Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending December 31, 2011, 2012, and 2013. RENN-DEVER CORPORATION

| Comparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending December 31, 2011, 2012, and 2013. |

| RENN-DEVER CORPORATION | |||||||||

| Statements of Retained Earnings | |||||||||

| For the Years Ended December 31 | 2013 | 2012 | 2011 | ||||||

| Balance at beginning of year | $ | 7,131,692 | $ | 5,649,452 | $ | 5,814,552 | |||

| Net income (loss) | 3,327,700 | 2,430,900 | (165,100) | ||||||

| Deductions: | |||||||||

| Stock dividend (41,200 shares) | 261,000 | ||||||||

| Common shares retired, September 30 (150,000 shares) | 231,660 | ||||||||

| Common stock cash dividends | 908,950 | 717,000 | 0 | ||||||

| Balance at end of year | $ | 9,289,442 | $ | 7,131,692 | $ | 5,649,452 | |||

| At December 31, 2010, paid-in capital consisted of the following: |

| Common stock, 2,210,000 shares at $1 par, | $ | 2,210,000 | |

| Paid in capitalexcess of par | 7,610,000 | ||

| No preferred stock or potential common shares were outstanding during any of the periods shown. |

| Required: |

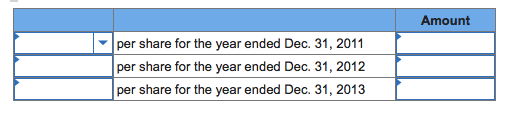

| Compute Renn-Devers earnings per share as it would have appeared in income statements for the years ended December 31, 2011, 2012, and 2013. (Do not round intermediate calculations and round your final answers to 2 decimal places.) |

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started