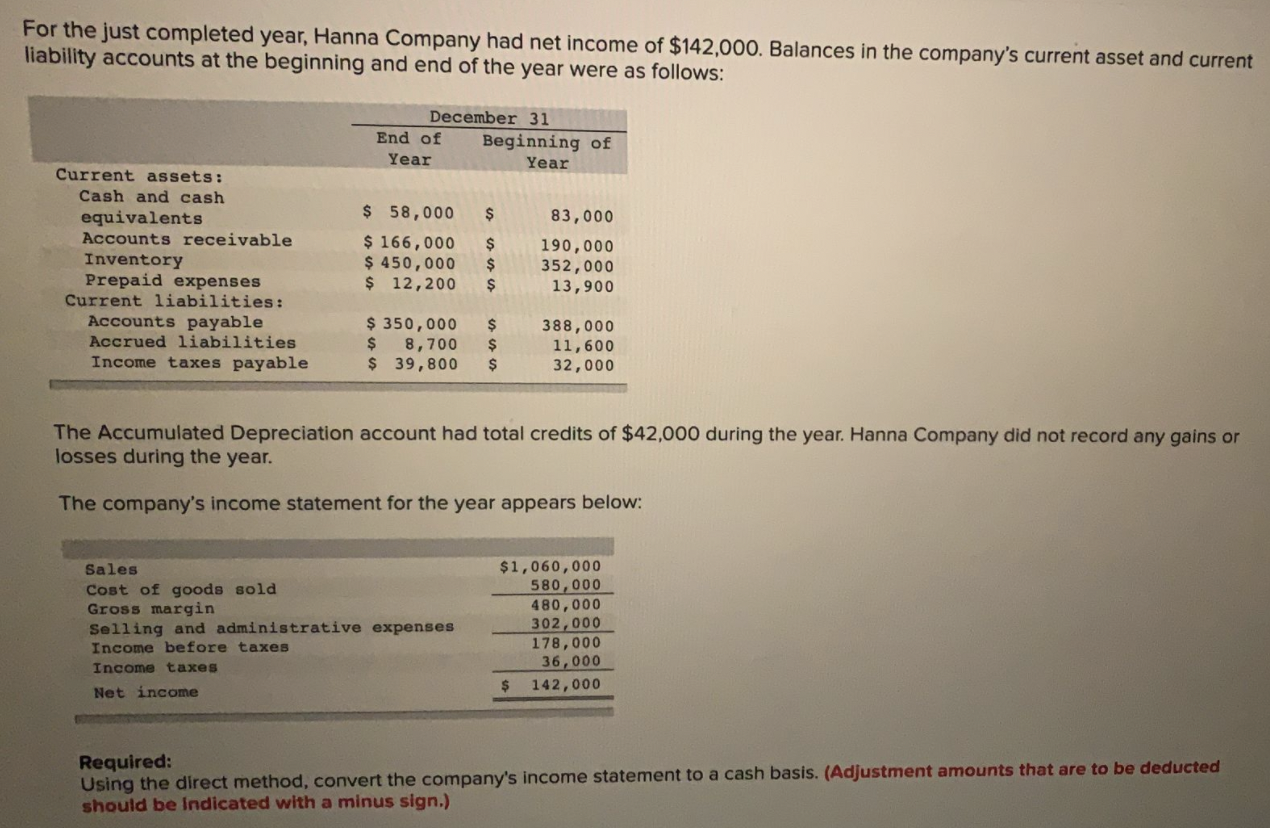

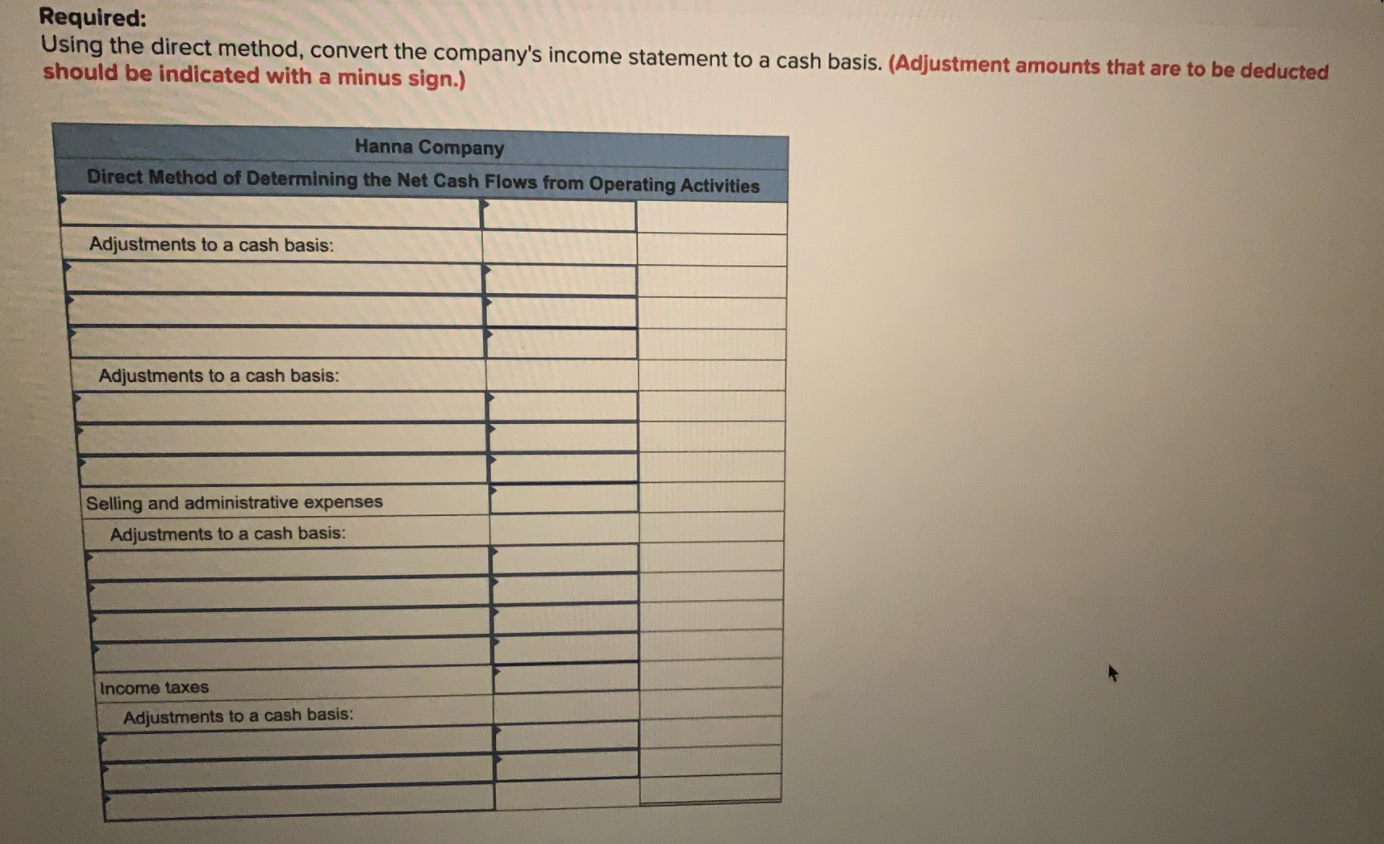

Comparative financial statement data for Carmono Company follow: This Year Last Year Assets Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity $ 9.50 58.00 102.50 170.00 243.00 48.80 194.20 $364.20 $ 18.00 51.00 89.60 158.60 202.00 36.60 165.40 $324.00 $ 61.50 134.00 168.70 $364.20 $ 50.00 103.00 171.00 $324.00 For this year, the company reported net income as follows: Sales $1,050.00 Cost of goods sold 630.00 Gross margin 420.00 Selling and administrative expenses 400.00 Net income $ 20.00 This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The company did not repurchase any of its own stock this year. Required: 1. Using the indirect method, prepare a statement of cash flows for this year. 2. Compute Carmono's free cash flow for this year. Required: 1. Using the indirect method, prepare a statement of cash flows for this year. 2. Compute Carmono's free cash flow for this year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Using the indirect method, prepare a statement of cash flows for this year. (List any deduction in cash and cash outflows as negative amounts. Round your intermediate calculations and final answers to 2 decimal places.) Carmono Company Statement of Cash Flows For This Year Ended December 31 Operating activities: 0.00 0.00 Investing activities: 0.00 Financing activities: Operating aluviues. 0.00 0.00 Investing activities: 0.00 Financing activities: 0.00 0.00 Beginning cash and cash equivalents Ending cash and cash equivalents $ 0.00 Below are several transactions that took place in Seneca Company last year: a. Paid suppliers for inventory purchases. b. Bought equipment for cash. c. Paid cash to repurchase its own stock. d. Collected cash from customers. e. Paid wages to employees. f. Equipment was sold for cash. g. Common stock was sold for cash to investors. h. Cash dividends were declared and paid. i. A long-term loan was made to a supplier. j. Income taxes were paid to the government. k. Interest was paid to a lender. 1. Bonds were retired by paying the principal amount due. Required: Indicate how each of the above transaction would be classified on a statement of cash flows. As appropriate, place an X in the Operating, Investing, or Financing column. Also, place an X in the Cash Inflow or Cash Outflow column. Transaction Operating Activity Investing Activity Financing Activity Cash Inflow Cash Outflow a. b C d. e. Paid suppliers for inventory purchases Bought equipment for cash Paid cash to repurchase its own stock Collected cash from customers Paid wages to employees Equipment was sold for cash Common stock was sold for cash to investors Cash dividends were declared and paid A long-term loan was made to a supplier if. 9 h. 1. Required: Indicate how each of the above transaction would be classified on a statement of cash flows. As appropriate, place an X in the Operating, Investing, or Financing column. Also, place an X in the Cash Inflow or Cash Outflow column. Transaction Operating Activity Investing Activity Financing Activity Cash Inflow Cash Outflow a. Paid suppliers for inventory purchases b. Bought equipment for cash C. Paid cash to repurchase its own stock d. Collected cash from customers e. Paid wages to employees f. Equipment was sold for cash g. Common stock was sold for cash to investors h. Cash dividends were declared and paid i. A long-term loan was made to a supplier ij Income taxes were paid to the government k. Interest was paid to a lender 1. Bonds were retired by paying the principal amount due st For the just completed year, Hanna Company had net income of $142,000. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: December 31 End of Beginning of Year Year $ Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable $ 58,000 $ 166,000 $ 450,000 $ 12,200 $ $ $ 83,000 190,000 352,000 13,900 $ 350,000 $ 8,700 $ 39,800 $ $ $ 388,000 11,600 32,000 The Accumulated Depreciation account had total credits of $42,000 during the year. Hanna Company did not record any gains or losses during the year. The company's income statement for the year appears below: Sales Cost of goods sold Gross margin Selling and administrative expenses Income before taxes Income taxes Net income $1,060,000 580,000 480,000 302,000 178,000 36,000 $ 142,000 Required: Using the direct method, convert the company's income statement to a cash basis. (Adjustment amounts that are to be deducted should be Indicated with a minus sign.) Required: Using the direct method, convert the company's income statement to a cash basis. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) Hanna Company Direct Method of Determining the Net Cash Flows from Operating Activities Adjustments to a cash basis: Adjustments to a cash basis: Selling and administrative expenses Adjustments to a cash basis: Income taxes Adjustments to a cash basis