Question

Buckeye Department Stores, Inc., operates a chain of department stores in Ohio. The companys organization chart appears below. Operating data for 20x5 follow. The following

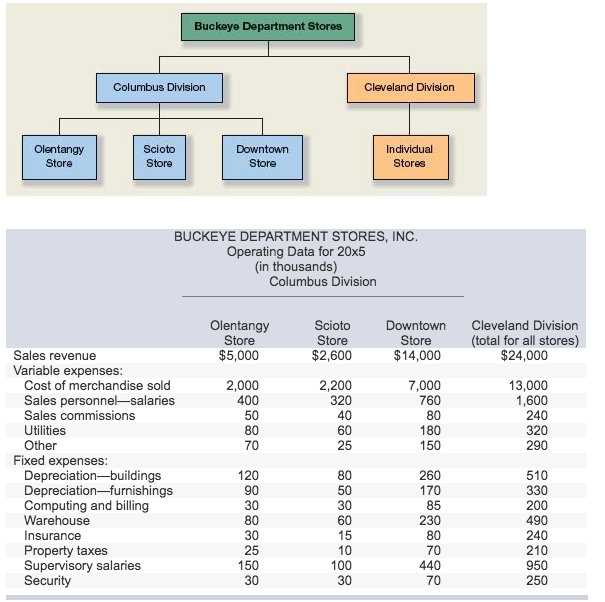

Buckeye Department Stores, Inc., operates a chain of department stores in Ohio. The companys organization chart appears below. Operating data for 20x5 follow.

| The following fixed expenses are controllable at the divisional level: depreciationfurnishings, computing and billing, warehouse, insurance, and security. In addition to these expenses, each division annually incurs $50,000 of computing costs, which are not allocated to individual stores. |

| The following fixed expenses are controllable only at the company level: depreciationbuilding, property taxes, and supervisory salaries. In addition to these expenses, each division incurs costs for supervisory salaries of $140,000, which are not allocated to individual stores. |

| Buckeye Department Stores incurs common fixed expenses of $130,000, which are not allocated to the two divisions. Income-tax expense for 20x5 is $1,980,000. |

| Required: |

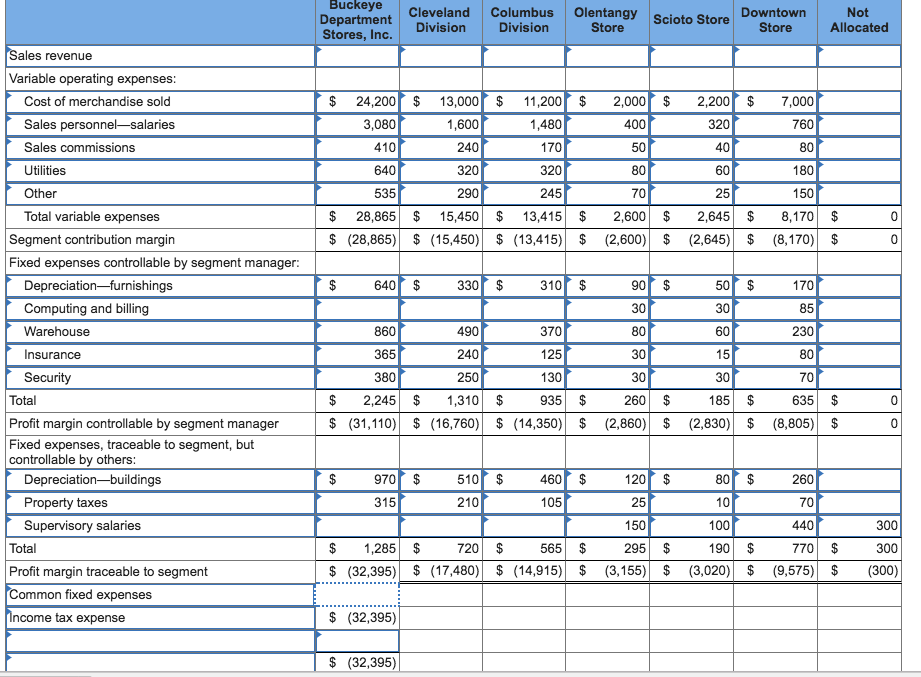

| 1. | Prepare a segmented income statement for Buckeye Department Stores, Inc. (Enter your answers in thousands.) Here's what I did so far...I only need help finding the rest...hopefully where to get the info as well. The supervisor salaries and computing and billing for sure. Also, where do I find the sales revenue?

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started