Answered step by step

Verified Expert Solution

Question

1 Approved Answer

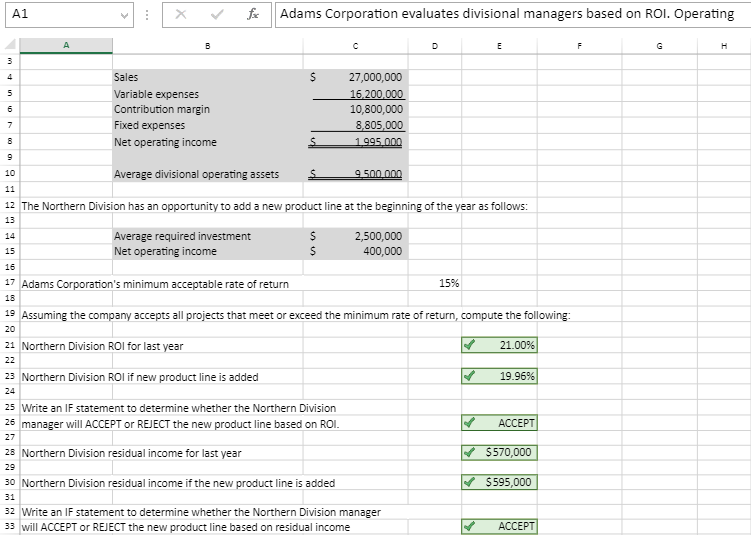

compare and contrast how the calculations may have impacted the division managers decision regarding accepting or rejecting a new product line. Include discussion of the

compare and contrast how the calculations may have impacted the division managers decision regarding accepting or rejecting a new product line. Include discussion of the limits of using ROI vs Residual Income for evaluating performance of the division. Do you think the division managers decision to invest would change if his/her bonus was based on company ROI versus Residual Income? What is best for the company as a whole?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started