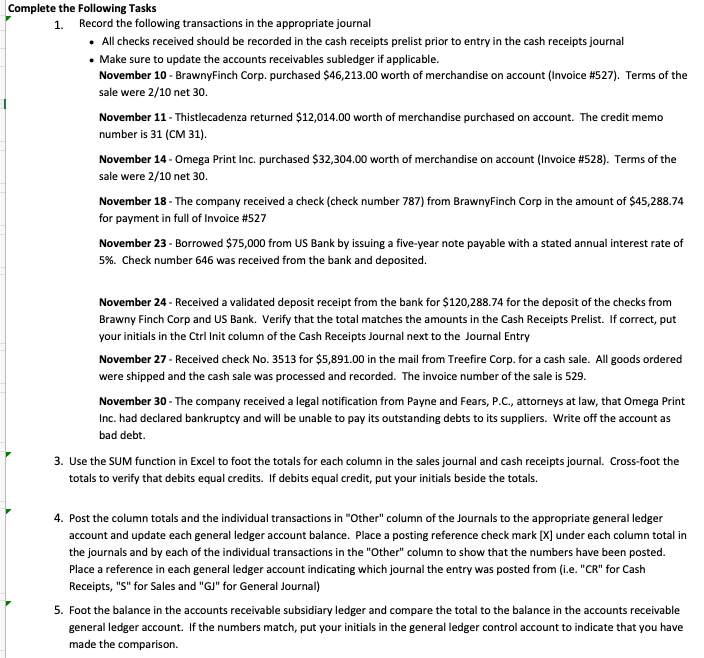

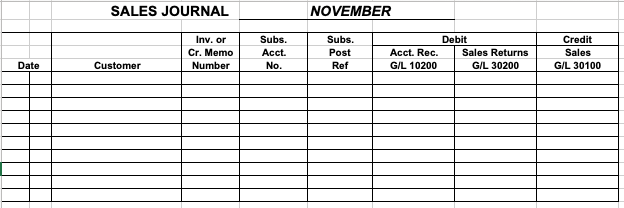

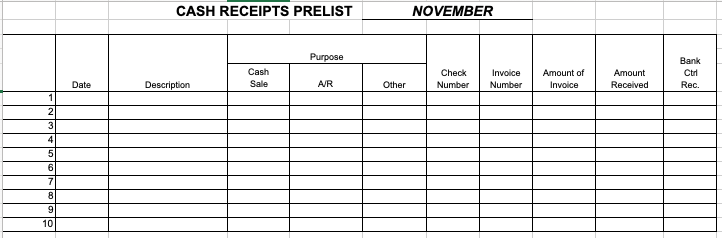

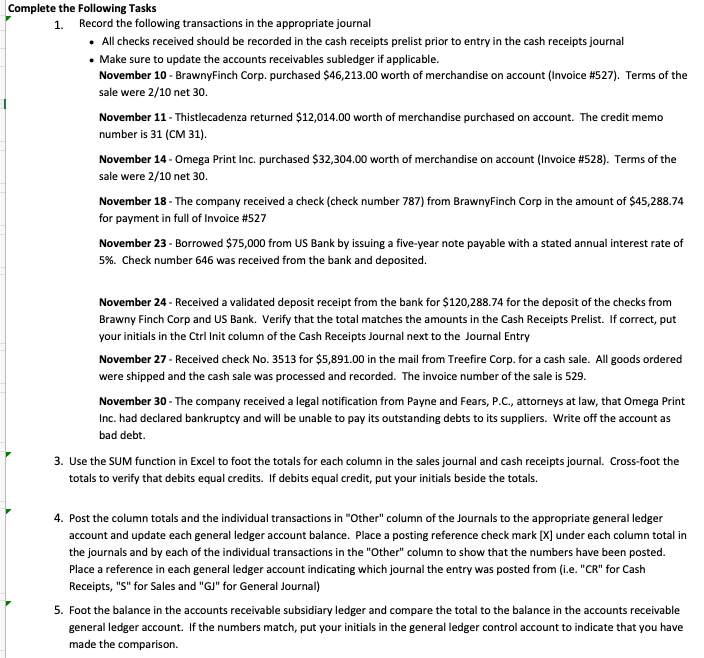

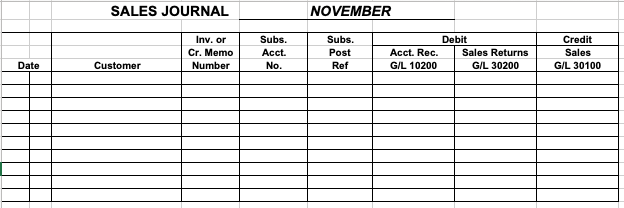

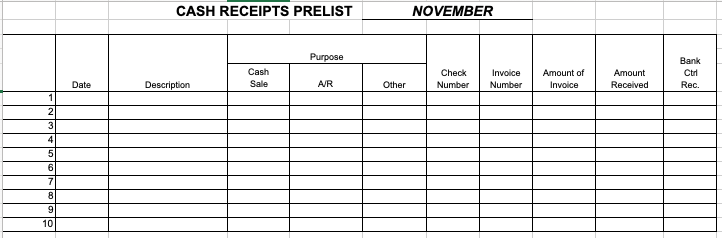

Complete the Following Tasks 1. Record the following transactions in the appropriate journal . All checks received should be recorded in the cash receipts prelist prior to entry in the cash receipts journal Make sure to update the accounts receivables subledger if applicable November 10-BrawnyFinch Corp. purchased $46,213.00 worth of merchandise on account (invoice #527). Terms of the sale were 2/10 net 30 November 11- Thistlecadenza returned $12,014.00 worth of merchandise purchased on account. The credit memo number is 31 (CM 31) November 14-Omega Print Inc. purchased $32,304.00 worth of merchandise on account (invoice #528). Terms of the sale were 2/10 net 30 November 18- The company received a check (check number 787) from BrawnyFinch Corp in the amount of $45,288.74 for payment in full of Invoice #527 November 23 - Borrowed $75,000 from US Bank by issuing a five-year note payable with a stated annual interest rate of 5%. Check number 646 was received from the bank and deposited. November 24 Received a validated deposit receipt from the bank for $120,288.74 for the deposit of the checks from Brawny Finch Corp and US Bank. Verify that the total matches the amounts in the Cash Receipts Prelist. If correct, put your initials in the Ctrl Init column of the Cash Receipts Journal next to the Journal Entry November 27- Received check No. 3513 for $5,891.00 in the mail from Treefire Corp. for a cash sale. All goods ordered were shipped and the cash sale was processed and recorded. The invoice number of the sale is 529 November 30 The company received a legal notification from Payne and Fears, P.C., attorneys at law, that Omega Print Inc. had declared bankruptcy and will be unable to pay its outstanding debts to its suppliers. Write off the account as bad debt. 3. Use the SUM function in Excel to foot the totals for each column in the sales journal and cash receipts journal. Cross-foot the totals to verify that debits equal credits. If debits equal credit, put your initials beside the totals. 4. Post the column totals and the individual transactions in "Other" column of the Journals to the appropriate general ledger account and update each general ledger account balance. Place a posting reference check mark [X] under each column total in the journals and by each of the individual transactions in the "Other" column to show that the numbers have been posted. Place a reference in each general ledger account indicating which journal the entry was posted from i.e. "CR" for Cash Receipts, '"S" for Sales and "GJ" for General Journal) 5. Foot the balance in the accounts receivable subsidiary ledger and compare the total to the balance in the accounts receivable general ledger account. If the numbers match, put your initials in the general ledger control account to indicate that you have made the comparison. SALES JOURNAL NOVEMBER or Subs. Cr. Memo Acct. Credit Sales GIL 30100 Inv.or Subs Post Ref Debit Acct. Rec. Sales Returns G/L 10200 Date Customer Number No G/L 30200 CASH RECEIPTS PRELIST NOVEMBER Cash Sale Check Invoice Amount of Number Number Amount Received Bank Ctrl Date Description AVR Other Invoice 10 CASH RECEIPTS JOURNAL NOVEMBER DEBIT Cash CREDIT Ctrl Init Sales Disc. | G/L 30300 | Subs. A/C # A/R G/L 10200 Sales | GL 301 001 Other G/L Date G/L 10100 Amt. Post A/C # Amt. Post GENERAL JOURNAL November, 2009 ACCT DATE NO EXPLANATION POST DEBIT CREDIT GENERAL LEDGER Debit Balance Debit Credit 10100 CASH Oct Journal 1 Balance Forward 44,407.53 CR 110,395.64 98,304.36 10,498.83 25.00 31 Net Wages and Salary Oct. Oct 45,974.98 Debit Balance 10200 ACCOUNTS RECEIVABLE Journal Debit Credit 1 Balance Forward 49,451.00 WLB 86,714.00 Oct 31 CR 74,369.00 61,796.00WLE Credit Balance 10300 ALLOWANCE FOR Debit Credit DOUBTFUL ACCOUNTS 1 Balance Forward Journal Oct 21,000.00 Credit Balance 21000 NOTES PAYABLE Journal Debit Credit 1 Balance Forward 0.00 Credit Balance 1,326,865.00 Debit Credit 30100 SALES Oct Journal 1 Balance Forward 31 Credit Sales 31 Cash Sales 86,714.00 36,607.00 Oct CR 1.450.186.00 Debit Balance 30200 SALES RETURNS & ALLOW. Journal Debit Credit 1Balance Forward 34,617.00 Debit Balance 30300 SALES DISCOUNTS TAKEN Journal Debit Credit 1Balance Forward 13,856.38 14,436.74 CR 580.36