Answered step by step

Verified Expert Solution

Question

1 Approved Answer

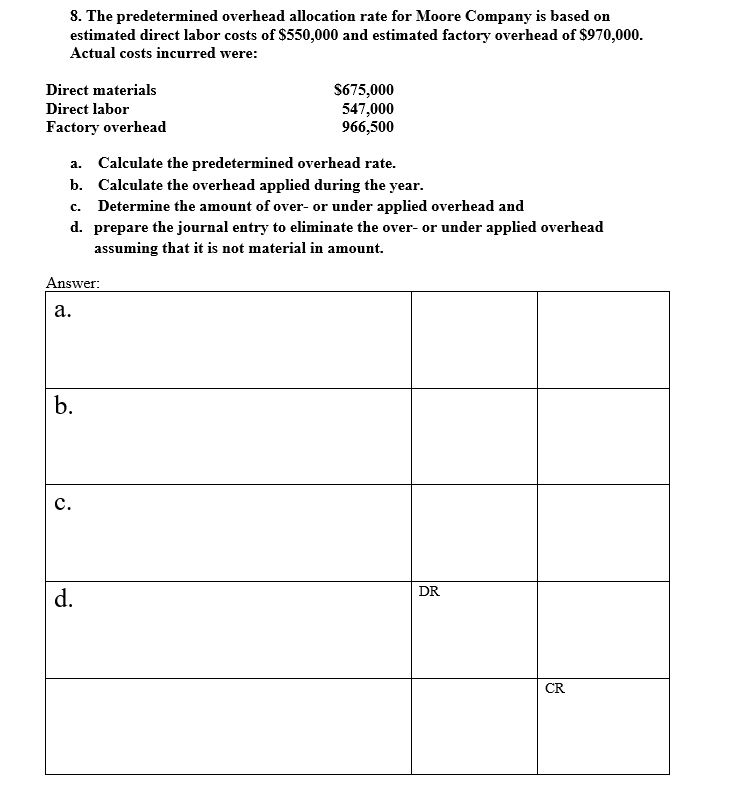

COMPLETE THE FOLLOWINGS WITH EXPLANATIONS: COMPLETE THE FOLLOWINGS WITH EXPLANATIONS: 8. The predetermined overhead allocation rate for Moore Company is based on estimated direct labor

COMPLETE THE FOLLOWINGS WITH EXPLANATIONS:

COMPLETE THE FOLLOWINGS WITH EXPLANATIONS:

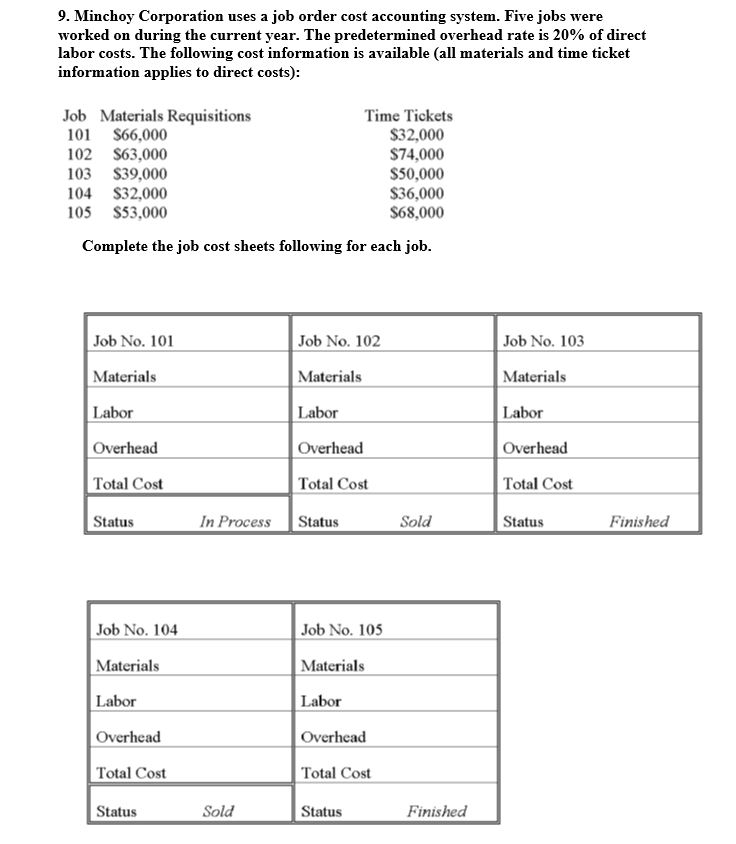

8. The predetermined overhead allocation rate for Moore Company is based on estimated direct labor costs of $550,000 and estimated factory overhead of $970,000. Actual costs incurred were: Direct materials Direct labor Factory overhead $675,000 547,000 966,500 a. Calculate the predetermined overhead rate. b. Calculate the overhead applied during the year. c. Determine the amount of over- or under applied overhead and d. prepare the journal entry to eliminate the over- or under applied overhead assuming that it is not material in amount. Answer: DR 9. Minchoy Corporation uses a job order cost accounting system. Five jobs were worked on during the current year. The predetermined overhead rate is 20% of direct labor costs. The following cost information is available (all materials and time ticket information applies to direct costs): Job Materials Requisitions 101 $66,000 102 $63,000 103 $39,000 104 $32,000 105 $53,000 Time Tickets $32,000 $74,000 $50,000 $36,000 $68,000 Complete the job cost sheets following for each job. Job No. 101 Job No. 102 Job No. 103 Materials Materials Materials Labor Labor Labor Overhead Overhead Overhead Total Cost Total Cost Total Cost Status In Process Status Sold Status Finished Job No. 104 Job No. 105 Materials Materials Labor Overhead Overhead Total Cost Status Sold Status Finished

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started