Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete all questions 1. Refer to the Caterpillar file in Moodle and answer the following. a. Calculate the Addition Funds Needed for Working Capital

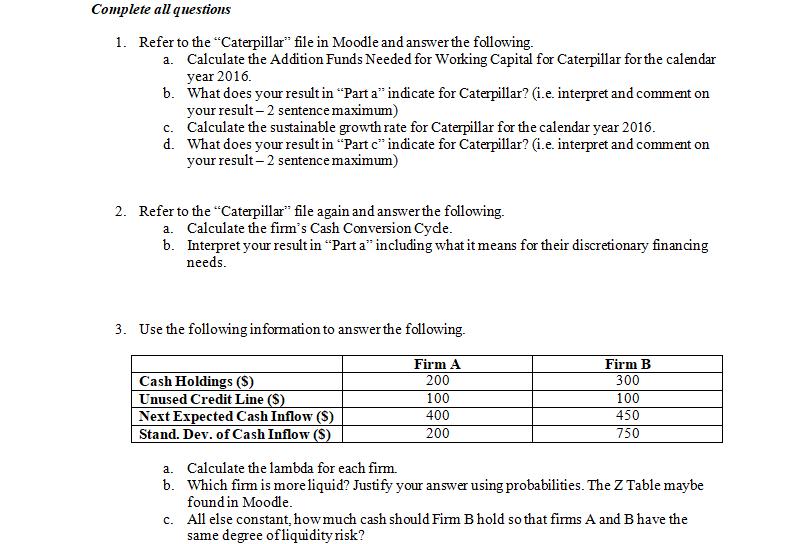

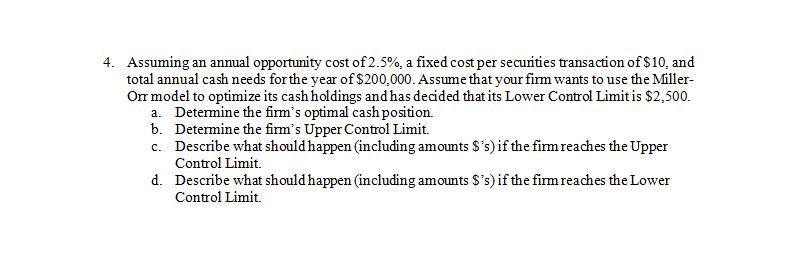

Complete all questions 1. Refer to the "Caterpillar" file in Moodle and answer the following. a. Calculate the Addition Funds Needed for Working Capital for Caterpillar for the calendar year 2016. b. What does your result in "Part a" indicate for Caterpillar? (i.e. interpret and comment on your result-2 sentence maximum) c. Calculate the sustainable growth rate for Caterpillar for the calendar year 2016. d. What does your result in "Part c" indicate for Caterpillar? (i.e. interpret and comment on your result-2 sentence maximum) 2. Refer to the "Caterpillar" file again and answer the following. a. Calculate the firm's Cash Conversion Cycle. b. Interpret your result in "Part a" including what it means for their discretionary financing needs. 3. Use the following information to answer the following. Cash Holdings (S) Unused Credit Line ($) Next Expected Cash Inflow (S) Stand. Dev. of Cash Inflow (S) Firm A 200 100 400 200 Firm B 300 100 450 750 a. Calculate the lambda for each firm. b. Which firm is more liquid? Justify your answer using probabilities. The Z Table maybe found in Moodle. c. All else constant, how much cash should Firm B hold so that firms A and B have the same degree of liquidity risk? 4. Assuming an annual opportunity cost of 2.5%, a fixed cost per securities transaction of $10, and total annual cash needs for the year of $200,000. Assume that your firm wants to use the Miller- Orr model to optimize its cash holdings and has decided that its Lower Control Limit is $2,500. a. Determine the firm's optimal cash position. b. Determine the firm's Upper Control Limit. c. Describe what should happen (including amounts $'s) if the firm reaches the Upper Control Limit. d. Describe what should happen (including amounts $'s) if the firm reaches the Lower Control Limit.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 a The addition funds needed for working capital for Caterpillar in 2016 is 2057 million b My resul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started