Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compare the price sensitivity to changes in interest rates for the following bonds: (i) 7 percent annual coupon bond, with 5 years to maturity,

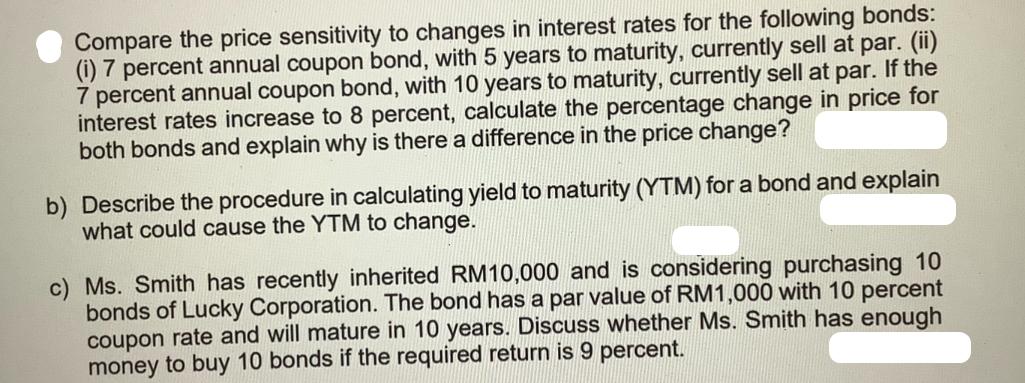

Compare the price sensitivity to changes in interest rates for the following bonds: (i) 7 percent annual coupon bond, with 5 years to maturity, currently sell at par. (ii) 7 percent annual coupon bond, with 10 years to maturity, currently sell at par. If the interest rates increase to 8 percent, calculate the percentage change in price for both bonds and explain why is there a difference in the price change? b) Describe the procedure in calculating yield to maturity (YTM) for a bond and explain what could cause the YTM to change. c) Ms. Smith has recently inherited RM10,000 and is considering purchasing 10 bonds of Lucky Corporation. The bond has a par value of RM1,000 with 10 percent coupon rate and will mature in 10 years. Discuss whether Ms. Smith has enough money to buy 10 bonds if the required return is 9 percent.

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a To compare the price sensitivity to changes in interest rates for the two bonds we can calculate the percentage change in price when the interest rates increase from 7 to 8 For bond i with 5 years t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started