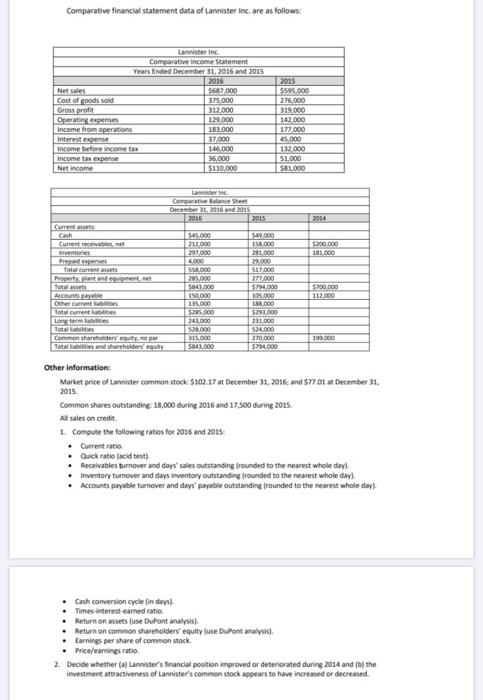

Comparative financial statement data of Lannister Inc. are as follows: Lannister in Comparative Income Statement Years Ended December 31, 2016 and 2015 2016 Net sales $687,000 Cost of goods sold 375,000 Gross profit 312,000 Operating expenses 129,000 income from operations 183,000 Interest expense 37.000 Income before income tax 145.000 income tax expense 36.000 Net Income $110.000 2015 $595.000 276,000 319,000 142.000 177,000 45,000 132.000 51,000 $81.000 Lannister in Comparative Balance Sheet December 31, 2016 2015 2016 2015 $49.000 15 000 281.000 $200.000 181000 Current Cash Current receivables et Inventories Prepaid expenses Total current sets Property, plant and equipment, net Total Accounts Other current Total current Long-term abilities $45.000 212 000 297.000 4000 558.000 285.000 1.000 150.000 135.000 $385.000 245.000 528.000 115.000 5843.000 $700.000 112.000 517.000 277 000 2000 105.000 TR000 5291.000 231 000 524000 270.000 $294.000 Common shareholders equity.re par Total Babies and hareholders' equity Other information: Market price of Lannister common stock $102.17 at December 31, 2016, and $77.01 at December 31, 2015 Common shares outstanding: 18,000 during 2016 and 17.500 during 2015 All sales on credit 1. Compute the following ratios for 2016 and 2015: Current ratio Quick ratio (acid test) Receivables turnover and days' sales outstanding grounded to the nearest whole day). Inventory turnover and days inventory outstanding frounded to the nearest whole day). Accounts payable turnover and days payable outstanding (rounded to the nearest whole day) Cash conversion cycle in days) Times interest-earned ratio Return on assets (use DuPont analysis). Return on common shareholders' equity (use DuPont analysis). Earnings per share of common stock Price/earnings ratio 2. Decide whether (a) Lannister's financial position improved or deteriorated during 2014 and (b) the investment attractiveness of Lannister's common stock appears to have increased or decreased. Comparative financial statement data of Lannister Inc. are as follows: Lannister in Comparative Income Statement Years Ended December 31, 2016 and 2015 2016 Net sales $687,000 Cost of goods sold 375,000 Gross profit 312,000 Operating expenses 129,000 income from operations 183,000 Interest expense 37.000 Income before income tax 145.000 income tax expense 36.000 Net Income $110.000 2015 $595.000 276,000 319,000 142.000 177,000 45,000 132.000 51,000 $81.000 Lannister in Comparative Balance Sheet December 31, 2016 2015 2016 2015 $49.000 15 000 281.000 $200.000 181000 Current Cash Current receivables et Inventories Prepaid expenses Total current sets Property, plant and equipment, net Total Accounts Other current Total current Long-term abilities $45.000 212 000 297.000 4000 558.000 285.000 1.000 150.000 135.000 $385.000 245.000 528.000 115.000 5843.000 $700.000 112.000 517.000 277 000 2000 105.000 TR000 5291.000 231 000 524000 270.000 $294.000 Common shareholders equity.re par Total Babies and hareholders' equity Other information: Market price of Lannister common stock $102.17 at December 31, 2016, and $77.01 at December 31, 2015 Common shares outstanding: 18,000 during 2016 and 17.500 during 2015 All sales on credit 1. Compute the following ratios for 2016 and 2015: Current ratio Quick ratio (acid test) Receivables turnover and days' sales outstanding grounded to the nearest whole day). Inventory turnover and days inventory outstanding frounded to the nearest whole day). Accounts payable turnover and days payable outstanding (rounded to the nearest whole day) Cash conversion cycle in days) Times interest-earned ratio Return on assets (use DuPont analysis). Return on common shareholders' equity (use DuPont analysis). Earnings per share of common stock Price/earnings ratio 2. Decide whether (a) Lannister's financial position improved or deteriorated during 2014 and (b) the investment attractiveness of Lannister's common stock appears to have increased or decreased