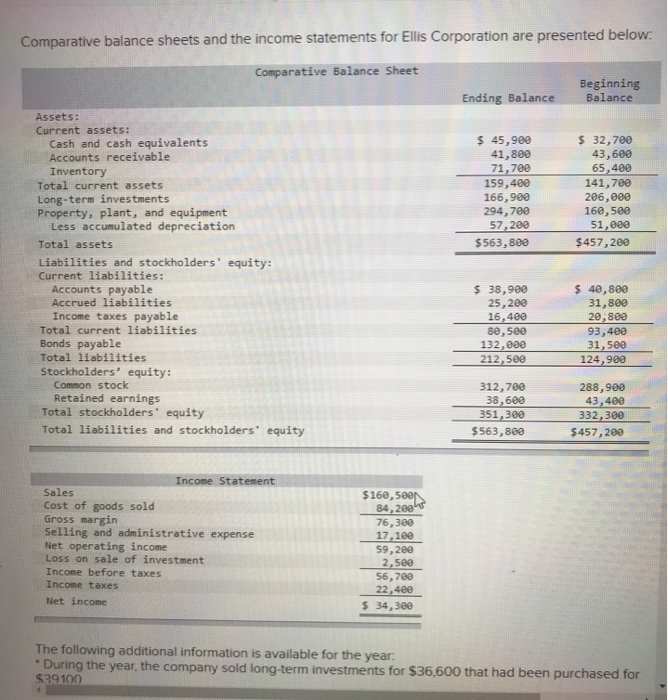

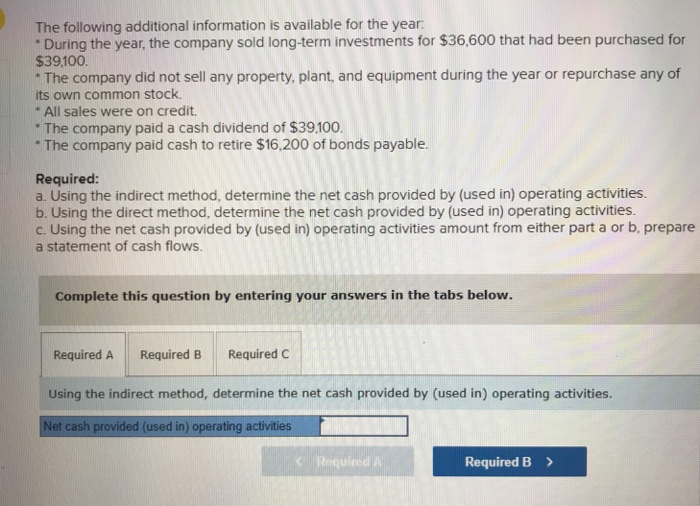

Comparative balance sheets and the income statements for Ellis Corporation are presented below Comparative Balance Sheet Beginning Ending Balance Balance Assets: Current assets: $ 45,900 41,800 71,700 159,400 166,900 294, 700 57,200 $563,800 s 32,7e0 43,600 65,400 141,700 206,000 160,580 51,000 $457,20e Cash and cash equivalents Accounts receivable Inventory Total current assets Long-term investments Property, plant, and equipment Less accumulated depreciation Total assets Liabilities and stockholders' equity: Current liabilities: Accounts payable $ 38,900 25,200 16,400 8e,500 132,000 212,508 S 40,80e 31,800 16,4862-8e9 93,400 Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity: 31,5e0 124,900 Common stock 312,700 38,600 351,300 $563,860 288,900 43,400 332,300 $457, 20e Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Income Statement Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Loss on sale of investment Income before taxes Income taxes Net income $160 84 76,300 17,100 59,280 2,500 56,780 22,400 s 34,3ee The following additional information is available for the year During the year, the company sold long-term investments for $36,600 that had been purchased for $39100 The following additional information is available for the year During the year, the company sold long-term investments for $36,600 that had been purchased for $39,100. The company did not sell any property, plant, and equipment during the year or repurchase any of its own common stock "All sales were on credit. The company paid a cash dividend of $39.100. The company paid cash to retire $16,200 of bonds payable. Required: a. Using the indirect method, determine the net cash provided by (used in) operating activities. b. Using the direct method, determine the net cash provided by (used in) operating activities. c. Using the net cash provided by (used in) operating activities amount from either part a or b, prepare a statement of cash flows. Complete this question by entering your answers in the tabs below. Required A Required B Required C Using the indirect method, determine the net cash provided by (used in) operating activities. Net cash provided (used in) operating activities Required B>