Question

Complete a 2021 Federal Tax Return: Zuko and Mai Firebender are married and are 74 and 76 years of age, respectively. In 2021, they paid

Complete a 2021 Federal Tax Return:

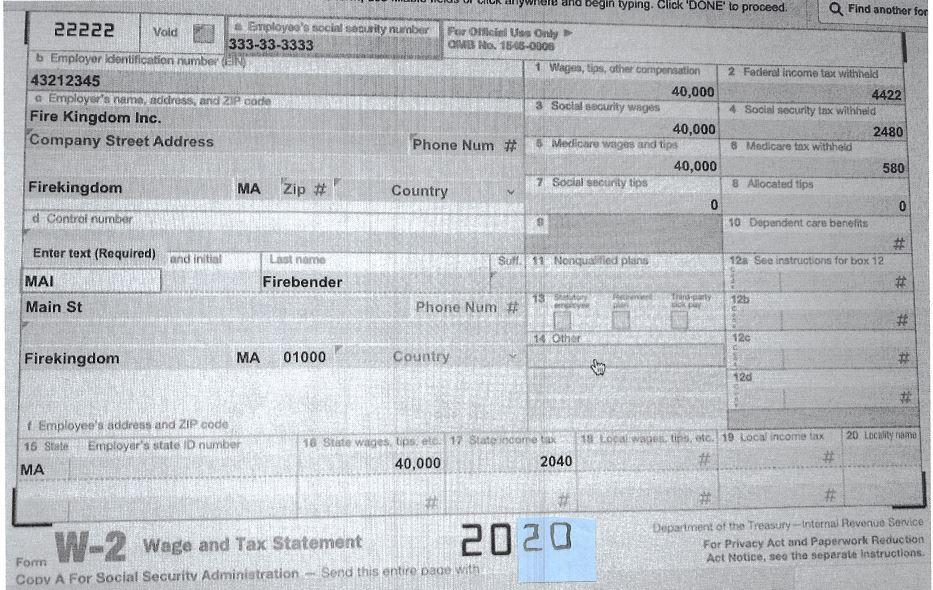

Zuko and Mai Firebender are married and are 74 and 76 years of age, respectively. In 2021, they paid real property taxes on their home of $1,500 and $1,000 of interest on their mortgage, had income tax preparation fees of $150, sold 100 shares of SuperX Corp stock for $1,500 (basis $500, purchased in 2015) and earned $100 of bank interest. Mai is a high school teacher and spent $250 on classroom supplies and materials. They also gave $500 to their one favorite charity (that is eligible for 501(c)3 status) and $5,000 cash to each of their 3 grandchildren (Dink, Josh, and Ruthrose). Assume Zuko and Mai's combined gross wages are $40,000 + $40,000 (= $80,000) in 2021 and they file a joint return.

Please note that the financial information (including wages and tax withholdings) are the same as Zuko (as they are all paid equally in the Fire Kingdom). They both worked and received W-2s.

NOTE: They take care of Zuko's mom and provide over 50% of Zuko's mother's support.

INSTRUCTIONS: Determine Zuko and Mai's taxable income, amount of taxes due and complete their tax return. HINT: You should complete the 2 page 1040 form as well as Schedule 1, Schedule D worksheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started