Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete all the question if you not solved all the question I give you downvote compler The market price of the company's Equity share is

complete all the question if you not solved all the question I give you downvote

compler

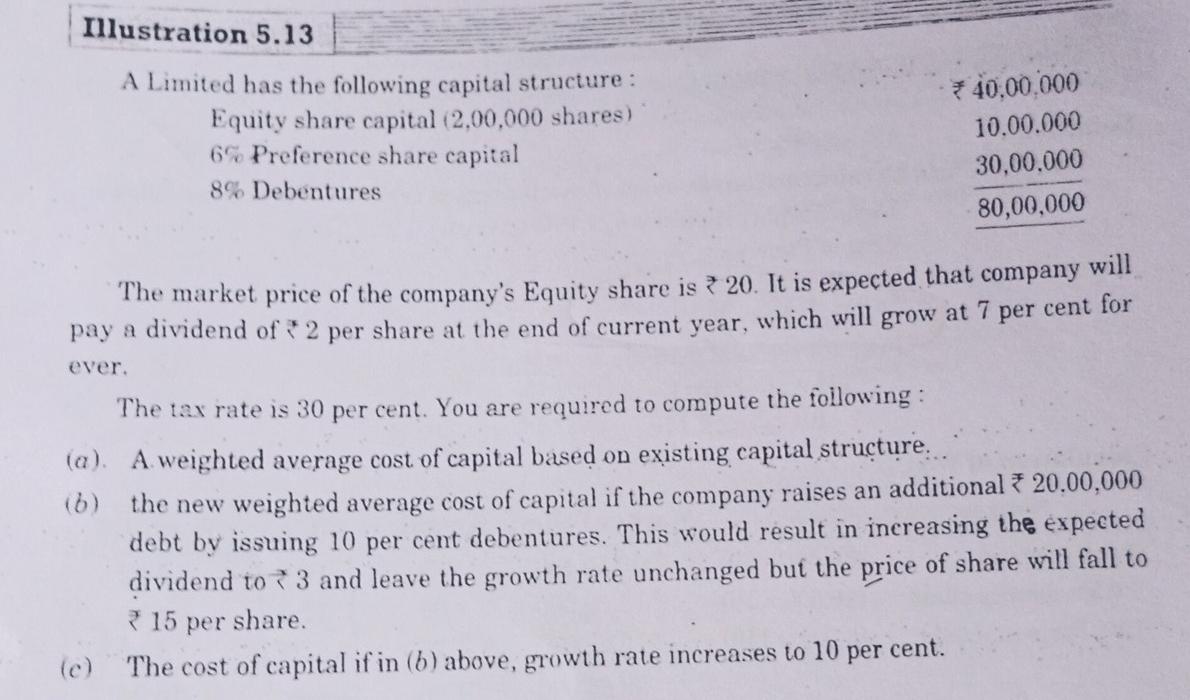

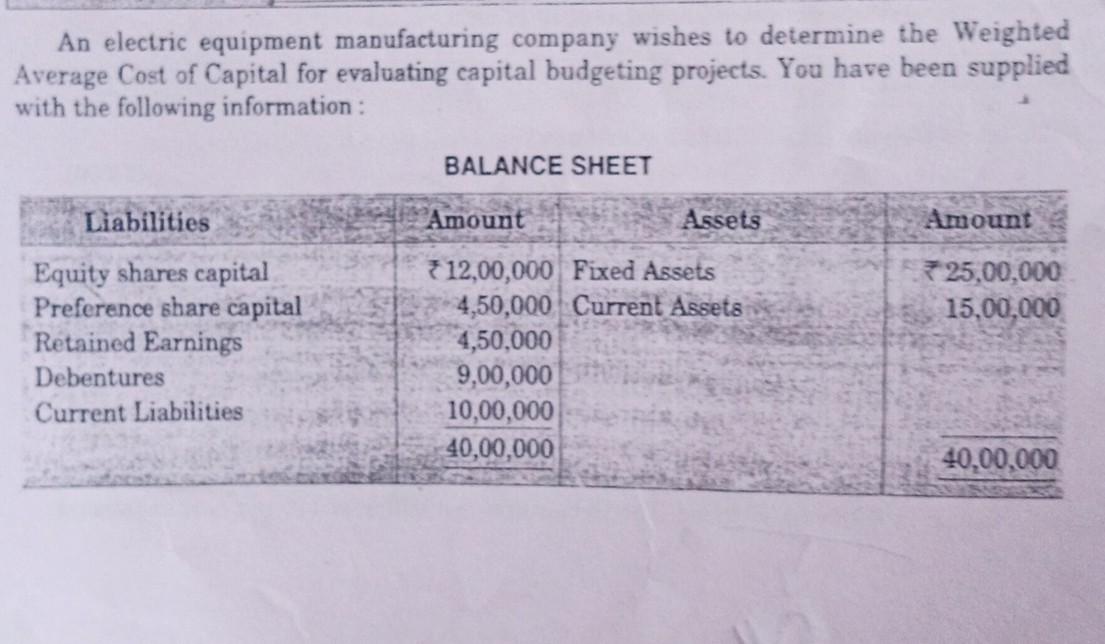

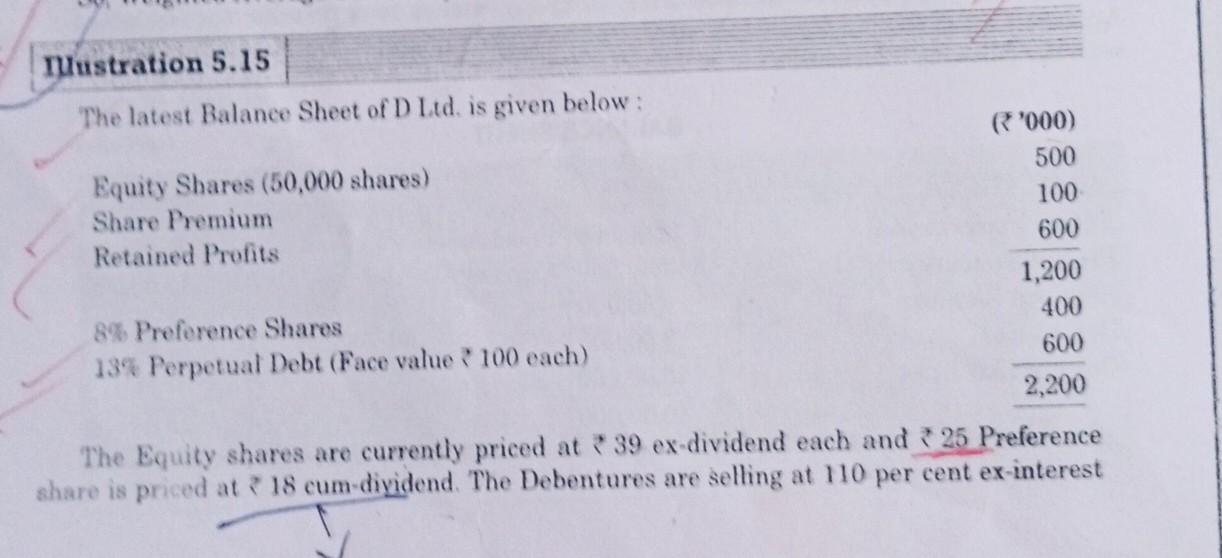

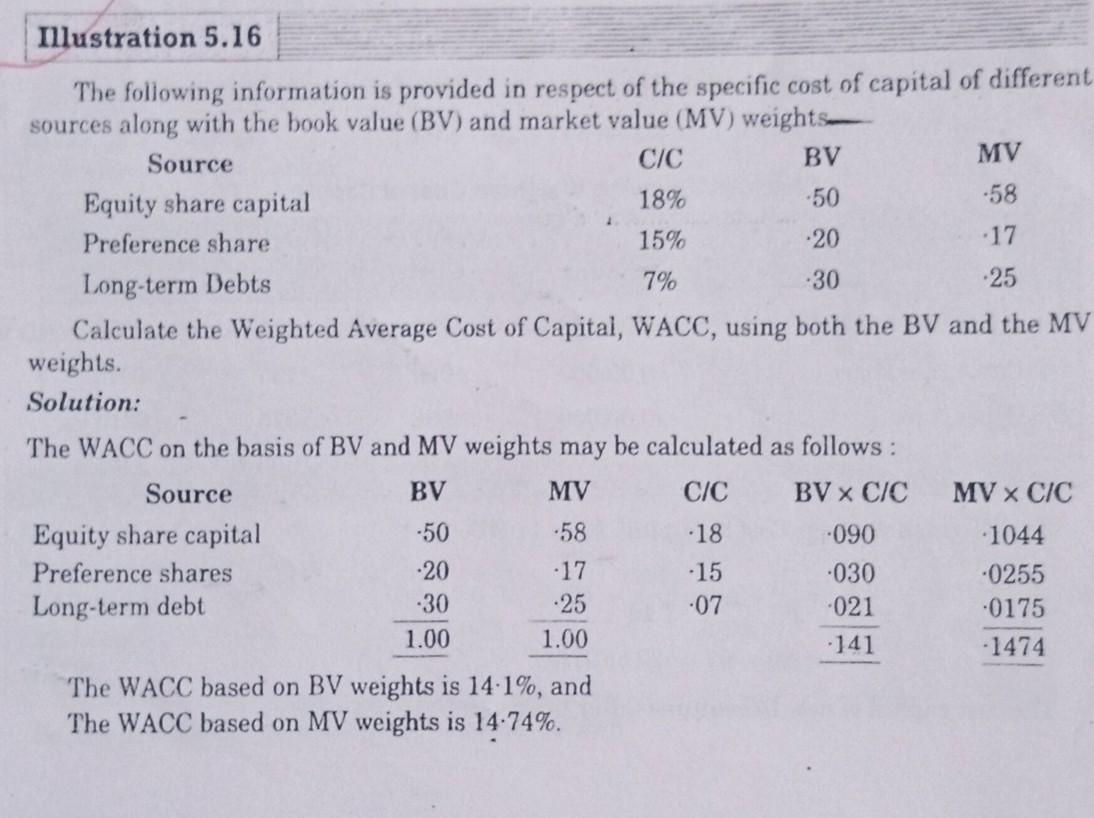

The market price of the company's Equity share is 20. It is expected that company will pay a dividend of 2 per share at the end of current year, which will grow at 7 per cent for ever. The tax rate is 30 per cent. You are required to compute the following : (a). A weighted average cost of capital based on existing capital structure (b) the new weighted average cost of capital if the company raises an additional 20,00,000 debt by issuing 10 per cent debentures. This would result in increasing the expected dividend to 3 and leave the growth rate unchanged but the price of share will fall to 15 per share. (c) The cost of capital if in (b) above, growth rate increases to 10 per cent. An electric equipment manufacturing company wishes to determine the Weighted Average Cost of Capital for evaluating capital budgeting projects. You have been supplied with the following information: The Equity shares are currently priced at 39 ex-dividend each and 25 Preference hare is priced at 18 cum-digidend. The Debentures are selting at 110 per cent ex-interest The following information is provided in respect of the specific cost of capital of different sources along with the book value (BV) and market Calculate the Weighted Average Cost of Capital, WACC, using both the BV and the MV weights. Solution: The WACC on the basis of BV and MV weights may be calculated as follows : The WACC based on BV weights is 141%, and The WACC based on MV weights is 14.74%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started