- complete Form 1065 pages 1/4/5, schedule K-1, and QBI for Mark only

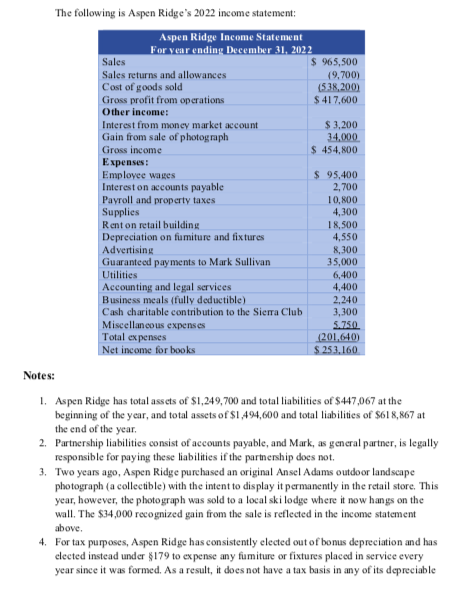

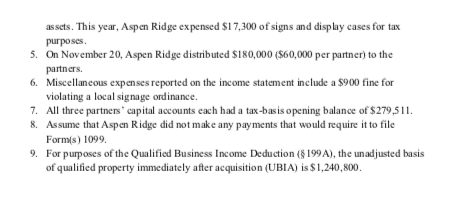

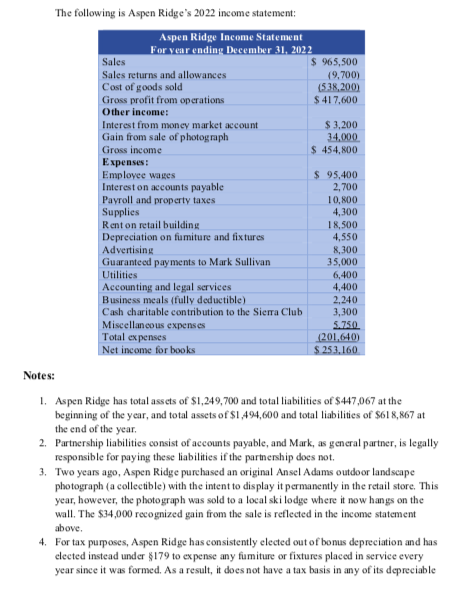

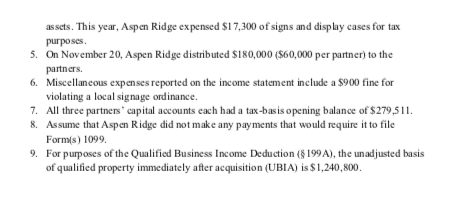

The following is Aspen Ridge's 2022 income statement: Notes: 1. Aspen Ridge has total assets of $1,249,700 and total liabilities of $447,067 at the beginning of the year, and total assets of $1,494,600 and total liabilities of $618,867 at the end of the year. 2. Partnership liabilities consist of accounts payable, and Mark, as general partner, is legally responsible for paying these liabilities if the partnership does not. 3. Two years ago, Aspen Ridge purchased an original Ansel Adams outdoor landseape photograph (a collectible) with the intent to display it permanently in the retail store. This year, however, the photograph was sold to a local ski lodge where it now hangs on the wall. The $34,000 recognized gain from the sale is reflected in the income statement above. 4. For tax purposes, Aspen Ridge has consistently elected out of bonus depreciation and has elected instead under 8179 to expense any fumiture or fixtures placed in service every year since it was formed. As a result, it does not have a tax basis in any of its depreciable assets. This year, Aspen Ridge expensed $17,300 of signs and display cases for tax purposes. 5. On November 20, Aspen Ridge distributed $180,000($60,000 per partner) to the partners. 6. Miscellaneous expenses reported on the income statement include a $900 fine for violating a local signage ordinance. 7. All three partners' capital accounts each had a tax-basis opening balance of $279,511. 8. Assume that Aspen Ridge did not make any payments that would require it to file Form(s) 1099. 9. For purposes of the Qualified Business Income Deduction (8199A), the unadjusted basis of qualified property immediately after acquisition (UBIA) is $1,240,800. Required: - For 2022, complete Aspen Ridge limited partnership's page 1 of Form 1065; complete Schedule K on page 4 of Form 1065; complete lines 1 and 2 of the Analysis of Net Income (Loss) at the top of page 5 of Form 1065; and complete Schedules M-1 and M-2 at the bottom of page 5 of Form 1065 (you may skip Schedule L). Finally, complete Mark Sullivan's Schedule K-1. - Form 4562 for depreciation and Schedule D for capital gains are not required. Include any tax depreciation or $179 expense on the appropriate line of page 1 of Form 1065 or Schedule K. - If any information is missing, use reasonable assumptions to fill in the gaps. - The forms, schedules, and instructions can be found at the IRS website (www. irs,gov). The instructions can be helpful in completing the forms. Facts: The Aspen Ridge limited partnership was formed on April 1, 2010, by Mark Sullivan, its general partner, and two other limited partners when they each contributed an equal amount of cash to start the new enterprise. Aspen Ridge is an outdoor equipment retailer selling camping, fishing, skiing, and other outdoor gear to the general public. Mark has a 33.33 pereent profits, loss, and capital interest and the limited partners hold the remaining 66.66 pereent of the profits, loss, and capital interests. Their profits, loss, and capital interests have remained unchanged since the partnership was formed. Mark is actively involved in managing the business while the limited partners are only investors, and Mark receives an annual guaranteed distribution of $35,000 for his services managing the business. - Aspen Ridge is located at 1065 North 365 South, Ogden, Utah 84401. - The employer identification number for Aspen Ridge is 85-8976654. - Aspen Ridge uses the acerual method of accounting and has a calendar year-end. - Mark's address is 543 W ander Lane, Holladay, Utah 84503 , and his Social Security number is 445-27-3584. His phone is 801-555-5555. Mark is designated as the Partnership Representative in the partnership agreement. The following is Aspen Ridge's 2022 income statement: Notes: 1. Aspen Ridge has total assets of $1,249,700 and total liabilities of $447,067 at the beginning of the year, and total assets of $1,494,600 and total liabilities of $618,867 at the end of the year. 2. Partnership liabilities consist of accounts payable, and Mark, as general partner, is legally responsible for paying these liabilities if the partnership does not. 3. Two years ago, Aspen Ridge purchased an original Ansel Adams outdoor landseape photograph (a collectible) with the intent to display it permanently in the retail store. This year, however, the photograph was sold to a local ski lodge where it now hangs on the wall. The $34,000 recognized gain from the sale is reflected in the income statement above. 4. For tax purposes, Aspen Ridge has consistently elected out of bonus depreciation and has elected instead under 8179 to expense any fumiture or fixtures placed in service every year since it was formed. As a result, it does not have a tax basis in any of its depreciable assets. This year, Aspen Ridge expensed $17,300 of signs and display cases for tax purposes. 5. On November 20, Aspen Ridge distributed $180,000($60,000 per partner) to the partners. 6. Miscellaneous expenses reported on the income statement include a $900 fine for violating a local signage ordinance. 7. All three partners' capital accounts each had a tax-basis opening balance of $279,511. 8. Assume that Aspen Ridge did not make any payments that would require it to file Form(s) 1099. 9. For purposes of the Qualified Business Income Deduction (8199A), the unadjusted basis of qualified property immediately after acquisition (UBIA) is $1,240,800. Required: - For 2022, complete Aspen Ridge limited partnership's page 1 of Form 1065; complete Schedule K on page 4 of Form 1065; complete lines 1 and 2 of the Analysis of Net Income (Loss) at the top of page 5 of Form 1065; and complete Schedules M-1 and M-2 at the bottom of page 5 of Form 1065 (you may skip Schedule L). Finally, complete Mark Sullivan's Schedule K-1. - Form 4562 for depreciation and Schedule D for capital gains are not required. Include any tax depreciation or $179 expense on the appropriate line of page 1 of Form 1065 or Schedule K. - If any information is missing, use reasonable assumptions to fill in the gaps. - The forms, schedules, and instructions can be found at the IRS website (www. irs,gov). The instructions can be helpful in completing the forms. Facts: The Aspen Ridge limited partnership was formed on April 1, 2010, by Mark Sullivan, its general partner, and two other limited partners when they each contributed an equal amount of cash to start the new enterprise. Aspen Ridge is an outdoor equipment retailer selling camping, fishing, skiing, and other outdoor gear to the general public. Mark has a 33.33 pereent profits, loss, and capital interest and the limited partners hold the remaining 66.66 pereent of the profits, loss, and capital interests. Their profits, loss, and capital interests have remained unchanged since the partnership was formed. Mark is actively involved in managing the business while the limited partners are only investors, and Mark receives an annual guaranteed distribution of $35,000 for his services managing the business. - Aspen Ridge is located at 1065 North 365 South, Ogden, Utah 84401. - The employer identification number for Aspen Ridge is 85-8976654. - Aspen Ridge uses the acerual method of accounting and has a calendar year-end. - Mark's address is 543 W ander Lane, Holladay, Utah 84503 , and his Social Security number is 445-27-3584. His phone is 801-555-5555. Mark is designated as the Partnership Representative in the partnership agreement