Question

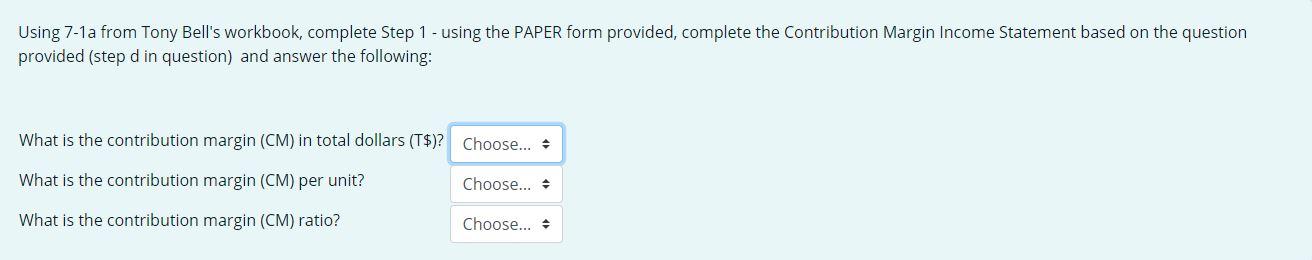

7-1A CVP Analysis, Margin of Safety, Degree of Operating Leverage Charming Clothiers manufactures neckties and bow ties. The company has the following information: The companys

7-1A CVP Analysis, Margin of Safety, Degree of Operating Leverage

Charming Clothiers manufactures neckties and bow ties. The company has the following information:

The companys sales price is $30 per unit. The variable costs of producing bowties is $18 per unit. The company expects to have fixed costs of $60,000 next year. The company expects to sell 8,000 bowties next year. Assume no taxes.

Calculate the breakeven point in units.

Calculate the breakeven point in SALES dollars.

How many units must the company sell to reach a target profit of $50,000?

Prepare a budgeted contribution format income statement.

Compute the margin of safety in both dollar and percentage terms.

Compute the degree of operating leverage.

If sales increase by 20% in the following year, how much would net income increase (use the degree of operating leverage to compute your answer).

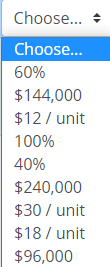

Use the below options to answer above:

Use the below options to answer above:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started