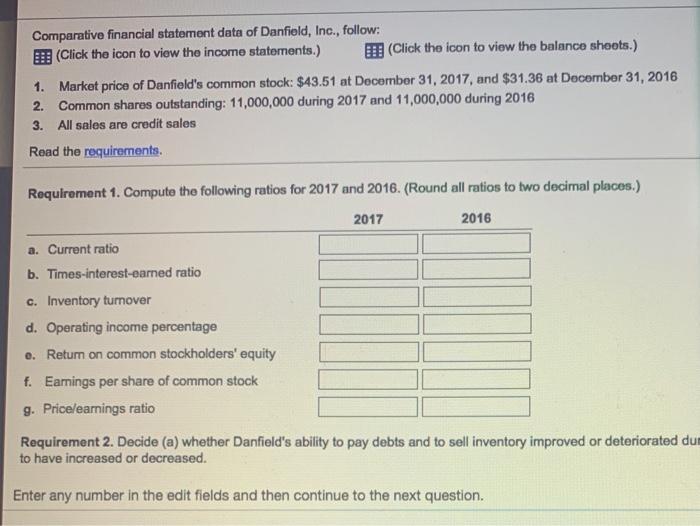

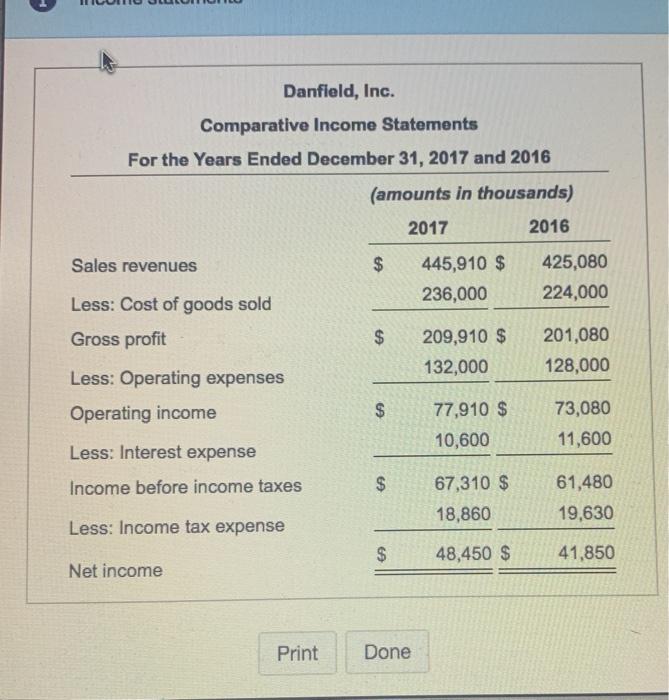

Comparative financial statement data of Danfield, Inc., follow: (Click the icon to view the income statements.) (Click the icon to view the balance shoots.) 1. Market price of Danfield's common stock: $43.51 at December 31, 2017, and $31.36 at December 31, 2016 2. Common shares outstanding: 11,000,000 during 2017 and 11,000,000 during 2016 3. All sales are credit sales Read the requirements. Requirement 1. Compute the following ratios for 2017 and 2016. (Round all ratios to two decimal places.) 2017 2016 a. Current ratio b. Times-interest-earned ratio c. Inventory turnover d. Operating income percentage e. Return on common stockholders' equity f. Eamings per share of common stock g. Price/earnings ratio Requirement 2. Decide (a) whether Danfield's ability to pay debts and to sell inventory improved or deteriorated dut to have increased or decreased. Enter any number in the edit fields and then continue to the next question. Danfield, Inc. Comparative Income Statements For the Years Ended December 31, 2017 and 2016 (amounts in thousands) 2017 2016 Sales revenues $ 445,910 $ 236,000 425,080 224,000 Less: Cost of goods sold Gross profit $ 209,910 $ 132,000 201,080 128,000 Less: Operating expenses Operating income $ 77,910 $ 10,600 73,080 11,600 Less: Interest expense Income before income taxes $ 67,310 $ 61,480 19,630 18,860 Less: Income tax expense $ 48,450 $ 41,850 Net income Print Done Comparative financial statement data of Danfield, Inc., follow: (Click the icon to view the income statements.) (Click the icon to view the balance shoots.) 1. Market price of Danfield's common stock: $43.51 at December 31, 2017, and $31.36 at December 31, 2016 2. Common shares outstanding: 11,000,000 during 2017 and 11,000,000 during 2016 3. All sales are credit sales Read the requirements. Requirement 1. Compute the following ratios for 2017 and 2016. (Round all ratios to two decimal places.) 2017 2016 a. Current ratio b. Times-interest-earned ratio c. Inventory turnover d. Operating income percentage e. Return on common stockholders' equity f. Eamings per share of common stock g. Price/earnings ratio Requirement 2. Decide (a) whether Danfield's ability to pay debts and to sell inventory improved or deteriorated dut to have increased or decreased. Enter any number in the edit fields and then continue to the next question. Danfield, Inc. Comparative Income Statements For the Years Ended December 31, 2017 and 2016 (amounts in thousands) 2017 2016 Sales revenues $ 445,910 $ 236,000 425,080 224,000 Less: Cost of goods sold Gross profit $ 209,910 $ 132,000 201,080 128,000 Less: Operating expenses Operating income $ 77,910 $ 10,600 73,080 11,600 Less: Interest expense Income before income taxes $ 67,310 $ 61,480 19,630 18,860 Less: Income tax expense $ 48,450 $ 41,850 Net income Print Done