Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c12 D&R Corporation has annual revenues of $284,000, an average contribution margin ratio of 33%, and fixed expenses of $113,100. Required: a. Management is considering

c12

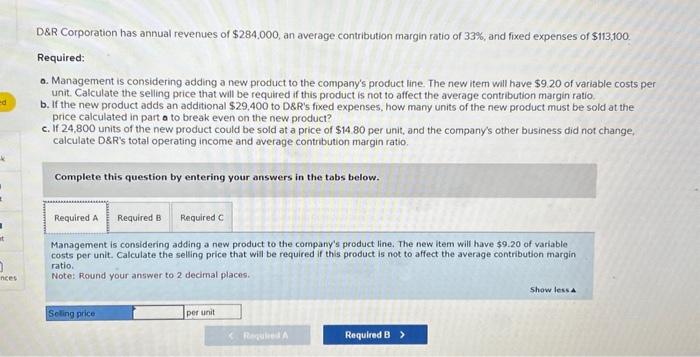

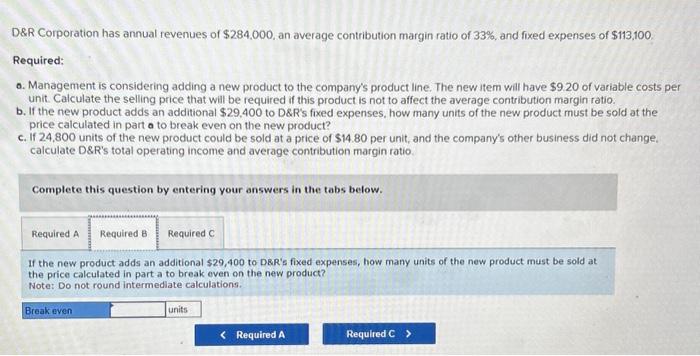

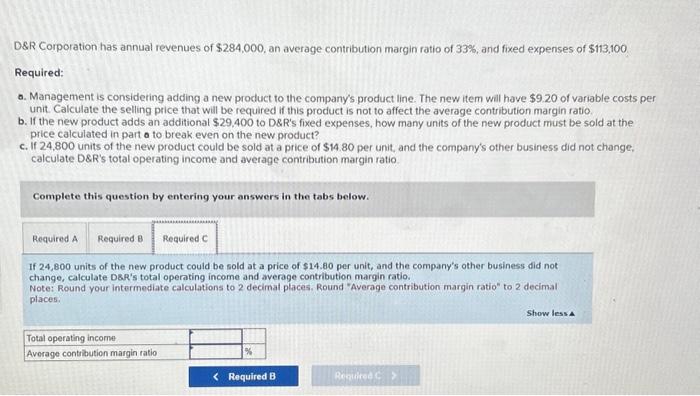

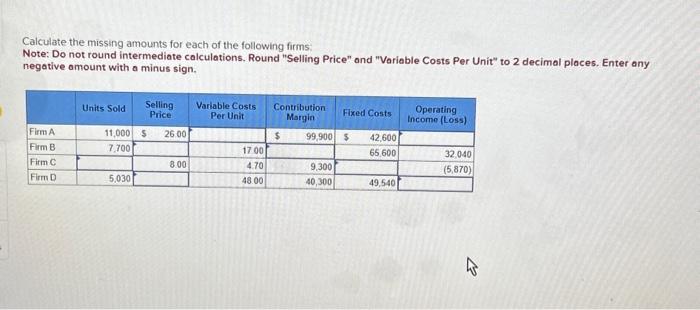

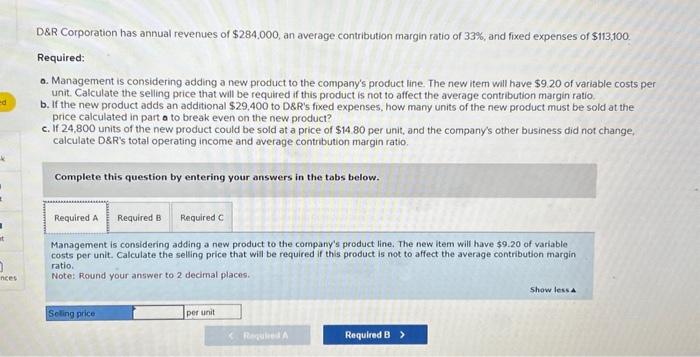

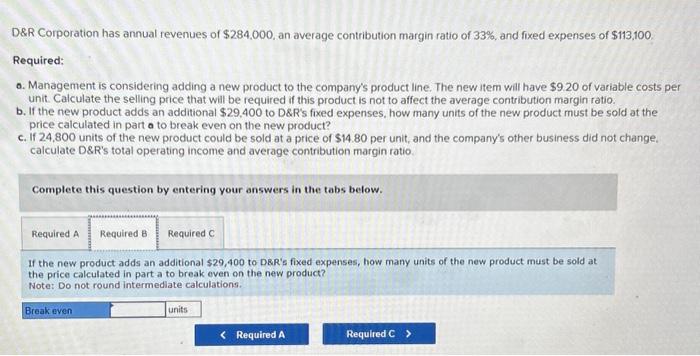

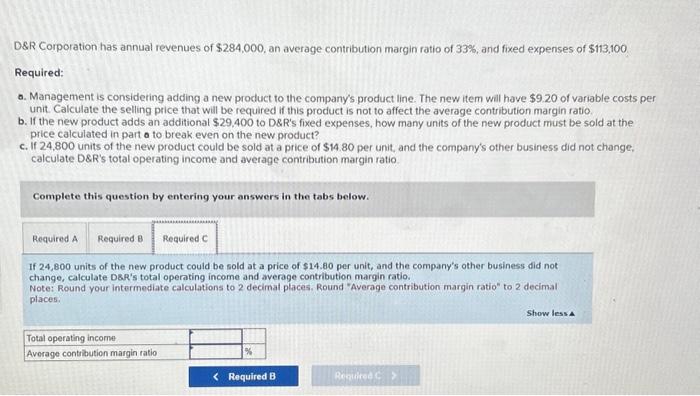

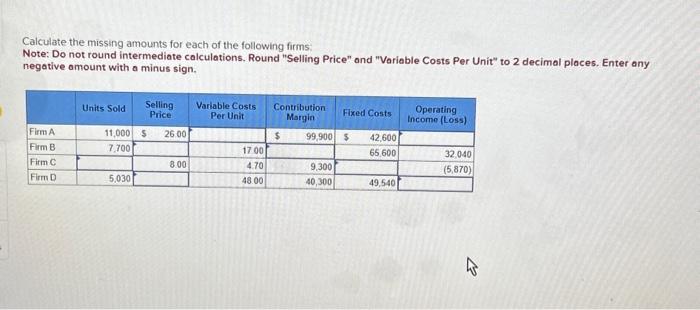

D\&R Corporation has annual revenues of $284,000, an average contribution margin ratio of 33%, and fixed expenses of $113,100. Required: a. Management is considering adding a new product to the company's product line. The new item will have $9.20 of variable costs per unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio, b. If the new product adds an additional $29,400 to D\&R's fixed expenses, how many units of the new product must be sold at the price calculated in part o to break even on the new product? c. If 24,800 units of the new product could be sold at a price of $14.80 per unit, and the company's other business did not change, calculate D\&R's total operating income and average contribution margin ratio. Complete this question by entering your answers in the tabs below. Management is considering adding a new product to the company's product line. The new item will have $9.20 of variable costs per unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio. Note: Round your answer to 2 decimal places. D\&R Corporation has annual revenues of $284,000, an average contribution margin ratio of 33%, and fixed expenses of $113,100. Required: a. Management is considering adding a new product to the company's product line. The new item will have $9.20 of variable costs pe unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio. b. If the new product adds an additional $29,400 to D\&R's fixed expenses, how many units of the new product must be sold at the price calculated in part a to break even on the new product? c. If 24.800 units of the new product could be sold at a price of $14.80 per unit, and the company's other business did not change, calculate D\&R's total operating income and average contribution margin ratio. Complete this question by entering your answers in the tabs below. If the new product adds an additional $29,400 to DER's fixed expenses, how many units of the new product must be sold at the price calculated in part a to break even on the new product? Note: Do not round intermediate calculations. D\&R Corporation has annual revenues of $284,000, an average contribution margin ratio of 33%, and fixed expenses of $113,100 Required: a. Management is considering adding a new product to the company's product line. The new item will have $9.20 of variable costs per unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio. b. If the new product adds an additional $29.400 to D\&R's fixed expenses, how many units of the new product must be sold at the price calculated in part a to break even on the new product? c. If 24,800 units of the new product could be sold at a price of $14.80 per unit, and the company's other business did not change, calculate D\&R's total operating income and average contribution margin ratio Complete this question by entering your answers in the tabs below. If 24,800 units of the new product could be sold at a price of $14.80 per unit, and the company's other business did not change, calculate D8R's total operating income and average contribution margin ratio. Note: Round your intermediate calculations to 2 decimat places. Round "Average contribution margin ratio" to 2 decimal places: Calculate the missing amounts for each of the following firms Note: Do not round intermediate calculations. Round "Selling Price" and "Variable Costs Per Unit" to 2 decimal places. Enter any negative amount with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started