Answered step by step

Verified Expert Solution

Question

1 Approved Answer

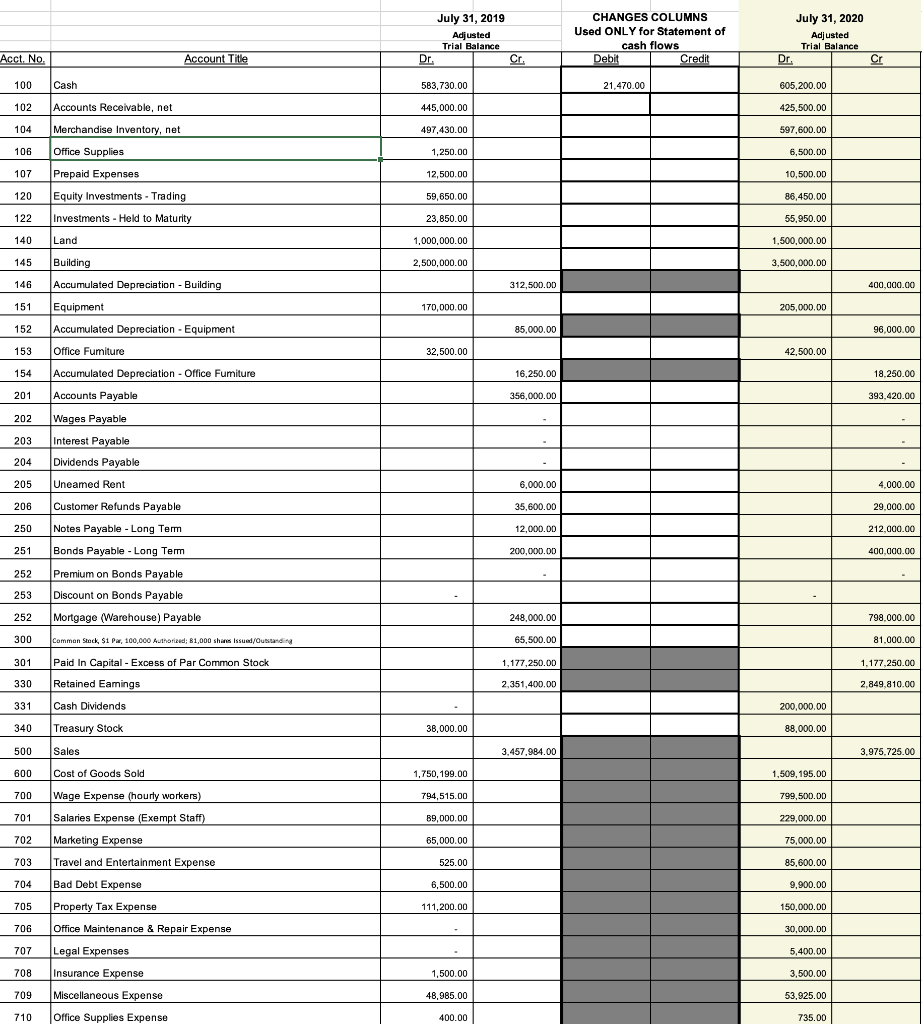

Complete a multi-step income statement, ONLY use accounts that have adjusted balances for July 31, 2020: Acct. No. Account Title 100 Cash 102 Accounts Receivable,

Complete a multi-step income statement, ONLY use accounts that have adjusted balances for July 31, 2020:

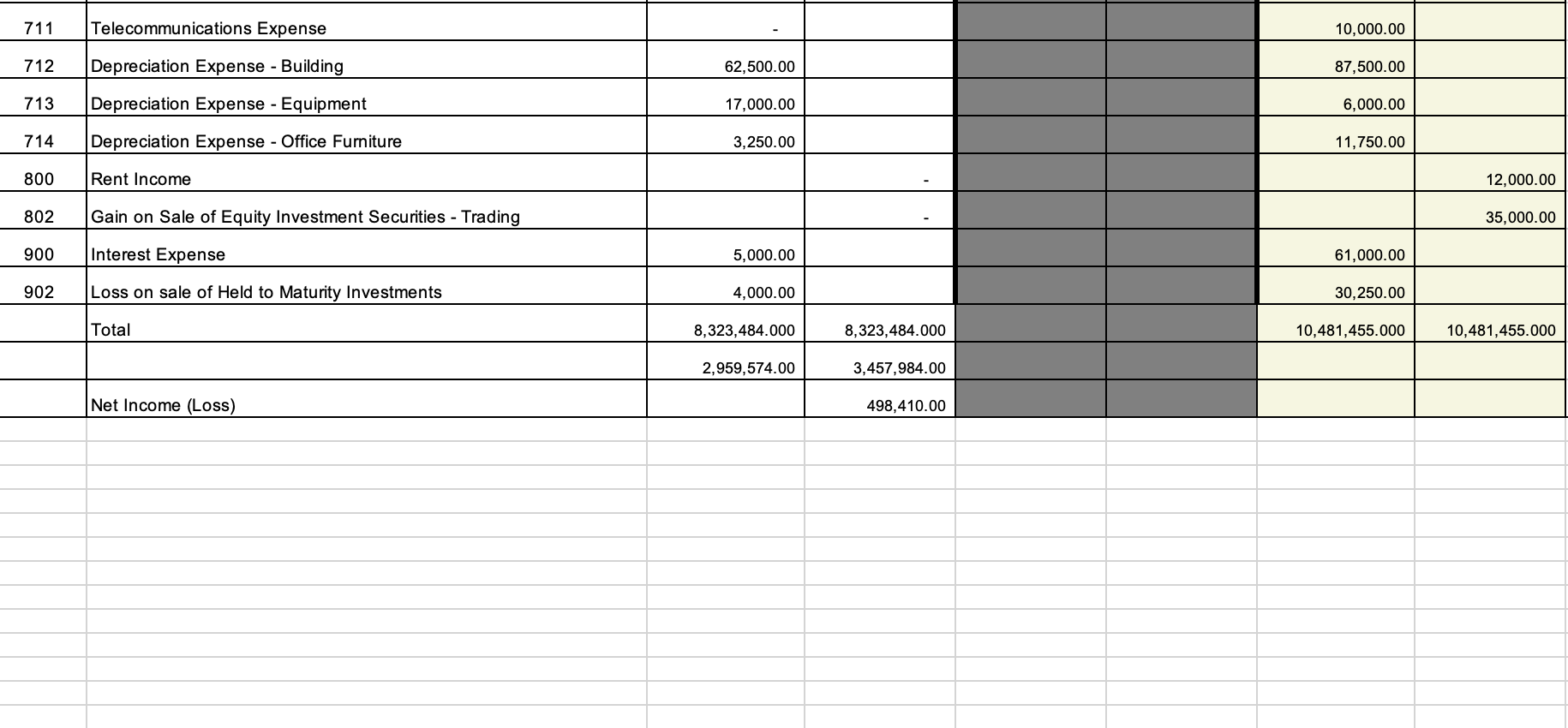

Acct. No. Account Title 100 Cash 102 Accounts Receivable, net 104 Merchandise Inventory, net 106 Office Supplies 107 Prepaid Expenses 120 Equity Investments - Trading 122 Investments - Held to Maturity 140 Land 145 Building 146 Accumulated Depreciation - Building 151 Equipment 152 Accumulated Depreciation - Equipment 153 Office Fumiture 154 Accumulated Depreciation - Office Fumiture 201 Accounts Payable 202 Wages Payable 203 Interest Payable 204 Dividends Payable 205 Uneamed Rent 206 Customer Refunds Payable 250 Notes Payable - Long Term 251 Bonds Payable - Long Term 252 Premium on Bonds Payable 253 Discount on Bonds Payable 252 Mortgage (Warehouse) Payable 300 Common Stock, $1 Par, 100,000 Authorized: 81,000 shares Issued/Outstanding 301 Paid In Capital - Excess of Par Common Stock 330 Retained Eamings 331 Cash Dividends 340 Treasury Stock 500 Sales 600 Cost of Goods Sold 700 Wage Expense (hourly workers) 701 Salaries Expense (Exempt Staff) 702 Marketing Expense 703 Travel and Entertainment Expense 704 Bad Debt Expense 705 Property Tax Expense 706 Office Maintenance & Repair Expense 707 Legal Expenses 708 Insurance Expense 709 Miscellaneous Expense 710 Office Supplies Expense July 31, 2019 Adjusted Trial Balance Dr. 583,730.00 445,000.00 497,430.00 1,250.00 12,500.00 59,650.00 23,850.00 1,000,000.00 2,500,000.00 170,000.00 32,500.00 38,000.00 1,750,199.00 794,515.00 89,000.00 65,000.00 525.00 6,500.00 111,200.00 1,500.00 48,985.00 400.00 Cr. 312,500.00 85,000.00 16,250.00 356,000.00 6,000.00 35,600.00 12,000.00 200,000.00 248,000.00 65,500.00 1,177,250.00 2,351,400.00 3,457,984.00 CHANGES COLUMNS Used ONLY for Statement of cash flows Debit Credit 21,470.00 July 31, 2020 Adjusted Trial Balance Dr. 605,200.00 425,500.00 597,600.00 6,500.00 10,500.00 86,450.00 55,950.00 1,500,000.00 3,500,000.00 205,000.00 42,500.00 200,000.00 88,000.00 1,509,195,00 799,500.00 229,000.00 75,000.00 85,600.00 9,900.00 150,000.00 30,000.00 5,400.00 3,500.00 53,925.00 735.00 Cr 400,000.00 96,000.00 18,250.00 393,420.00 - 4,000.00 29,000.00 212,000.00 400,000.00 798,000.00 81,000.00 1,177,250.00 2,849,810.00 3,975,725.00 711 Telecommunications Expense 712 Depreciation Expense - Building 713 Depreciation Expense - Equipment 714 Depreciation Expense - Office Furniture 800 Rent Income 802 Gain on Sale of Equity Investment Securities - Trading 900 Interest Expense 902 Loss on sale of Held to Maturity Investments Total Net Income (Loss) 62,500.00 17,000.00 3,250.00 5,000.00 4,000.00 8,323,484.000 2,959,574.00 8,323,484.000 3,457,984.00 498,410.00 10,000.00 87,500.00 6,000.00 11,750.00 61,000.00 30,250.00 10,481,455.000 12,000.00 35,000.00 10,481,455.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started