Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete Schedule M-1 for each of the following cases: Required: Corporate financial statement: net income of $55,000 including tax expense of $16,200, charitable contributions of

Complete Schedule M-1 for each of the following cases:

Required:

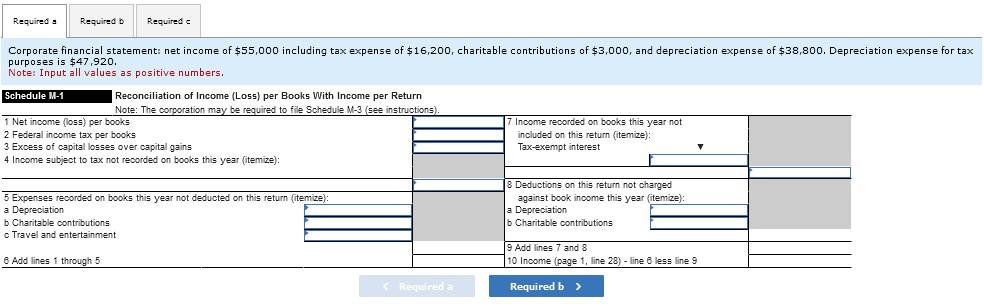

- Corporate financial statement: net income of $55,000 including tax expense of $16,200, charitable contributions of $3,000, and depreciation expense of $38,800. Depreciation expense for tax purposes is $47,920.

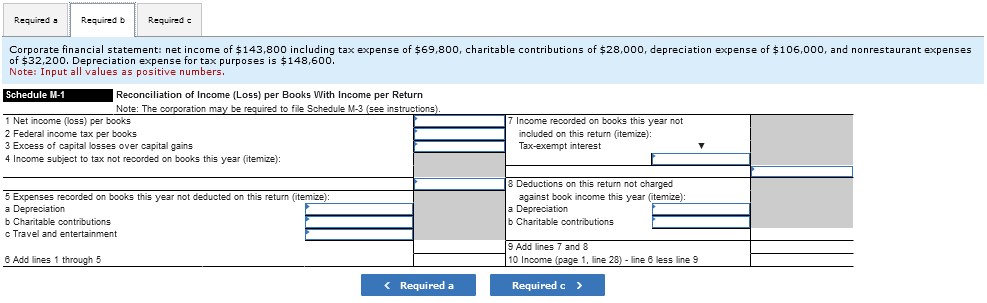

- Corporate financial statement: net income of $143,800 including tax expense of $69,800, charitable contributions of $28,000, depreciation expense of $106,000, and nonrestaurant meals expenses of $32,200. Depreciation expense for tax purposes is $148,600.

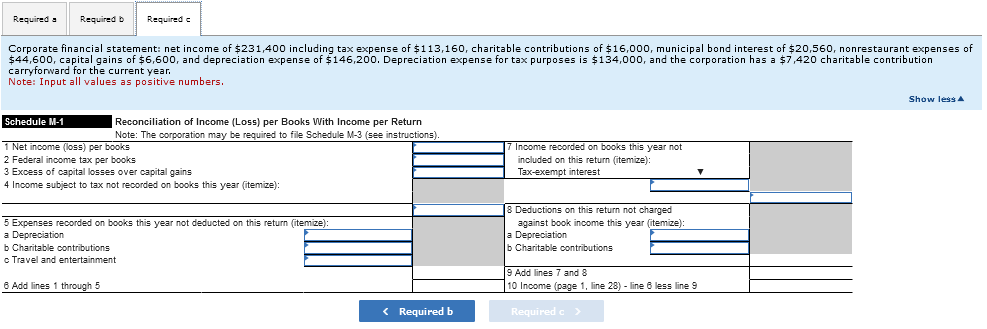

- Corporate financial statement: net income of $231,400 including tax expense of $113,160, charitable contributions of $16,000, municipal bond interest of $20,560, nonrestaurant meals expenses of $44,600, capital gains of $6,600, and depreciation expense of $146,200. Depreciation expense for tax purposes is $134,000, and the corporation has a $7,420 charitable contribution carryforward for the current year.

\begin{tabular}{|l|l|l|} \hline Required a & Required b & Required e \\ \hline \end{tabular} purposes is $47,920. Note: Input all values as positive numbers. Schedule M-1 Reconciliation of Income (Los5) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemize): 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions c Travel and entertainment 6 Add lines 1 through 5 \begin{tabular}{|l|l|l|} \hline & 7Incomerecordedonbooksthisyearnotincludedonthisreturn(itemize):Tax-exemptinterest & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Required b > \begin{tabular}{|l|l|l|} \hline Required a & Required b \\ \hline \end{tabular} of $32,200. Depreciation expense for tax purposes is $148,600. Note: Input all values as positive numbers. Schedule M-1 Reconciliation of Income (Los5) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemice): \begin{tabular}{l} 4 Income subject to tax not recorded on books this year (itemize): \\ \hline 5 Expenses recorded on books this year not deducted on this return (itemize): \\ a Depreciation \\ b Charitable contributions \\ c Travel and entertainment \\ 6 Add lines 1 through 5 \end{tabular} \begin{tabular}{|l|l|l} 7 Income recorded on books this year not \\ included on this return (itemize): \\ Tax-exempt interest \\ \hline & & \\ \hline & & \\ 8.ductions on this return not charged \\ against book income this year (itemize): \\ a Depreciation \\ b Charitable contributions & & \\ \hline 9 Add lines 7 and 8 & & \\ 10 Income (page 1 , line 28 ) - line 6 less line 9 & \\ \hline \end{tabular} Required a Required c > carryforward for the current year. Note: Input all values as positive numbers. \begin{tabular}{|l|l|l|} \hline Required a & Required b & Required e \\ \hline \end{tabular} purposes is $47,920. Note: Input all values as positive numbers. Schedule M-1 Reconciliation of Income (Los5) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemize): 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions c Travel and entertainment 6 Add lines 1 through 5 \begin{tabular}{|l|l|l|} \hline & 7Incomerecordedonbooksthisyearnotincludedonthisreturn(itemize):Tax-exemptinterest & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Required b > \begin{tabular}{|l|l|l|} \hline Required a & Required b \\ \hline \end{tabular} of $32,200. Depreciation expense for tax purposes is $148,600. Note: Input all values as positive numbers. Schedule M-1 Reconciliation of Income (Los5) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemice): \begin{tabular}{l} 4 Income subject to tax not recorded on books this year (itemize): \\ \hline 5 Expenses recorded on books this year not deducted on this return (itemize): \\ a Depreciation \\ b Charitable contributions \\ c Travel and entertainment \\ 6 Add lines 1 through 5 \end{tabular} \begin{tabular}{|l|l|l} 7 Income recorded on books this year not \\ included on this return (itemize): \\ Tax-exempt interest \\ \hline & & \\ \hline & & \\ 8.ductions on this return not charged \\ against book income this year (itemize): \\ a Depreciation \\ b Charitable contributions & & \\ \hline 9 Add lines 7 and 8 & & \\ 10 Income (page 1 , line 28 ) - line 6 less line 9 & \\ \hline \end{tabular} Required a Required c > carryforward for the current year. Note: Input all values as positive numbers

\begin{tabular}{|l|l|l|} \hline Required a & Required b & Required e \\ \hline \end{tabular} purposes is $47,920. Note: Input all values as positive numbers. Schedule M-1 Reconciliation of Income (Los5) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemize): 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions c Travel and entertainment 6 Add lines 1 through 5 \begin{tabular}{|l|l|l|} \hline & 7Incomerecordedonbooksthisyearnotincludedonthisreturn(itemize):Tax-exemptinterest & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Required b > \begin{tabular}{|l|l|l|} \hline Required a & Required b \\ \hline \end{tabular} of $32,200. Depreciation expense for tax purposes is $148,600. Note: Input all values as positive numbers. Schedule M-1 Reconciliation of Income (Los5) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemice): \begin{tabular}{l} 4 Income subject to tax not recorded on books this year (itemize): \\ \hline 5 Expenses recorded on books this year not deducted on this return (itemize): \\ a Depreciation \\ b Charitable contributions \\ c Travel and entertainment \\ 6 Add lines 1 through 5 \end{tabular} \begin{tabular}{|l|l|l} 7 Income recorded on books this year not \\ included on this return (itemize): \\ Tax-exempt interest \\ \hline & & \\ \hline & & \\ 8.ductions on this return not charged \\ against book income this year (itemize): \\ a Depreciation \\ b Charitable contributions & & \\ \hline 9 Add lines 7 and 8 & & \\ 10 Income (page 1 , line 28 ) - line 6 less line 9 & \\ \hline \end{tabular} Required a Required c > carryforward for the current year. Note: Input all values as positive numbers. \begin{tabular}{|l|l|l|} \hline Required a & Required b & Required e \\ \hline \end{tabular} purposes is $47,920. Note: Input all values as positive numbers. Schedule M-1 Reconciliation of Income (Los5) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemize): 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions c Travel and entertainment 6 Add lines 1 through 5 \begin{tabular}{|l|l|l|} \hline & 7Incomerecordedonbooksthisyearnotincludedonthisreturn(itemize):Tax-exemptinterest & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Required b > \begin{tabular}{|l|l|l|} \hline Required a & Required b \\ \hline \end{tabular} of $32,200. Depreciation expense for tax purposes is $148,600. Note: Input all values as positive numbers. Schedule M-1 Reconciliation of Income (Los5) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemice): \begin{tabular}{l} 4 Income subject to tax not recorded on books this year (itemize): \\ \hline 5 Expenses recorded on books this year not deducted on this return (itemize): \\ a Depreciation \\ b Charitable contributions \\ c Travel and entertainment \\ 6 Add lines 1 through 5 \end{tabular} \begin{tabular}{|l|l|l} 7 Income recorded on books this year not \\ included on this return (itemize): \\ Tax-exempt interest \\ \hline & & \\ \hline & & \\ 8.ductions on this return not charged \\ against book income this year (itemize): \\ a Depreciation \\ b Charitable contributions & & \\ \hline 9 Add lines 7 and 8 & & \\ 10 Income (page 1 , line 28 ) - line 6 less line 9 & \\ \hline \end{tabular} Required a Required c > carryforward for the current year. Note: Input all values as positive numbers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started