Complete 100% old answer was incorrest

Complete 100% old answer was incorrest

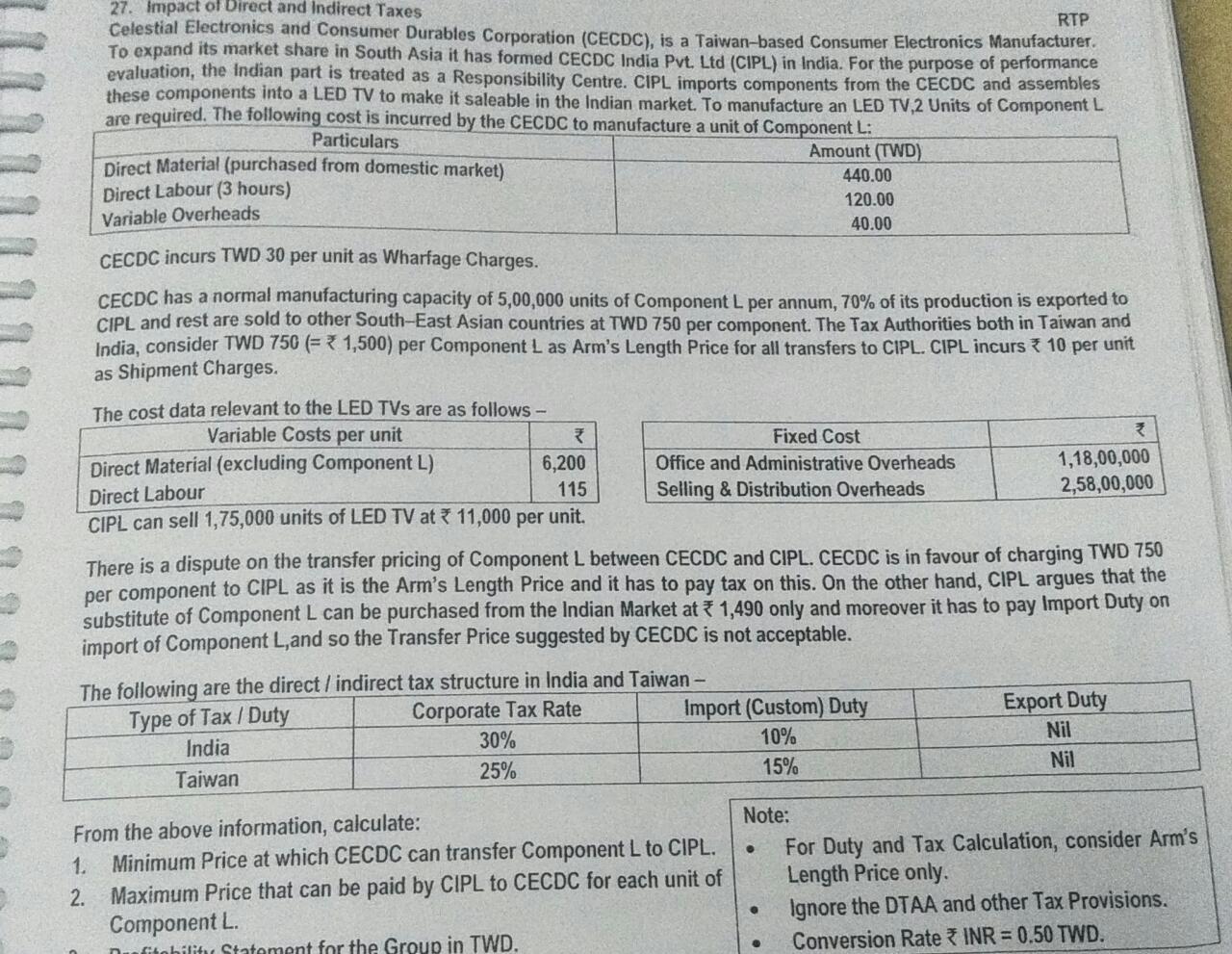

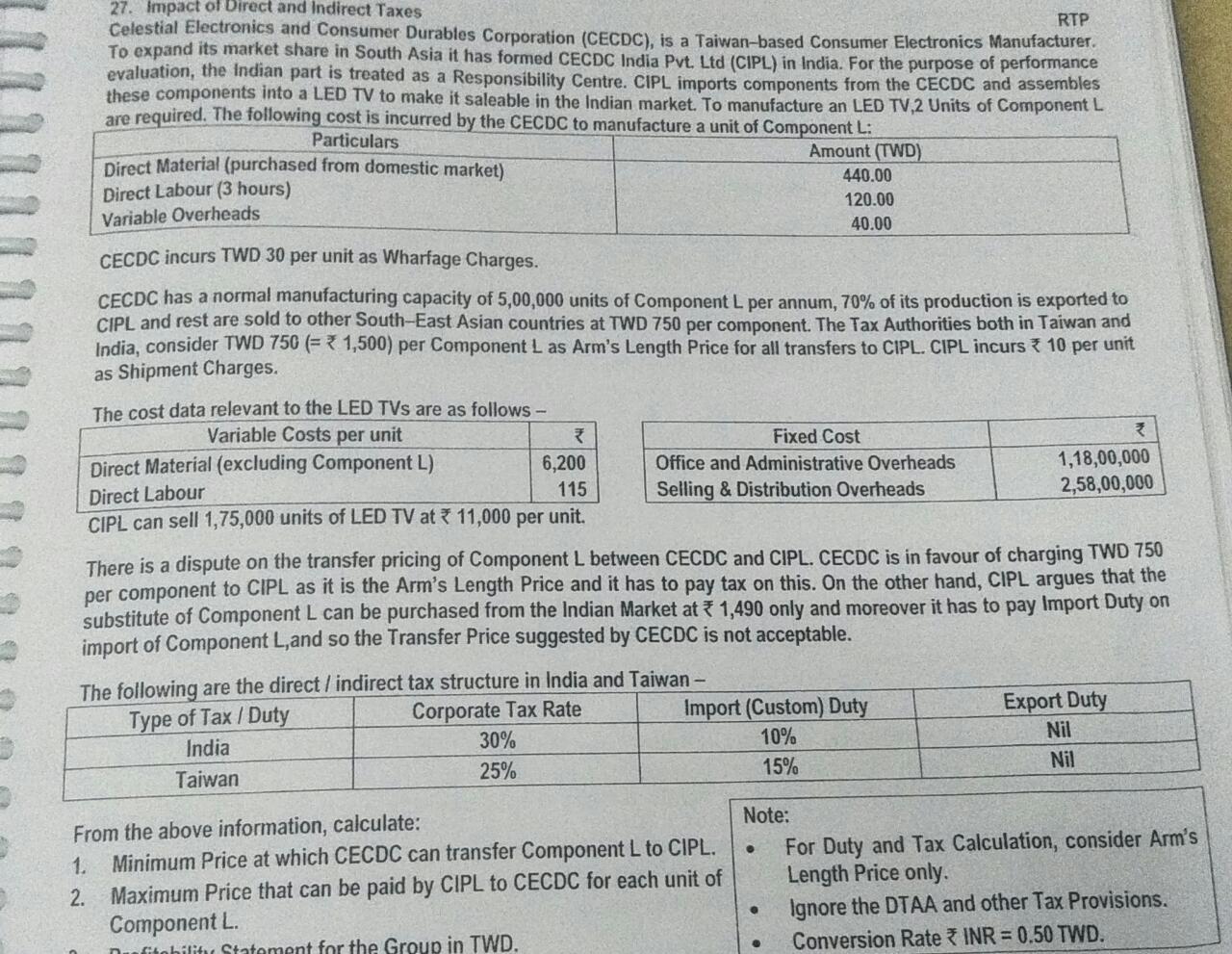

27. Impact of Direct and Indirect Taxes Celestial Electronics and Consumer Durables Corporation (CECDC), is a Taiwan-based Consumer Electronics Manufacturer. RTP To expand its market share in South Asia it has formed CECDC India Pvt. Ltd (CIPL) in India. For the purpose of performance evaluation, the Indian part is treated as a Responsibility Centre. CIPL imports components from the CECDC and assembles these components into a LED TV to make it saleable in the Indian market. To manufacture an LED TV,2 Units of Component L are required. The following cost is incurred by the CECDC to manufacture a unit of Component L: Particulars Direct Material (purchased from domestic market) Amount (TWD) 440.00 Direct Labour (3 hours) 120.00 Variable Overheads 40.00 CECDC incurs TWD 30 per unit as Wharfage Charges. CECDC has a normal manufacturing capacity of 5,00,000 units of Component L per annum, 70% of its production is exported to CIPL and rest are sold to other South-East Asian countries at TWD 750 per component. The Tax Authorities both in Taiwan and India, consider TWD 750 (+ 1,500) per Component Las Arm's Length Price for all transfers to CIPL. CIPL incurs ? 10 per unit as Shipment Charges. The cost data relevant to the LED TVs are as follows - Variable Costs per unit Fixed Cost R Direct Material (excluding Component L) 6,200 Office and Administrative Overheads 1,18,00,000 Direct Labour Selling & Distribution Overheads 2,58,00,000 CIPL can sell 1,75,000 units of LED TV at 11,000 per unit. There is a dispute on the transfer pricing of Component L between CECDC and CIPL. CECDC is in favour of charging TWD 750 per component to CIPL as it is the Arm's Length Price and it has to pay tax on this. On the other hand, CIPL argues that the substitute of Component L can be purchased from the Indian Market at * 1,490 only and moreover it has to pay Import Duty on import of Component L, and so the Transfer Price suggested by CECDC is not acceptable. The following are the direct / indirect tax structure in India and Taiwan - Type of Tax / Duty Corporate Tax Rate Import (Custom) Duty Export Duty India 30% 10% Nil 25% Taiwan 15% Nil 115 From the above information, calculate: 1. Minimum Price at which CECDC can transfer Component L to CIPL. 2. Maximum Price that can be paid by CIPL to CECDC for each unit of Component L. Dufitability Statement for the Group in TWD. Note: For Duty and Tax Calculation, consider Arm's Length Price only. Ignore the DTAA and other Tax Provisions. Conversion Rate INR = 0.50 TWD

Complete 100% old answer was incorrest

Complete 100% old answer was incorrest