Answered step by step

Verified Expert Solution

Question

1 Approved Answer

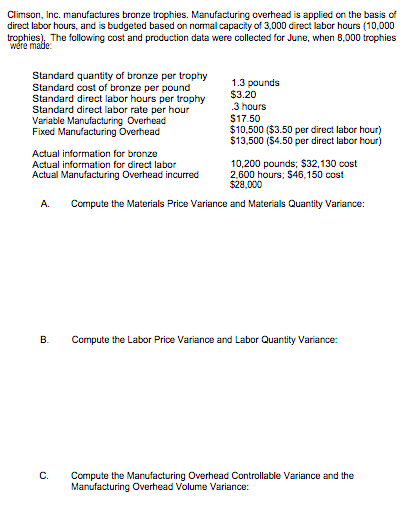

Please complete A-C, Thank you! Climson, Inc. manufactures bronze trophies. Manufacturing overhead is applied on the basis of direct labor hours, and is budgeted based

Please complete A-C, Thank you!

Climson, Inc. manufactures bronze trophies. Manufacturing overhead is applied on the basis of direct labor hours, and is budgeted based on normal capacity of 3,000 direct labor hours (10,000 oeph imsde The folwing cost and production data were collected for June, when 8,000 trophies Standard quantity of bronze per trophy.3 punds Standard cost of bronze per pound Standard direct labor hours per trophy Standard direct labor rate per hour Variable Manufacturing Overhead Fixed Manufacturing Overhead $3.20 3 hours S17.50 $10,500 (53.50 per direct labor hour) 513,500 (54.50 per direct labor hour) Actual information for bronze Actual information for direct labor Actual Manufacturing Overhead incurred 10,200 pounds; $32,130 cost 2,600 hours: $46,150 cost $28,000 A. Compute the Materials Price Variance and Materals Quantity Variance: B. Compute the Labor Price Variance and Labor Quantity Variance: C. Compute the Manufacturing Overhead Controllable Variance and the Manufacturing Overhead Volume Variance: Climson, Inc. manufactures bronze trophies. Manufacturing overhead is applied on the basis of direct labor hours, and is budgeted based on normal capacity of 3,000 direct labor hours (10,000 oeph imsde The folwing cost and production data were collected for June, when 8,000 trophies Standard quantity of bronze per trophy.3 punds Standard cost of bronze per pound Standard direct labor hours per trophy Standard direct labor rate per hour Variable Manufacturing Overhead Fixed Manufacturing Overhead $3.20 3 hours S17.50 $10,500 (53.50 per direct labor hour) 513,500 (54.50 per direct labor hour) Actual information for bronze Actual information for direct labor Actual Manufacturing Overhead incurred 10,200 pounds; $32,130 cost 2,600 hours: $46,150 cost $28,000 A. Compute the Materials Price Variance and Materals Quantity Variance: B. Compute the Labor Price Variance and Labor Quantity Variance: C. Compute the Manufacturing Overhead Controllable Variance and the Manufacturing Overhead Volume VarianceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started