Compare and analyze Telus's cash flow statement and Shaw's cash flow statement. What is the interpretation of Telus and Shaw's cash flow statements? (ex. choose depreciation and amortization, net income to analyze; choose investment in property and acquisitions to analyze; choose debt repayment and dividends paid to analyze)

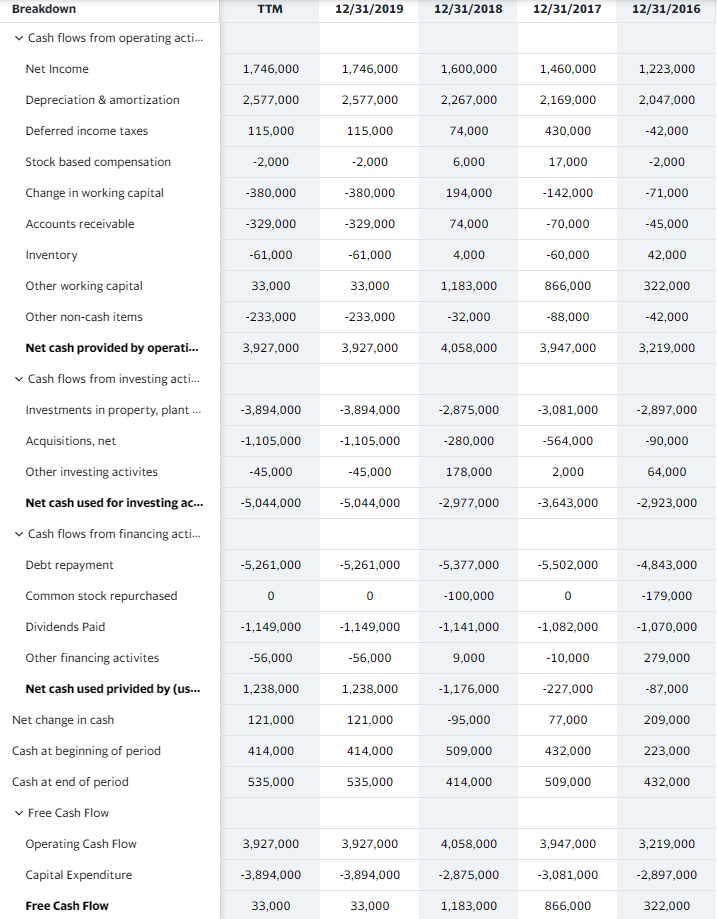

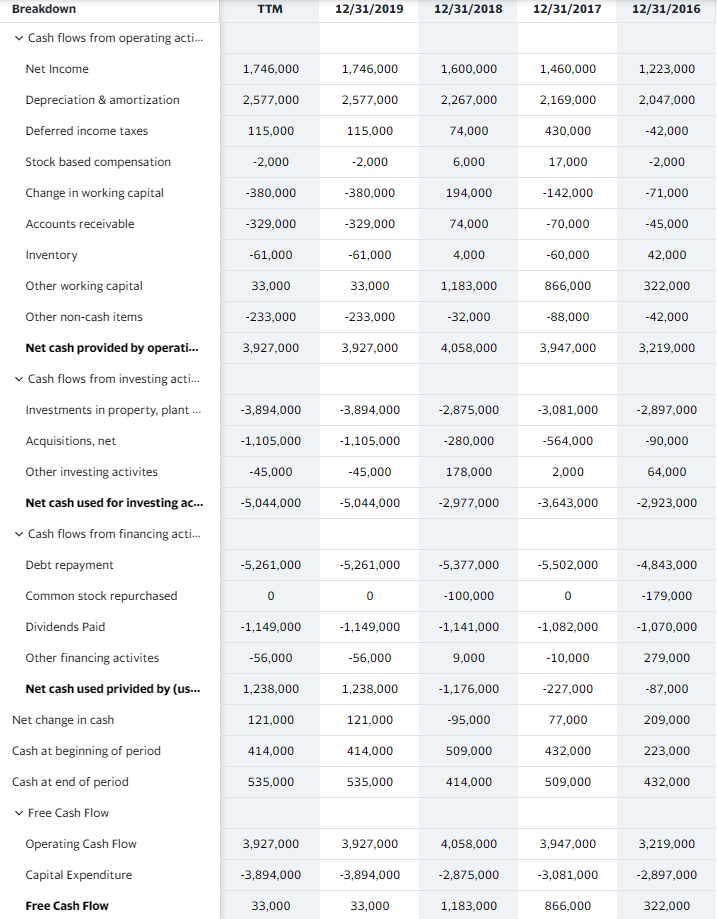

Telus's cash flow statement

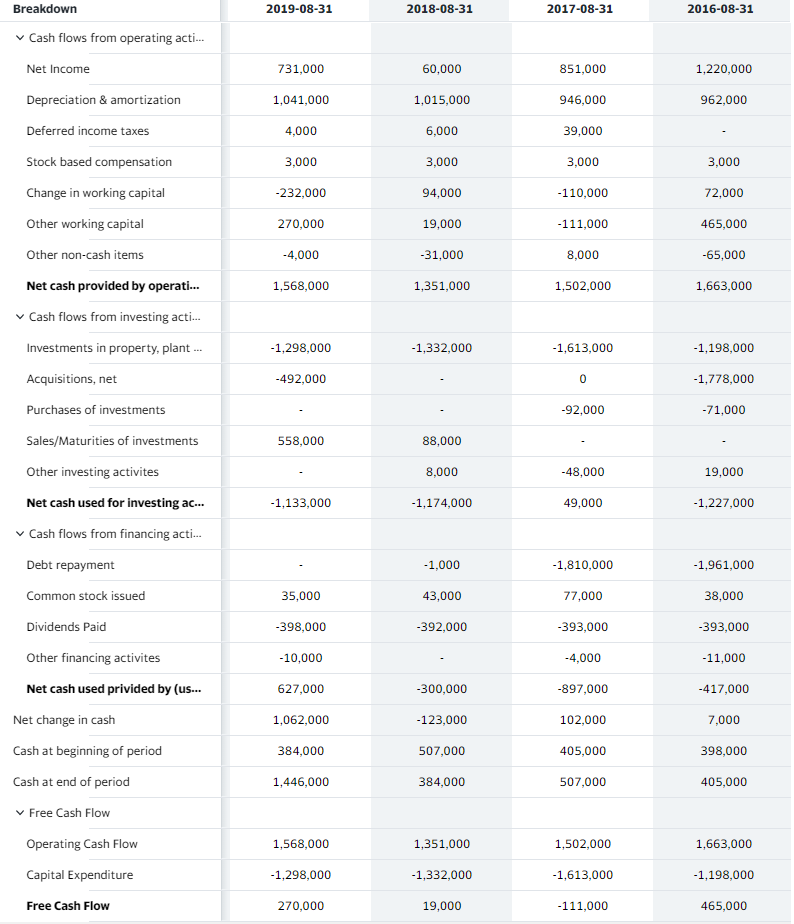

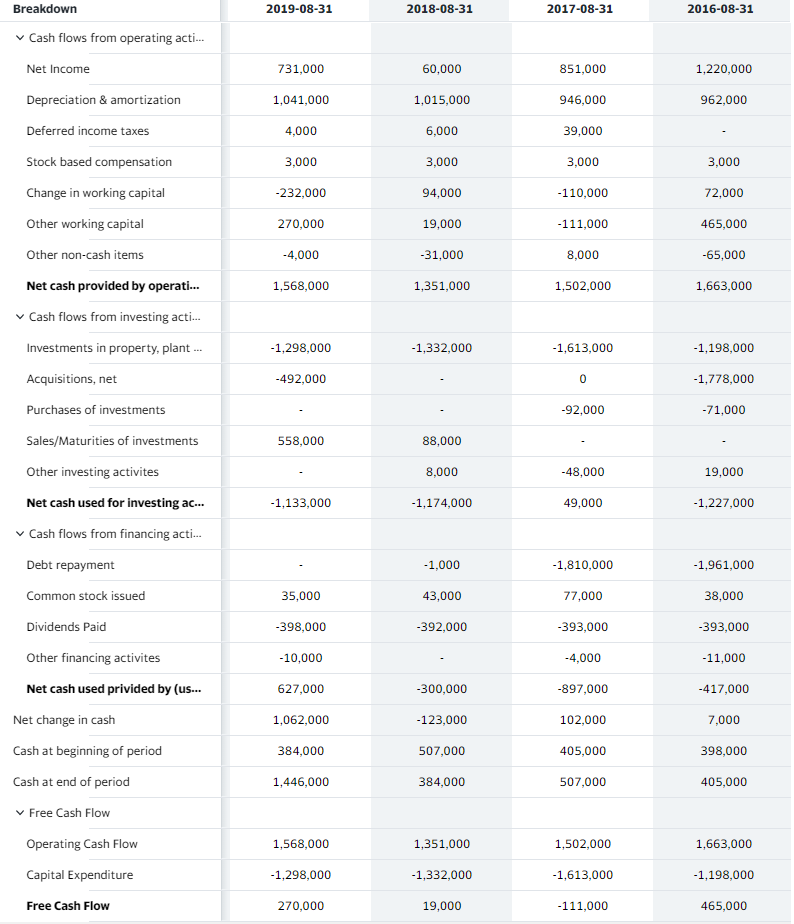

Shaw's cash flow statement

Breakdown TTM 12/31/2019 12/31/2018 12/31/2017 12/31/2016 Cash flows from operating acti... Net Income 1,746,000 1,746,000 1,600,000 1,460,000 1,223,000 Depreciation & amortization 2,577,000 2,577,000 2,267,000 2,169,000 2,047,000 Deferred income taxes 115,000 115,000 74,000 430,000 -42,000 Stock based compensation -2,000 -2,000 6,000 17,000 -2,000 Change in working capital -380,000 -380,000 194,000 -142,000 -71,000 Accounts receivable -329,000 -329,000 74,000 -70,000 -45,000 Inventory -61,000 -61,000 4,000 -60,000 42,000 Other working capital 33,000 33,000 1,183,000 866,000 322,000 Other non-cash items -233,000 -233,000 -32,000 -88,000 -42,000 Net cash provided by operati... 3,927,000 3,927,000 4,058,000 3,947,000 3,219,000 Cash flows from investing acti... Investments in property, plant... -3,894,000 -3,894,000 -2,875,000 -3,081,000 -2,897,000 Acquisitions, net -1,105,000 -1,105,000 -280,000 -564,000 -90,000 Other investing activites -45,000 -45,000 178,000 2,000 64,000 Net cash used for investing ac... -5,044,000 -5,044,000 -2,977,000 -3,643,000 -2,923,000 Cash flows from financing acti... Debt repayment -5,261,000 -5,261,000 -5,377,000 -5,502,000 -4.843,000 Common stock repurchased -100,000 -179,000 Dividends Paid -1,149,000 -1,149,000 -1,141,000 -1,082,000 -1,070,000 Other financing activites -56,000 -56,000 9,000 -10,000 279,000 Net cash used privided by (us... 1,238,000 1,238,000 -1,176,000 -227,000 -87,000 Net change in cash 121,000 121,000 -95,000 77,000 209,000 Cash at beginning of period 414,000 414,000 509,000 432,000 223,000 Cash at end of period 535,000 535,000 414,000 509,000 432,000 Free Cash Flow Operating Cash Flow 3,927,000 3,927,000 4,058,000 3,947,000 3,219,000 Capital Expenditure -3,894,000 -3,894,000 -2,875,000 -3,081,000 -2,897,000 Free Cash Flow 33,000 33,000 1,183,000 866,000 322,000 Breakdown 2019-08-31 2018-08-31 2017-08-31 2016-08-31 Cash flows from operating acti... Net Income 731,000 60,000 851,000 1,220,000 Depreciation & amortization 1,041,000 1,015,000 946,000 962,000 Deferred income taxes 4,000 6,000 39,000 Stock based compensation 3,000 3,000 3,000 3,000 Change in working capital -232,000 94,000 -110,000 72,000 Other working capital 270,000 19,000 -111,000 465,000 Other non-cash items -4.000 -31,000 8,000 -65,000 Net cash provided by operati... 1,568,000 1,351,000 1,502,000 1,663,000 Cash flows from investing acti... Investments in property, plant ... -1,298,000 -1,332,000 -1,613,000 -1,198,000 Acquisitions, net -492,000 -1,778,000 Purchases of investments -92,000 -71,000 Sales/Maturities of investments 558,000 88,000 Other investing activites 8,000 -48,000 19,000 Net cash used for investing ac... -1,133,000 -1,174,000 49,000 -1,227,000 Cash flows from financing acti... Debt repayment -1,000 -1,810,000 -1,961,000 Common stock issued 35,000 43,000 77,000 38,000 Dividends Paid -398,000 -392,000 -393,000 -393,000 Other financing activites -10,000 -4,000 -11,000 Net cash used privided by (us... 627,000 -300,000 -897,000 -417,000 Net change in cash 1,062,000 -123,000 102,000 7,000 Cash at beginning of period 384,000 507,000 405,000 398,000 Cash at end of period 1,446,000 384,000 507,000 405,000 Free Cash Flow Operating Cash Flow 1,568,000 1,351,000 1,502,000 1,663,000 Capital Expenditure -1,298,000 -1,332,000 -1,613,000 -1,198,000 Free Cash Flow 270,000 19,000 -111,000 465,000