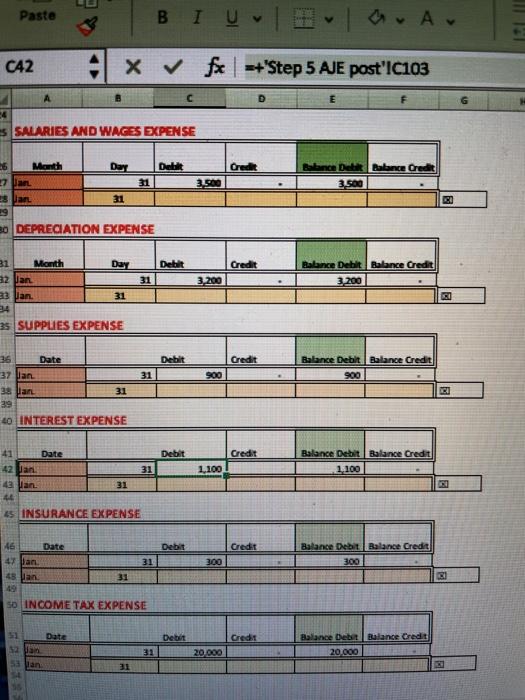

Complete following closing entries & Post closing

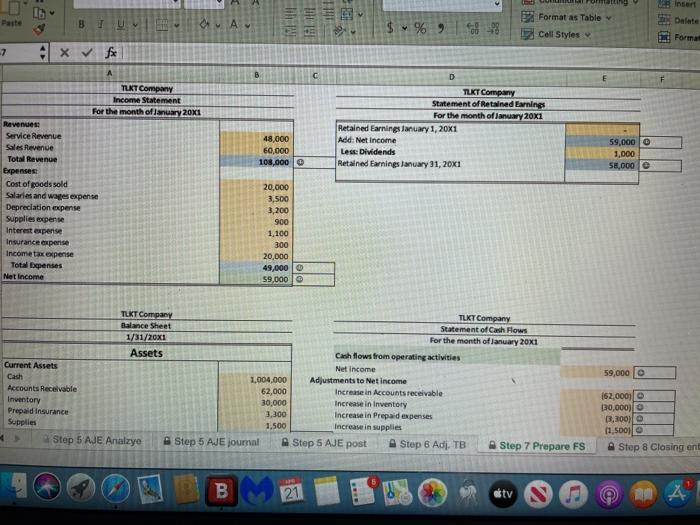

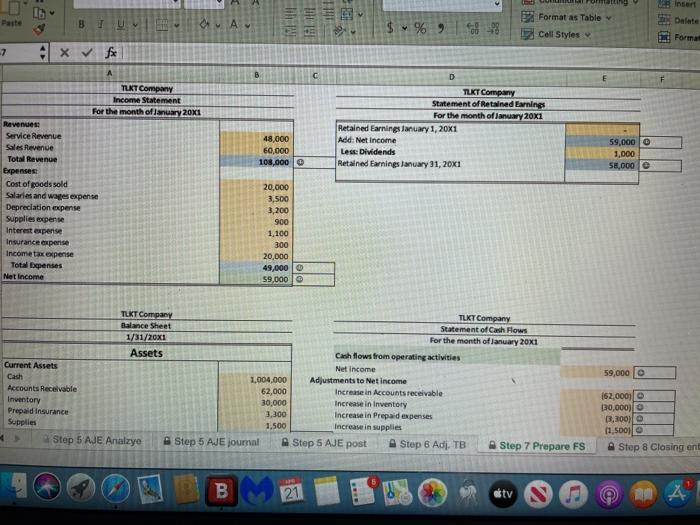

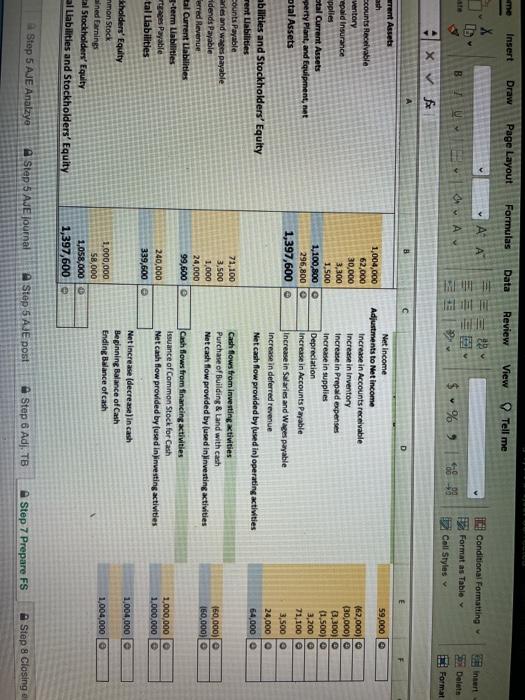

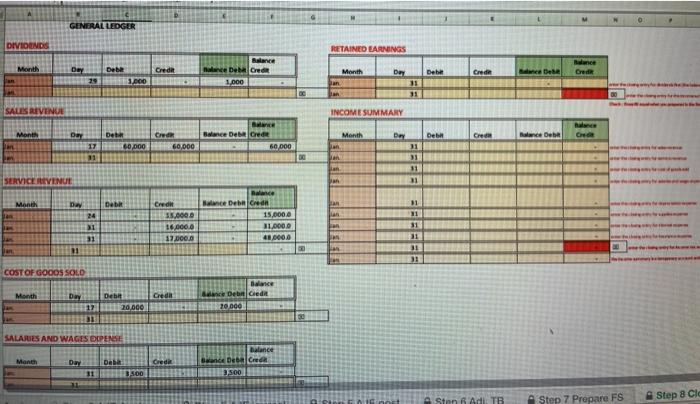

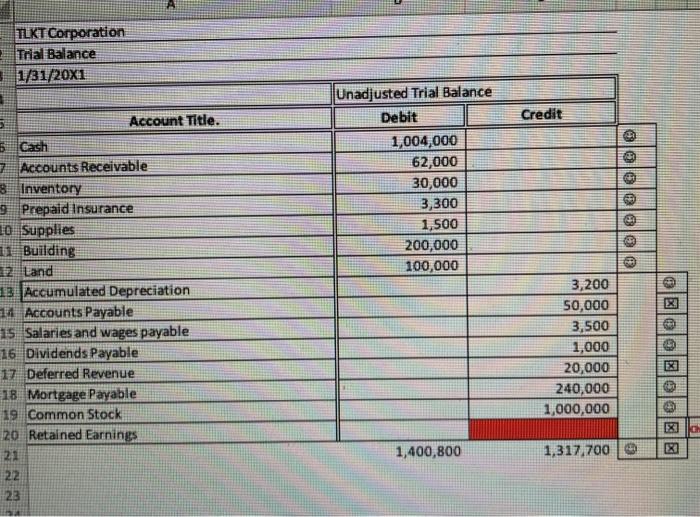

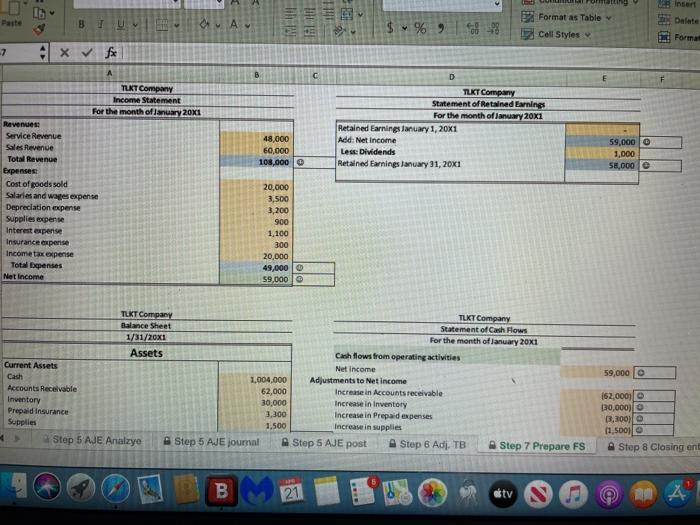

Paste BTU a. A $ % E2 Format as Table Cell Styles B Insert Dalate Forma 7 Xf A D TLKT Company Statement of Retained Earnings For the month of January 20X1 Retained Earnings January 1, 20X1 Add: Net Income Les Dividends Retained Earnings January 31, 20X1 48,000 60,000 108,000 59,000 1,000 58.000 TLKT Company Income Statement For the month of January 20X1 Revenues Service Revenue Sales Revenue Total Revenue Expenses Cost of goods sold Salaries and was expense Depreciation expense Supplies experts Interest expense Insurance expense Income tax expense Total Expenses Net Income 20,000 3,500 3,200 900 1.100 300 20,000 49,000 59,000 TLKT Company Balance Sheet 1/31/20X1 Assets Current Assets Cash Accounts Receivable Inventory Prepaid insurance Supplies Step 5 AJE Analye 59,000 TLKT Company Statement of Cash Flows For the month of January 20X1 Cash flows from operating activities Net Income 1,004,000 Adjustments to Net income 62,000 Increase in Accounts receivable 30,000 Increase in inventory 3,300 Increase in Prepaid expenses 1,500 Increase in supplies Step 5 AJE journal A Step 5 AJE post Step 6 Adj. TB Step 7 Prepare FS 162.000) 130,000) 3,300) (1.500 A Step 8 Closing on B 21 sty me Insert Draw Page Layout Formulas Data Review View Tell me C 29 ID Conditional Formatting Format as Table Call Styles net Dy Dalets G A $ %) F Format X fx A D 59,0000 arent Assets ath counts Receivable ventory epaid insurance pplies atal Current Assets perty Plant, and Equipment, net otal Assets 1,004,000 62,000 30,000 3,300 1,500 1,100,800 295,800 1,397,600 Net Income Adjustments to Net Income Increase in Accounts receivable Increase in Inventory Increase in Prepaid expenses Increase in supplies Depreciation Increase in Accounts Payable Increase in Salaries and Wages payable Increase in deferred revenue Net cash flow provided by used in) operating activities (62,000) (30,000) 0.300) (1.500) 3,200 71,100 3,500 24,000 64,000 abilities and Stockholders' Equity rent Liabilities counts Payable aries and wages payable idends Payable Ferred Revenue cal Qurrent abilities 3-term Liabilities tapes Payable tal Liabilities 71,100 3,500 1,000 24,000 99,600 160,000) 150.000) Cash flows from investing stivities Purchase of Building & Land with cash Net cash flow provided by used in investing activities Cash flows from financing activities Issuance of Common Stock for Cash Net cash flow provided by (used in investing activities Net Increase (decrease in cash Beginning Balance of Cash Ending Balance of cash 240,000 339,600 1,000,000 1,000,000 1,004,000 1,004,000 holders' Equity mmon Stock ined Earnings al Stockholders' Equity al Liabilities and Stockholders' Equity 1,000,000 58,000 1,058,000 1,397,600 Step 5 AJE Analye A Step 5 AJE Journal Step 5 AJE post Step 6 Adj. TB Step 7 Prepare FS Step 8 Closing GENERAL LEDGER DIVIDENDS RETAINED EARNINGS dance Debe Crede Dey 25 Balance DeCred 1.000 Month Debe Crede Dred 1.000 De 31 31 SALES REVENUE INCOME SUMMARY Month Month Crem Race De Grec Day Det COM 1760000 60,000 11 Balance Dev Cred 60 000 Day 31 31 od SERVICE REVENUE 11 Mont Det 10 91 11 lan D 24 31 31 11 Credit 35.000 16000 6 17 000 Balance Nate Deba Credin 15,000.0 31.000.0 48000 EEEEE 11 31 3: COST OF GOODS SOLD Month boy De Crede 1770.000 3 Balance Den ledet 20.000 SALAJUES AND WAGES DEPENSE Manth Deba cred balance Bande De Cro 500 31 5.00 cat Sten Adi TB Step 7 Prepare FS Step 8 Cle Paste BIU a. Av IMI C42 4 fx =+'Step 5 AJE post'IC103 24 SALARIES AND WAGES EXPENSE Day Delt Credit 26 Month 27 pa 31 Balance De Balance Credit 3.500 2.500 28 Jan 31 19 DEPRECIATION EXPENSE Debit Credit 31 Balance Debit Balance Credit 3.200 3.200 31 Month Day 32 Jan 23 Jan 31 34 35 SUPPLIES EXPENSE Debit Credit Balance Debt Balance Credit 900 31 900 36 Date 37 Jan 38 Jan 39 31 40 INTEREST EXPENSE Debit Credit Balance Debit Balance Credit 1.100 1.100 41 Date 42 Jan 31 43 Van 31 45 4 INSURANCE EXPENSE Credit Balance DebitBalance Credit 300 300 46 Date Debit 47 Jan 31 31 49 SO INCOME TAX EXPENSE 5 Date saan 53 Van Debit 20.000 Balance De Balance Credit 20.000 31 TLKT Corporation Tral Balance 1/31/20X1 Credit Unadjusted Trial Balance Debit 1,004,000 62,000 30,000 3,300 1,500 200,000 100,000 0 0 0 0 0 0 Account Title 5 Cash Accounts Receivable 3 Inventory 9 Prepaid Insurance 0. Supplies 1 Building 2 Land 13 Accumulated Depreciation 1 Accounts Payable 15 Salaries and wages payable 16 Dividends Payable 17 Deferred Revenue 18 Mortgage Payable 19 Common Stock 20 Retained Earnings 21 22 23 3,200 50,000 3,500 1,000 20,000 240,000 1,000,000 Belgola wo 1,400,800 1,317,700