Answered step by step

Verified Expert Solution

Question

1 Approved Answer

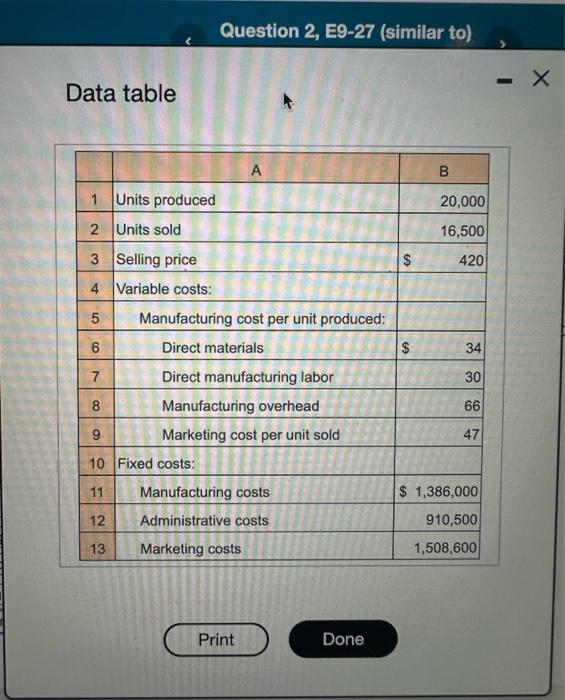

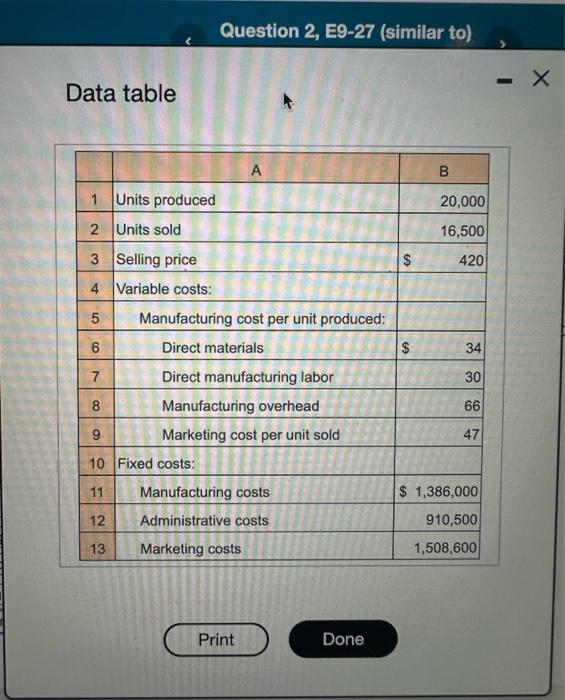

complete all requirements make the answers very clear for me to see Data table Requirements 1. Prepare a 2020 income statement for Griswold Company using

complete all requirements make the answers very clear for me to see

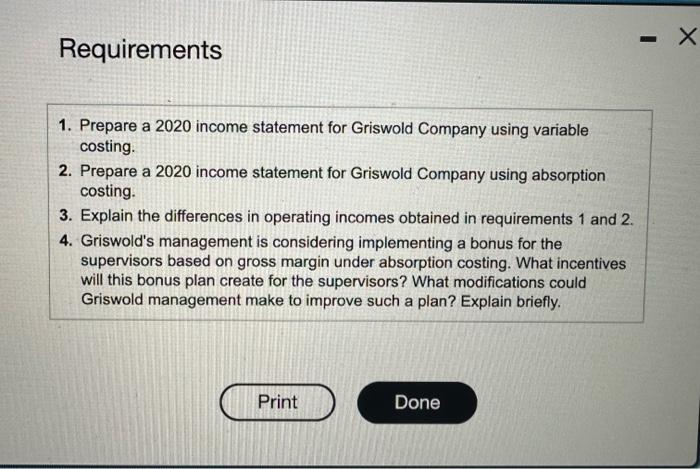

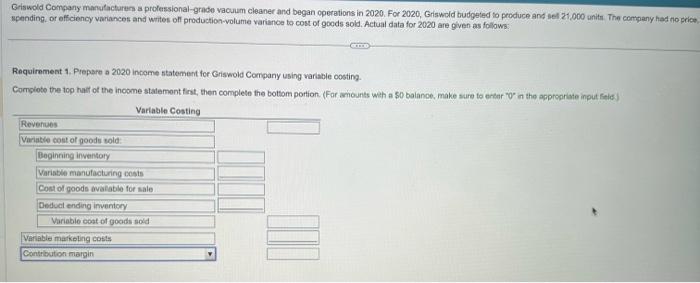

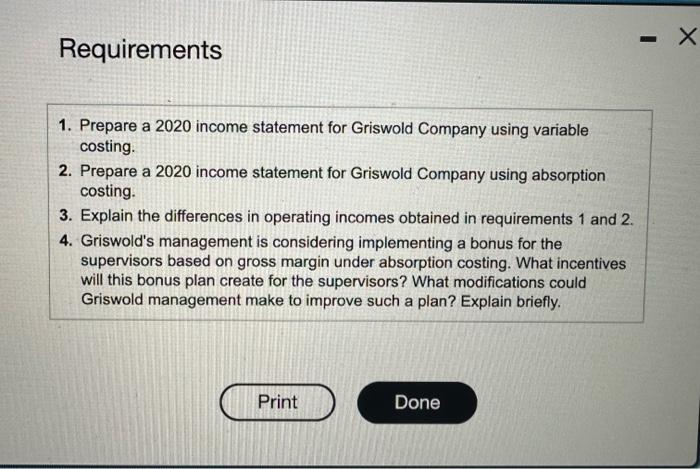

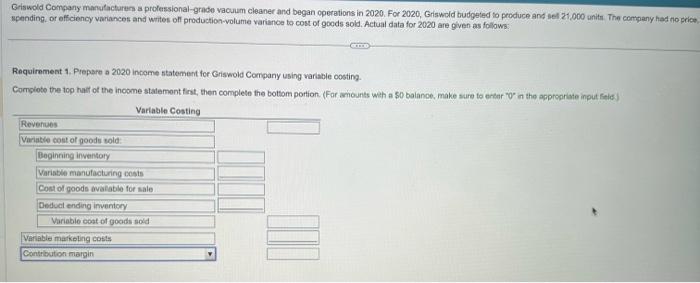

Data table Requirements 1. Prepare a 2020 income statement for Griswold Company using variable costing. 2. Prepare a 2020 income statement for Griswold Company using absorption costing. 3. Explain the differences in operating incomes obtained in requirements 1 and 2. 4. Griswold's management is considering implementing a bohus for the supervisors based on gross margin under absorption costing. What incentives will this bonus plan create for the supervisors? What modifications could Griswold management make to improve such a plan? Explain briefly. Griswold Company manutacturen a prolessional-grade vacuum cleaner and began operations in 2020 . For 2020, Griswoid budgeted to produce and sel Z1, oco unith. The company hed no price spending. or effeiency variances and wites of production-volume variance to cost of goeds sold. Actual data for 2020 are given as follows: Requirement 4. Plepsre a 2020 income statement for Griswold Company using varable oosting. Complote the tog haif of the inoome stalemont fint, then complete the bottom portion. (Far anounts weh a $0 balance. make sure to ertar "o" in the agproariate input Felc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started