Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete Balance sheet and Income statement Plastic Sports, Inc. Income Statement In thousands of dollars begin{tabular}{|l|l|r|r|r|} hline 4 & & 2022 & 2021 & 2020

Complete Balance sheet and Income statement

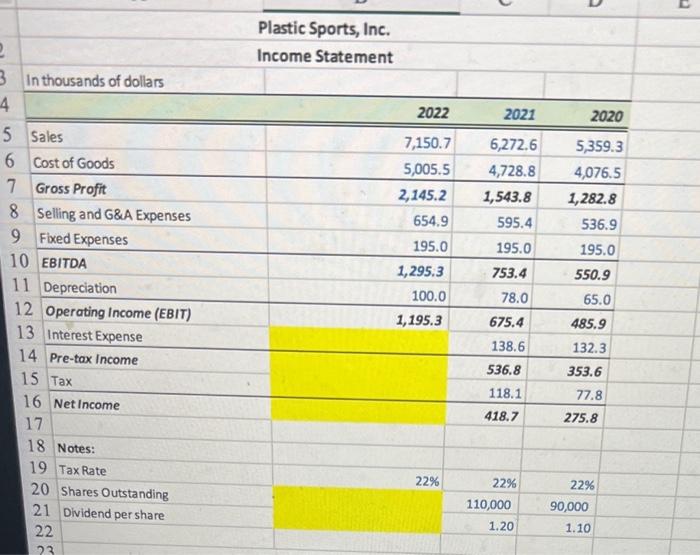

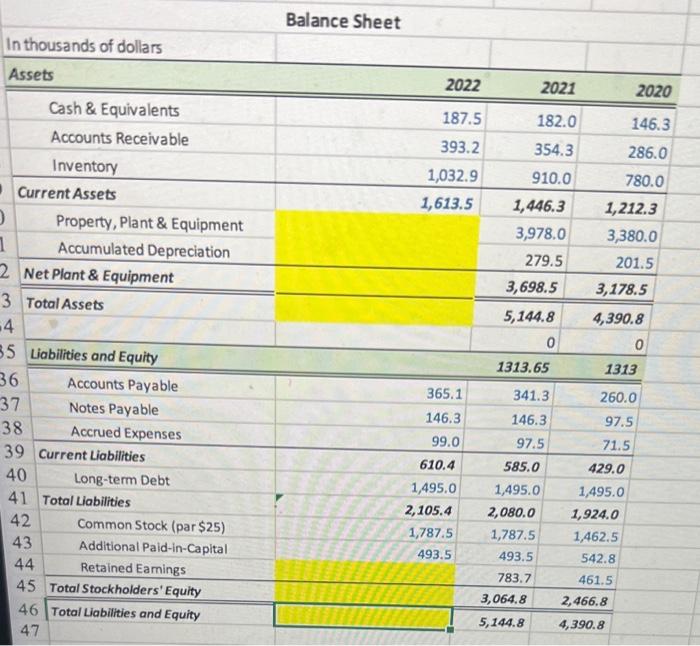

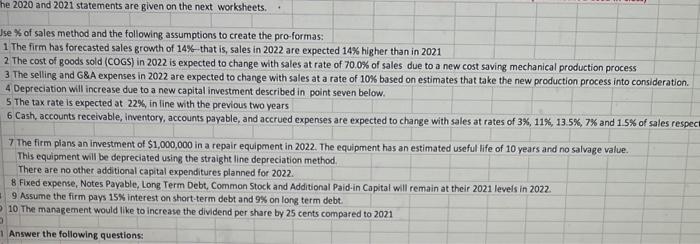

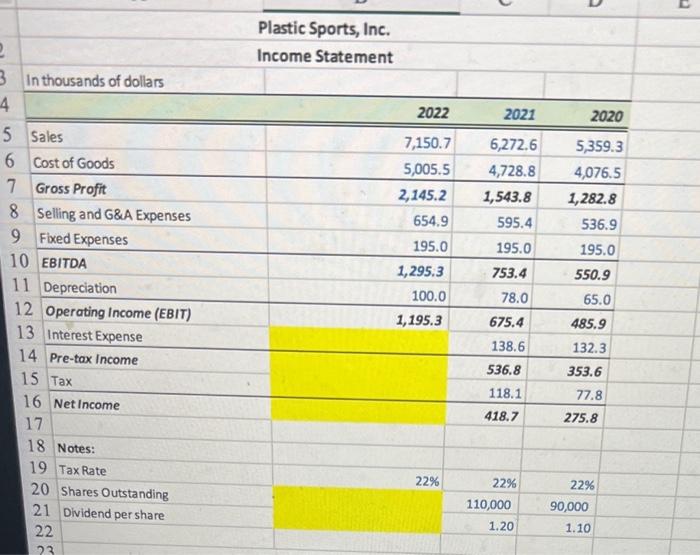

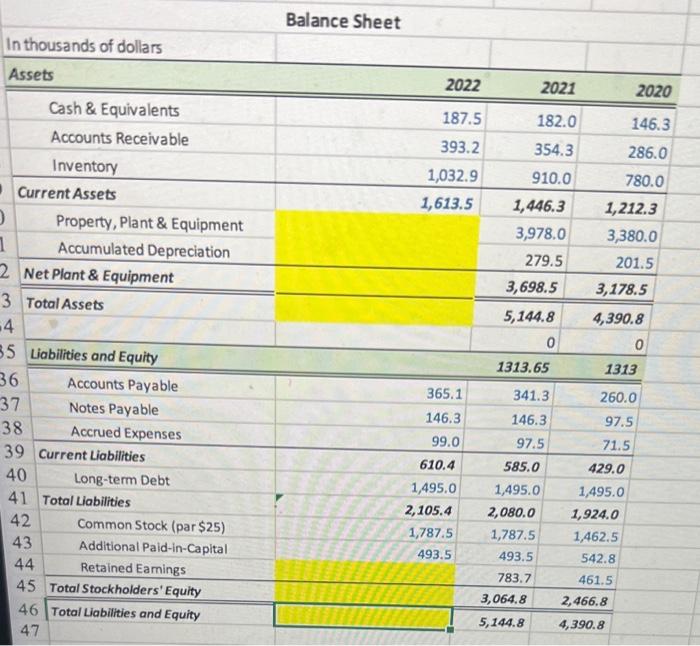

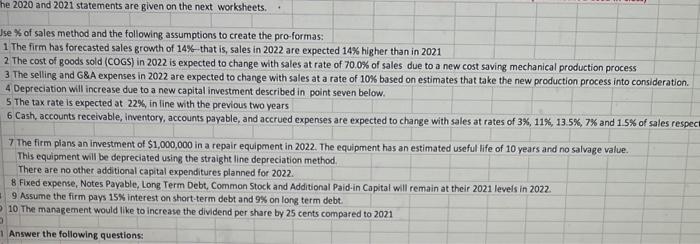

Plastic Sports, Inc. Income Statement In thousands of dollars \begin{tabular}{|l|l|r|r|r|} \hline 4 & & 2022 & 2021 & 2020 \\ \hline \hline 5 & Sales & 7,150.7 & 6,272.6 & 5,359.3 \\ \hline 6 & Cost of Goods & 5,005.5 & 4,728.8 & 4,076.5 \\ \hline 7 & Gross Profit & 2,145.2 & 1,543.8 & 1,282.8 \\ \hline 8 & Selling and G\&A Expenses & 654.9 & 595.4 & 536.9 \\ \hline 9 & Fixed Expenses & 195.0 & 195.0 & 195.0 \\ \hline 10 & EBITDA & 1,295.3 & 753.4 & 550.9 \\ 11 & Depreciation & 100.0 & 78.0 & 65.0 \\ \hline 12 & Operating Income (EBIT) & 1,195.3 & 675.4 & 485.9 \\ \hline 13 & Interest Expense & & 138.6 & 132.3 \\ \hline 14 & Pre-tax Income & & 536.8 & 353.6 \\ \hline 15 & Tax & & 118.1 & 77.8 \\ \hline 16 & Net Income & & 418.7 & 275.8 \\ \hline 17 & & & \\ \hline \end{tabular} 18 Notes: 19 Tax Rate 20 Shares Outstanding 22% 21 Dividend per share 22 Balance Sheet In thousands of dollars Ise % of sales method and the following assumptions to create the pro-formas: 1 The firm has forecasted sales growth of 14%-that is, sales in 2022 are expected 14% higher than in 2021 2 The cost of goods sold (COGS) in 2022 is expected to change with sales at rate of 70.0% of sales due to a new cost saving mechanical production process 3 The selling and G\&A expenses in 2022 are expected to change with sales at a rate of 10% based on estimates that take the new production process into consideration. 4 Depreciation will increase due to a new capital investment described in point seven below. 5 The tax rate is expected at 22%, in line with the previous two years 6 Cash, accounts receivable, inventory, accounts payable, and acerued expenses are expected to change with sales at rates of 3%,11%,13.5%,7% and 1.5% of sales respec T The firm pians an investment of $1,000,000 in a repair equipment in 2022. The equipment has an estimated useful life of 10 years and no salvage value. This equipment will be depreciated using the straight line depreciation method. There are no other additional capital expenditures planned for 2022 . 8 fixed expense, Notes Payable, Long Term Debt, Common Stock and Additional Paid-in Capital will remain at their 2021 levels in 2022. 9 Assume the firm pays 15% interest on short-term debt and 9% on long term debt. 10 The management would like to increase the dividend per share by 25 cents compared to 2021 Plastic Sports, Inc. Income Statement In thousands of dollars \begin{tabular}{|l|l|r|r|r|} \hline 4 & & 2022 & 2021 & 2020 \\ \hline \hline 5 & Sales & 7,150.7 & 6,272.6 & 5,359.3 \\ \hline 6 & Cost of Goods & 5,005.5 & 4,728.8 & 4,076.5 \\ \hline 7 & Gross Profit & 2,145.2 & 1,543.8 & 1,282.8 \\ \hline 8 & Selling and G\&A Expenses & 654.9 & 595.4 & 536.9 \\ \hline 9 & Fixed Expenses & 195.0 & 195.0 & 195.0 \\ \hline 10 & EBITDA & 1,295.3 & 753.4 & 550.9 \\ 11 & Depreciation & 100.0 & 78.0 & 65.0 \\ \hline 12 & Operating Income (EBIT) & 1,195.3 & 675.4 & 485.9 \\ \hline 13 & Interest Expense & & 138.6 & 132.3 \\ \hline 14 & Pre-tax Income & & 536.8 & 353.6 \\ \hline 15 & Tax & & 118.1 & 77.8 \\ \hline 16 & Net Income & & 418.7 & 275.8 \\ \hline 17 & & & \\ \hline \end{tabular} 18 Notes: 19 Tax Rate 20 Shares Outstanding 22% 21 Dividend per share 22 Balance Sheet In thousands of dollars Ise % of sales method and the following assumptions to create the pro-formas: 1 The firm has forecasted sales growth of 14%-that is, sales in 2022 are expected 14% higher than in 2021 2 The cost of goods sold (COGS) in 2022 is expected to change with sales at rate of 70.0% of sales due to a new cost saving mechanical production process 3 The selling and G\&A expenses in 2022 are expected to change with sales at a rate of 10% based on estimates that take the new production process into consideration. 4 Depreciation will increase due to a new capital investment described in point seven below. 5 The tax rate is expected at 22%, in line with the previous two years 6 Cash, accounts receivable, inventory, accounts payable, and acerued expenses are expected to change with sales at rates of 3%,11%,13.5%,7% and 1.5% of sales respec T The firm pians an investment of $1,000,000 in a repair equipment in 2022. The equipment has an estimated useful life of 10 years and no salvage value. This equipment will be depreciated using the straight line depreciation method. There are no other additional capital expenditures planned for 2022 . 8 fixed expense, Notes Payable, Long Term Debt, Common Stock and Additional Paid-in Capital will remain at their 2021 levels in 2022. 9 Assume the firm pays 15% interest on short-term debt and 9% on long term debt. 10 The management would like to increase the dividend per share by 25 cents compared to 2021

Plastic Sports, Inc. Income Statement In thousands of dollars \begin{tabular}{|l|l|r|r|r|} \hline 4 & & 2022 & 2021 & 2020 \\ \hline \hline 5 & Sales & 7,150.7 & 6,272.6 & 5,359.3 \\ \hline 6 & Cost of Goods & 5,005.5 & 4,728.8 & 4,076.5 \\ \hline 7 & Gross Profit & 2,145.2 & 1,543.8 & 1,282.8 \\ \hline 8 & Selling and G\&A Expenses & 654.9 & 595.4 & 536.9 \\ \hline 9 & Fixed Expenses & 195.0 & 195.0 & 195.0 \\ \hline 10 & EBITDA & 1,295.3 & 753.4 & 550.9 \\ 11 & Depreciation & 100.0 & 78.0 & 65.0 \\ \hline 12 & Operating Income (EBIT) & 1,195.3 & 675.4 & 485.9 \\ \hline 13 & Interest Expense & & 138.6 & 132.3 \\ \hline 14 & Pre-tax Income & & 536.8 & 353.6 \\ \hline 15 & Tax & & 118.1 & 77.8 \\ \hline 16 & Net Income & & 418.7 & 275.8 \\ \hline 17 & & & \\ \hline \end{tabular} 18 Notes: 19 Tax Rate 20 Shares Outstanding 22% 21 Dividend per share 22 Balance Sheet In thousands of dollars Ise % of sales method and the following assumptions to create the pro-formas: 1 The firm has forecasted sales growth of 14%-that is, sales in 2022 are expected 14% higher than in 2021 2 The cost of goods sold (COGS) in 2022 is expected to change with sales at rate of 70.0% of sales due to a new cost saving mechanical production process 3 The selling and G\&A expenses in 2022 are expected to change with sales at a rate of 10% based on estimates that take the new production process into consideration. 4 Depreciation will increase due to a new capital investment described in point seven below. 5 The tax rate is expected at 22%, in line with the previous two years 6 Cash, accounts receivable, inventory, accounts payable, and acerued expenses are expected to change with sales at rates of 3%,11%,13.5%,7% and 1.5% of sales respec T The firm pians an investment of $1,000,000 in a repair equipment in 2022. The equipment has an estimated useful life of 10 years and no salvage value. This equipment will be depreciated using the straight line depreciation method. There are no other additional capital expenditures planned for 2022 . 8 fixed expense, Notes Payable, Long Term Debt, Common Stock and Additional Paid-in Capital will remain at their 2021 levels in 2022. 9 Assume the firm pays 15% interest on short-term debt and 9% on long term debt. 10 The management would like to increase the dividend per share by 25 cents compared to 2021 Plastic Sports, Inc. Income Statement In thousands of dollars \begin{tabular}{|l|l|r|r|r|} \hline 4 & & 2022 & 2021 & 2020 \\ \hline \hline 5 & Sales & 7,150.7 & 6,272.6 & 5,359.3 \\ \hline 6 & Cost of Goods & 5,005.5 & 4,728.8 & 4,076.5 \\ \hline 7 & Gross Profit & 2,145.2 & 1,543.8 & 1,282.8 \\ \hline 8 & Selling and G\&A Expenses & 654.9 & 595.4 & 536.9 \\ \hline 9 & Fixed Expenses & 195.0 & 195.0 & 195.0 \\ \hline 10 & EBITDA & 1,295.3 & 753.4 & 550.9 \\ 11 & Depreciation & 100.0 & 78.0 & 65.0 \\ \hline 12 & Operating Income (EBIT) & 1,195.3 & 675.4 & 485.9 \\ \hline 13 & Interest Expense & & 138.6 & 132.3 \\ \hline 14 & Pre-tax Income & & 536.8 & 353.6 \\ \hline 15 & Tax & & 118.1 & 77.8 \\ \hline 16 & Net Income & & 418.7 & 275.8 \\ \hline 17 & & & \\ \hline \end{tabular} 18 Notes: 19 Tax Rate 20 Shares Outstanding 22% 21 Dividend per share 22 Balance Sheet In thousands of dollars Ise % of sales method and the following assumptions to create the pro-formas: 1 The firm has forecasted sales growth of 14%-that is, sales in 2022 are expected 14% higher than in 2021 2 The cost of goods sold (COGS) in 2022 is expected to change with sales at rate of 70.0% of sales due to a new cost saving mechanical production process 3 The selling and G\&A expenses in 2022 are expected to change with sales at a rate of 10% based on estimates that take the new production process into consideration. 4 Depreciation will increase due to a new capital investment described in point seven below. 5 The tax rate is expected at 22%, in line with the previous two years 6 Cash, accounts receivable, inventory, accounts payable, and acerued expenses are expected to change with sales at rates of 3%,11%,13.5%,7% and 1.5% of sales respec T The firm pians an investment of $1,000,000 in a repair equipment in 2022. The equipment has an estimated useful life of 10 years and no salvage value. This equipment will be depreciated using the straight line depreciation method. There are no other additional capital expenditures planned for 2022 . 8 fixed expense, Notes Payable, Long Term Debt, Common Stock and Additional Paid-in Capital will remain at their 2021 levels in 2022. 9 Assume the firm pays 15% interest on short-term debt and 9% on long term debt. 10 The management would like to increase the dividend per share by 25 cents compared to 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started