Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compare the alternatives below using Future Worth analysis and applying an interest rate of 8% per year. Alternative P First cost: $-23,000 Annual operating cost:

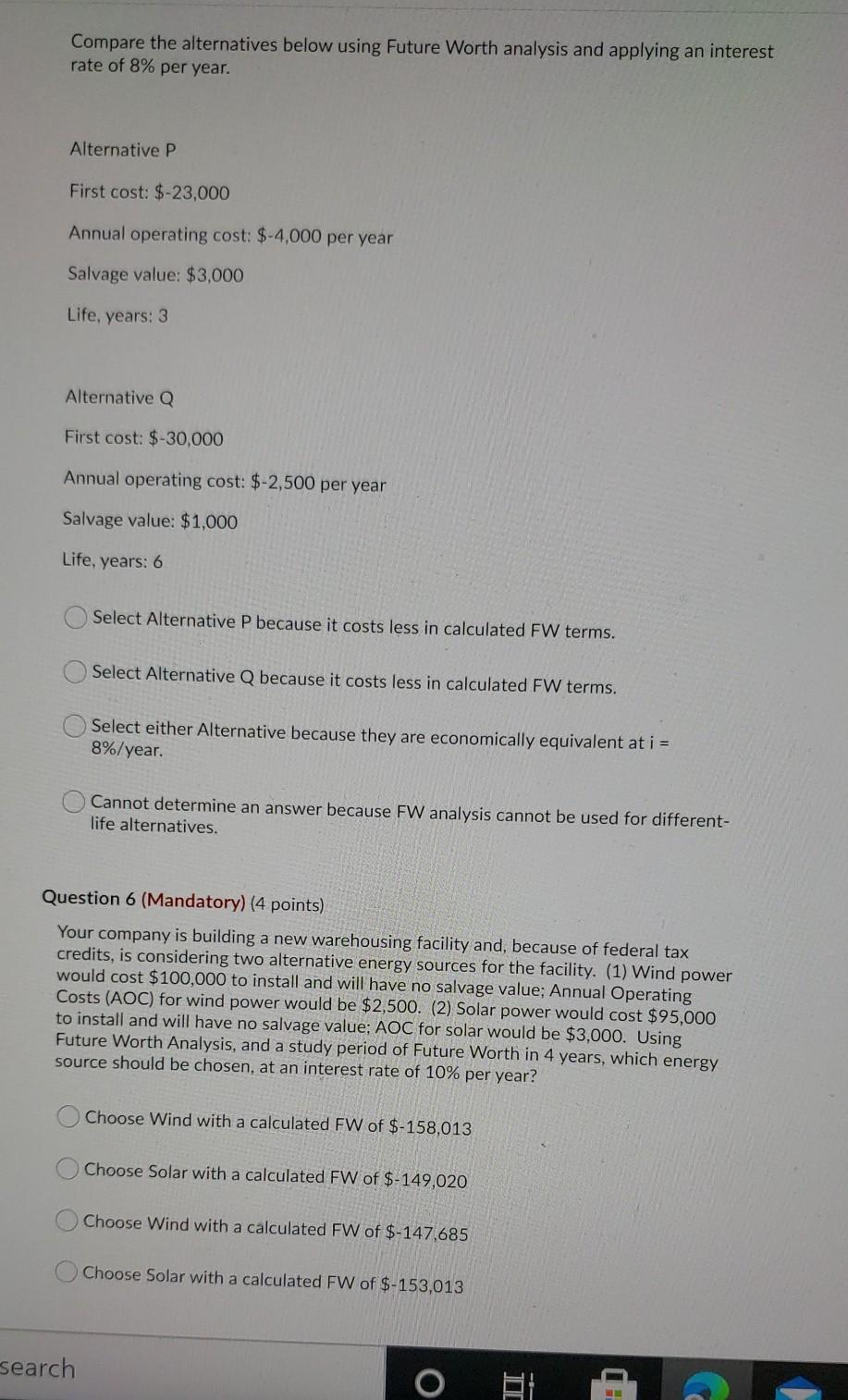

Compare the alternatives below using Future Worth analysis and applying an interest rate of 8% per year. Alternative P First cost: $-23,000 Annual operating cost: $-4,000 per year Salvage value: $3,000 Life, years: 3 Alternative Q First cost: $-30,000 Annual operating cost: $-2,500 per year Salvage value: $1,000 Life, years: 6 Select Alternative P because it costs less in calculated FW terms. Select Alternative Q because it costs less in calculated FW terms. Select either Alternative because they are economically equivalent at i = 8%/year. Cannot determine an answer because FW analysis cannot be used for different- life alternatives. Question 6 (Mandatory) (4 points) Your company is building a new warehousing facility and, because of federal tax credits, is considering two alternative energy sources for the facility. (1) Wind power would cost $100,000 to install and will have no salvage value; Annual Operating Costs (AOC) for wind power would be $2,500. (2) Solar power would cost $95,000 to install and will have no salvage value; AOC for solar would be $3,000. Using Future Worth Analysis, and a study period of Future Worth in 4 years, which energy source should be chosen, at an interest rate of 10% per year? Choose Wind with a calculated FW of $-158,013 Choose Solar with a calculated FW of $-149,020 Choose Wind with a calculated FW of $-147,685 Choose Solar with a calculated FW of $-153,013 search O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started