Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compiler Who will be the Compiler/Project Lead ? 2015 2014 2013 1 Student A Liquidity Current Ratio 2 Student A Liquidity Quick Ratio find out

| Compiler | Who will be the Compiler/Project Lead ? | |||||||||||

| Student A | Liquidity | Current Ratio | ||||||||||

| Student A | Liquidity | Quick Ratio | ||||||||||

find out the liquidity current ratio and quick ratio of the years

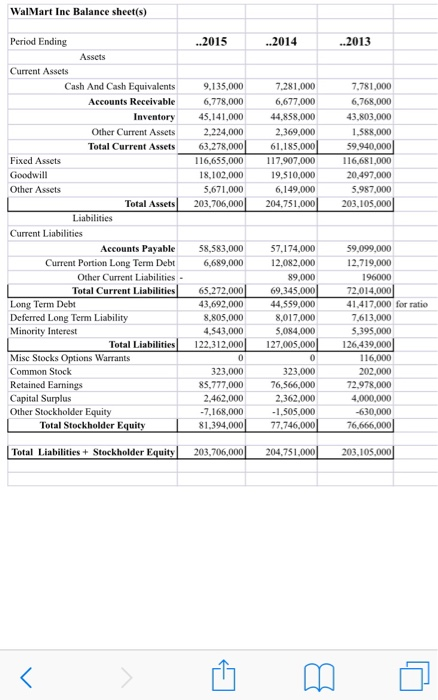

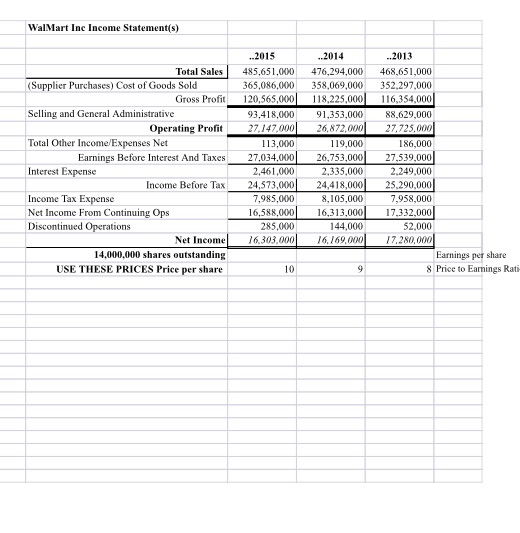

WalMart Inc Balance sheet(s) ..2015 ..2014 ..2013 9.135.000 6,778.000 45,141,000 2.224.000 63.278,000 116,655,000 18.102.000 5.671.000 203,706,000 7.281.000 6,677,000 44.858.000 2.369,000 61.185.000 117.907.000 19.510,000 6.149,000 204,751,000 7.781,000 6.768.000 43.803,000 1.588,000 59.940,000 116,681,000 20,497,000 5.987.000 203,105,000 Period Ending Assets Current Assets Cash And Cash Equivalents Accounts Receivable Inventory Other Current Assets Total Current Assets Fixed Assets Goodwill Other Assets Total Assets Liabilities Current Liabilities Accounts Payable Current Portion Long Term Debt Other Current Liabilities - Total Current Liabilities Long Term Debt Deferred Long Term Liability Minority Interest Total Liabilities Mise Stocks Options Warrants Common Stock Retained Earnings Capital Surplus Other Stockholder Equity Total Stockholder Equity 58,583,000 6,689,000 65.272.000 43,692,000 8,805,000 4,543,000 122,312,000|| 57,174,000 12.082,000 89,000 69.345,000 44.559,000 8,017,000 5,084,000 127,005,000 59,099.000 12,719,000 196000 72,014,000 41,417,000 for ratio 7,613,000 5.395,000 126,439,000 116,000 202,000 72,978,000 4,000,000 -630,000 76,666,000 0 323,000 85,777,000 2,462,000 -7,168,000 323,000 76,566,000 2,362,000 -1,505,000 Total Liabilities + Stockholder Equity 203,706,000 204.751.000 203.105.000 WalMart Inc Income Statement(s) Total Sales (Supplier Purchases) Cost of Goods Sold Gross Profit Selling and General Administrative Operating Profit Total Other Income Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Net Income From Continuing Ops Discontinued Operations Net Income 14,000,000 shares outstanding USE THESE PRICES Price per share ..2015 485,651,000 365,086,000 120,565,000 93,418,000 27.147.000 113,000 27.034.000 2.461.000 24,573,000 7,985,000 16,588.000 285,000 16,303,000 -2014 476,294,000 358,069,000 118.225.000 91,353,000 26.872.000 119,000 26,753,000 2.335,000 24,418,000 8,105,000 16,313,000 144,000 16,169.000 2013 468,651,000 352,297,000 116,354,000 88,629,000 27.725,000 186,000 27.539,000 2.249,000 25.290,000 7,958,000 17,332,000 52,000 17.280,000 Earnings per share 8 Price to Earnings Rati 10 9 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started