Answered step by step

Verified Expert Solution

Question

1 Approved Answer

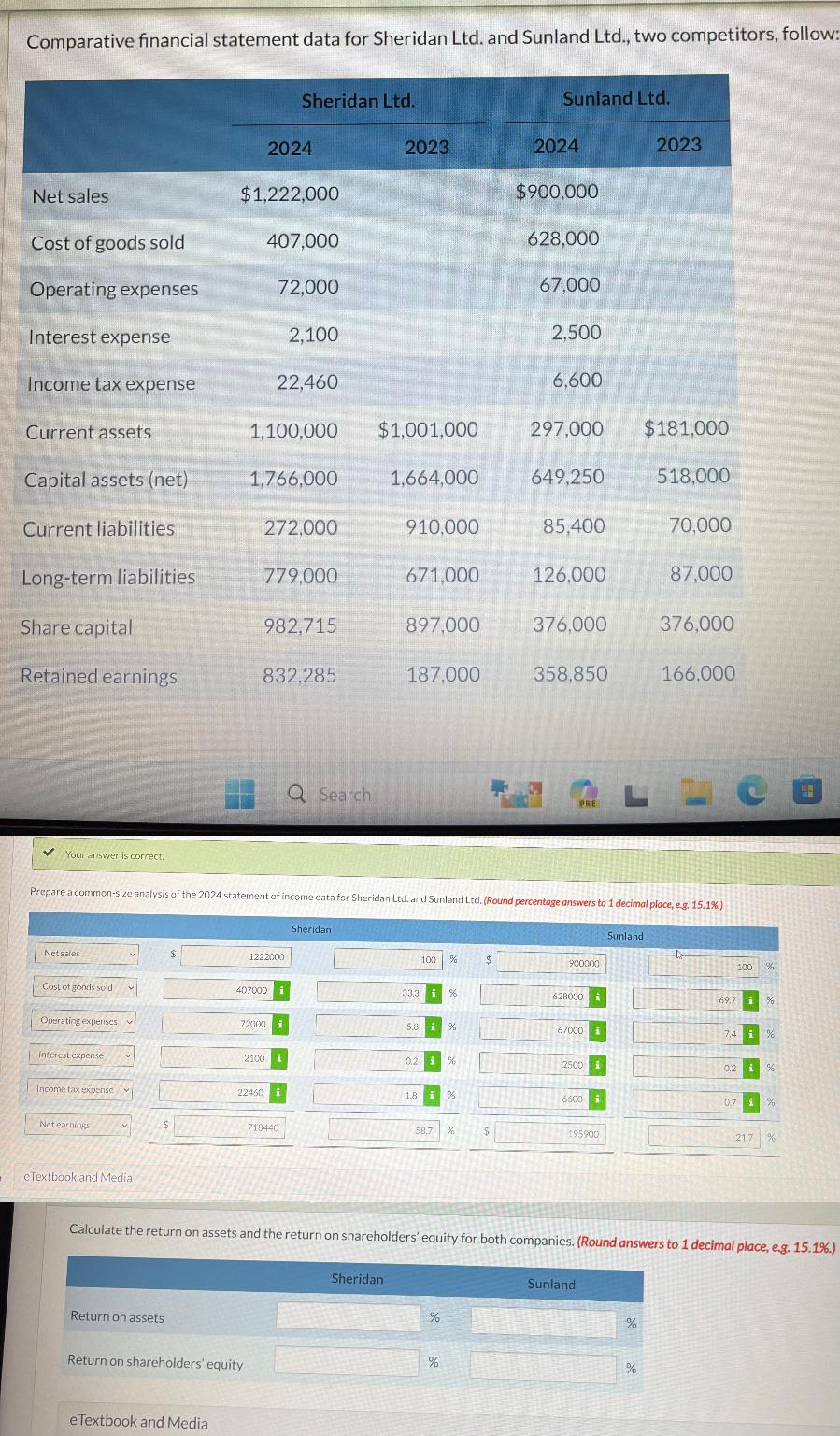

Comparative financial statement data for Sheridan Ltd. and Sunland Ltd., two competitors, follow Sheridan Ltd. Sunland Ltd. 2024 2023 2024 2023 Net sales $1,222,000

Comparative financial statement data for Sheridan Ltd. and Sunland Ltd., two competitors, follow Sheridan Ltd. Sunland Ltd. 2024 2023 2024 2023 Net sales $1,222,000 $900,000 Cost of goods sold 407,000 628,000 Operating expenses 72,000 67,000 Interest expense 2,100 2,500 Income tax expense 22,460 6,600 Current assets 1,100,000 $1,001,000 297,000 $181,000 Capital assets (net) 1,766,000 1,664,000 649,250 518,000 Current liabilities. 272,000 910,000 85,400 70,000 Long-term liabilities 779,000 671,000 126,000 87,000 Share capital 982,715 897,000 376,000 376,000 Retained earnings 832.285 187,000 358,850 166,000 Your answer is correct. Q Search PRE Prepare a common-size analysis of the 2024 statement of income data for Sheridan Ltd. and Sunland Ltd. (Round percentage answers to 1 decimal place, eg. 15.1 %.) Net sales 1222000 Cost of goods sold 407000 Operating expenses 72000 Interest expense Income tax expense Net earnings eTextbook and Media. Sheridan 100 % $ Sunland 900000 100 % 33.3 % 628000 69.7 i % 5.8 % 67000 7.4 i % 2100 i 0.2 % 2500 i 0.2 % 22460 i 1.8 i % $ 718440 6600 i 0.7 % 58.7 % $ 195900 21.7 % Calculate the return on assets and the return on shareholders' equity for both companies. (Round answers to 1 decimal place, e.g. 15.1%.) Return on assets Return on shareholders' equity eTextbook and Media Sheridan Sunland % % % %

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Return on Assets ROA and Return on Shareholders Equity ROE for Sheridan Ltd and Sunland Ltd We can c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started