ Comparative balance sheet accounts of Swifty Inc. are presented below. Credit Accounts Allowance for Doubtful Accounts Accumulated Depreciation-Machinery Accumulated Depreciation-Buildings Accounts Payable Accrued Payables Long-Term Notes Payable Common Stock, no-par Retained Earnings \begin{tabular}{llr} $269,10038,600 & & $239,500 \\ \hline \end{tabular} Additional data (ignoring taxes): 1. Net income for the year was $41,300. 2. Cash dividends declared and paid during the year were $21,200. 3. A 20% stock dividend was declared during the year. $25,000 of retained earnings was capitalized. 4. Equity investments (level of ownership is less than 20% ) that cost $25,200 were sold during the year for $28,900. No unrealized gains and losses were recorded on these investments in 2020. 5. Machinery that cost $3,800, on which $750 of depreciation had accumulated, was sold for $2,250. (a) Compute net cash flow from operating activities using the direct method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net cash flow from operating activities $ (b) Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. 15,000 or in parenthesis e.g. (15,000). SWIFTY INC. Statement of Cash Flows (Indirect Method) Adjustments to reconcile net income to $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started