Answered step by step

Verified Expert Solution

Question

1 Approved Answer

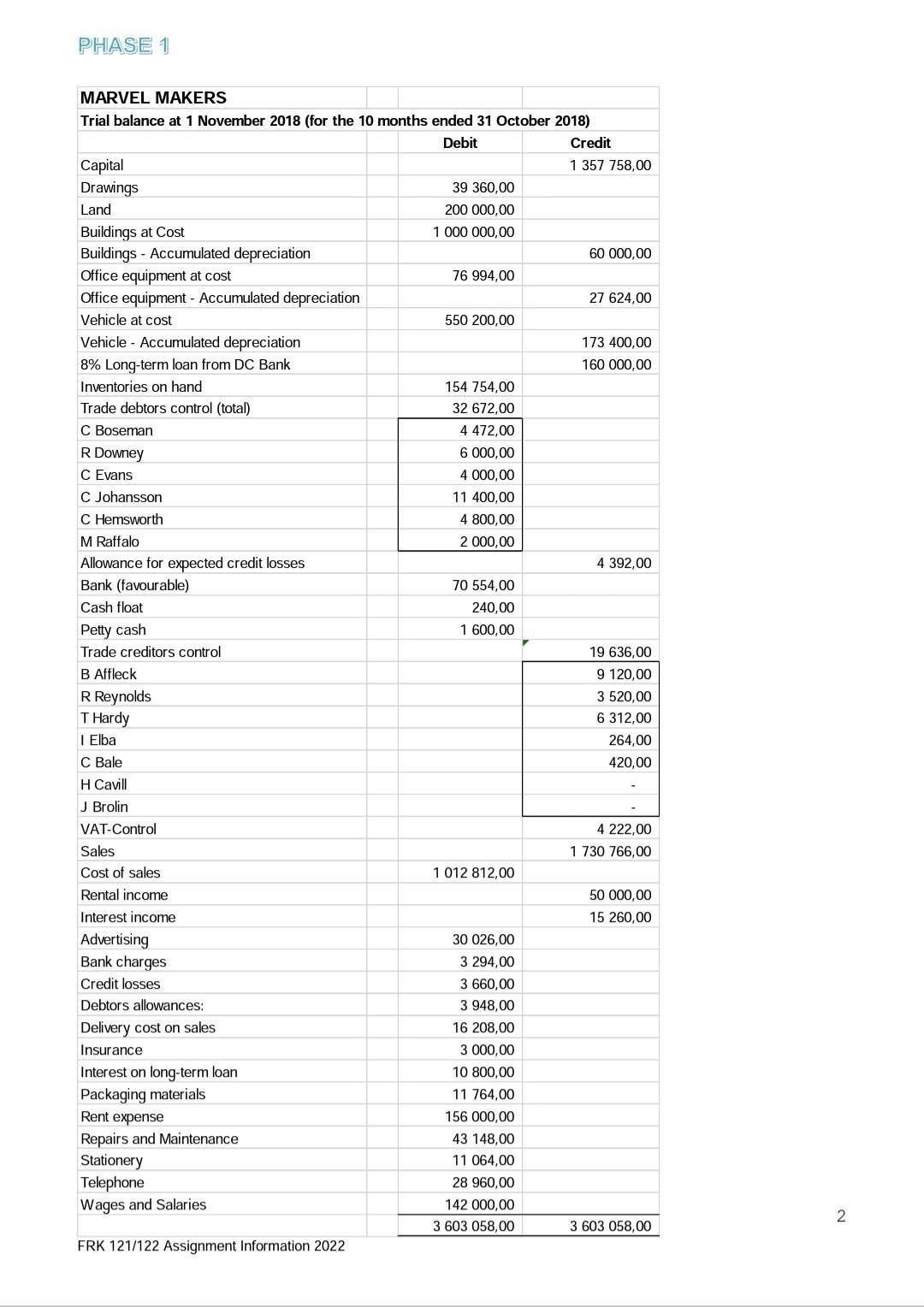

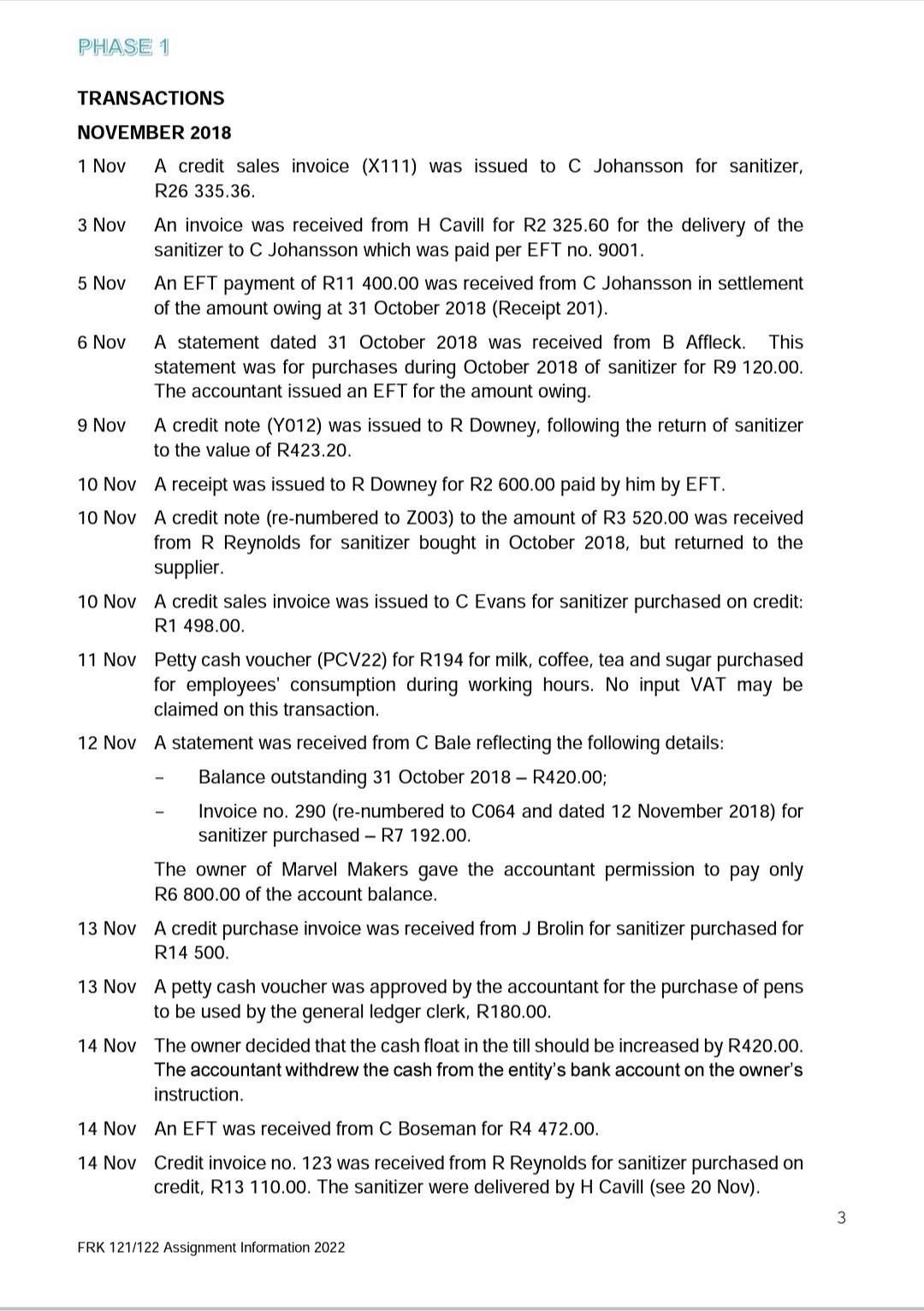

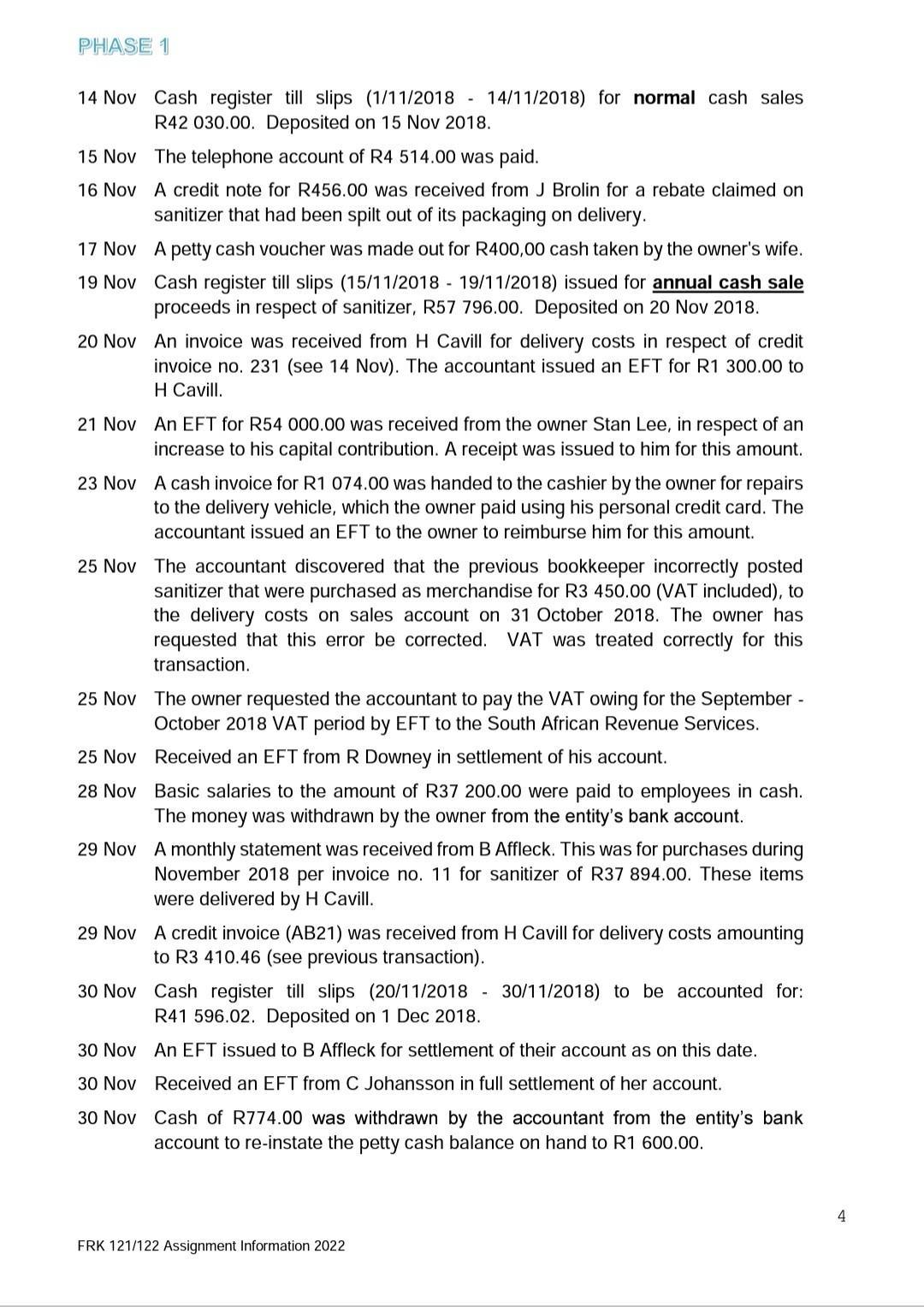

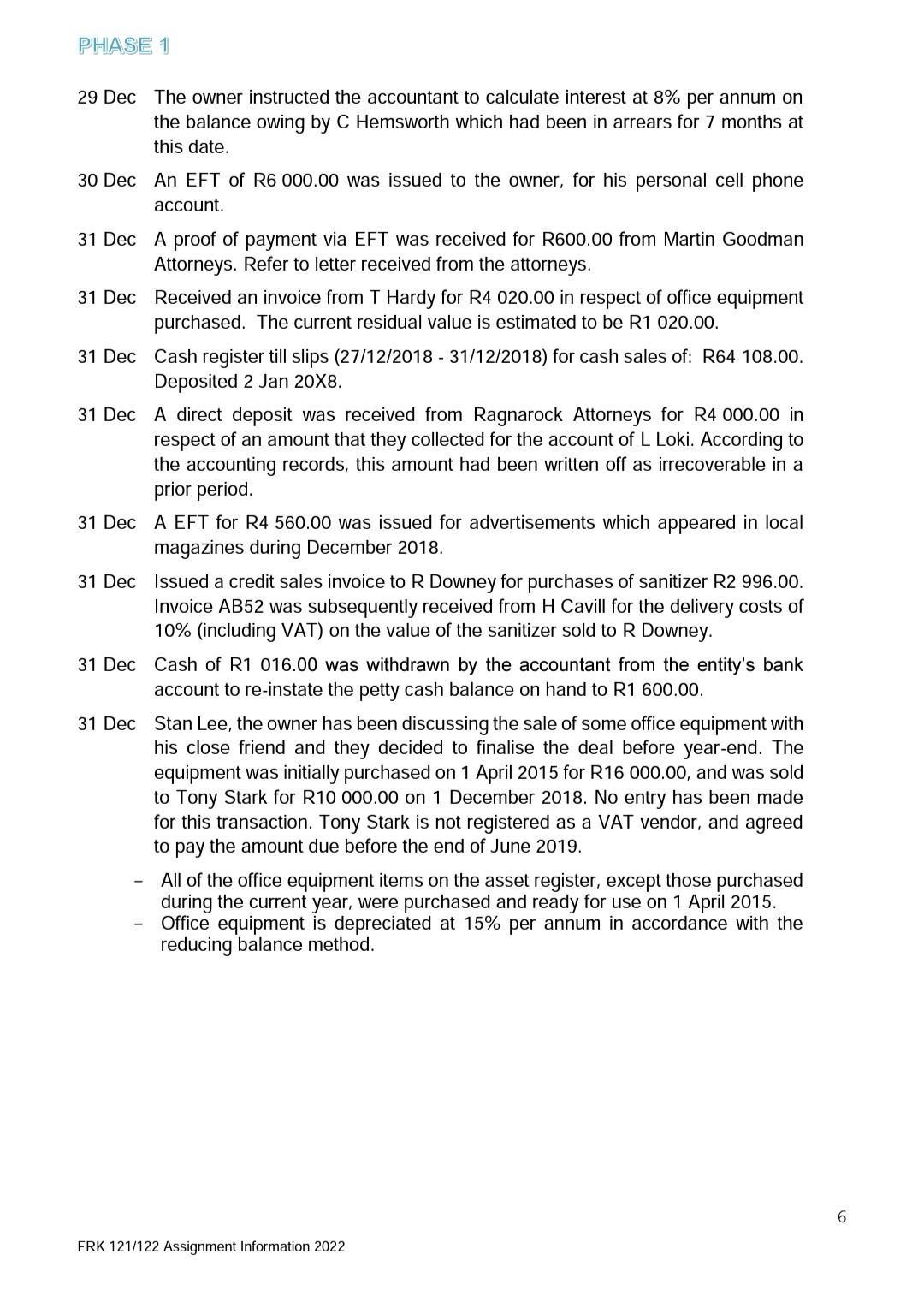

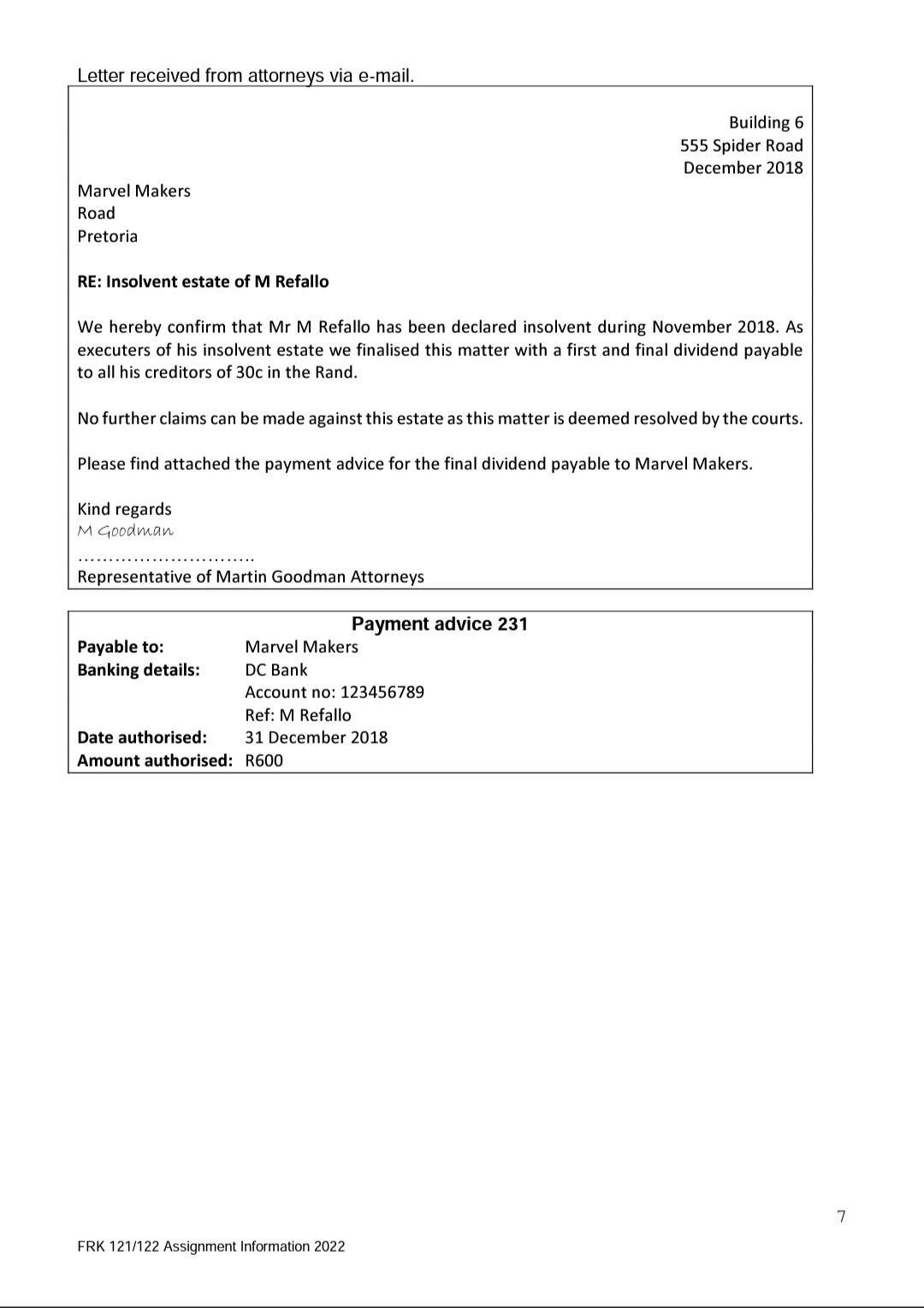

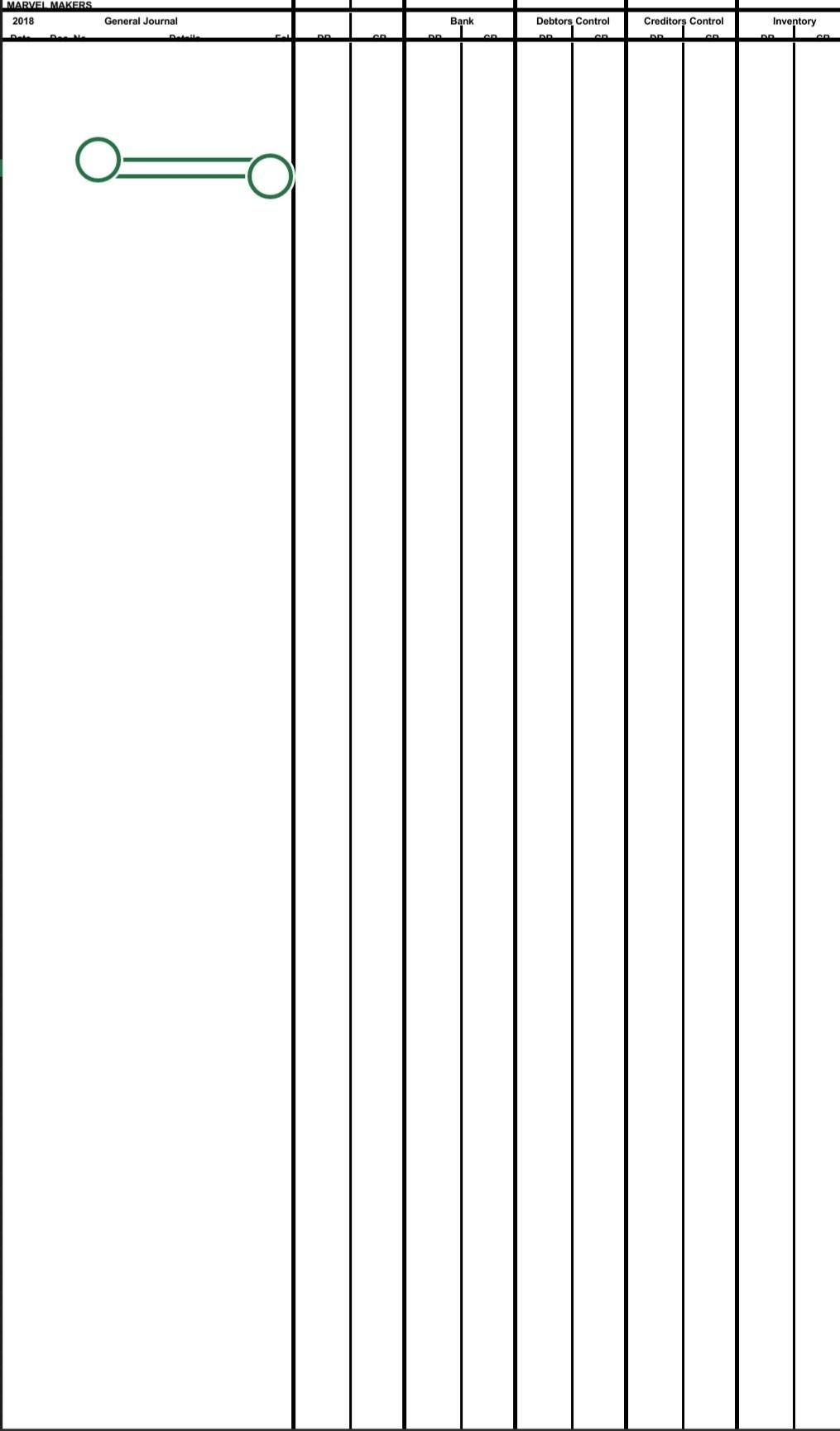

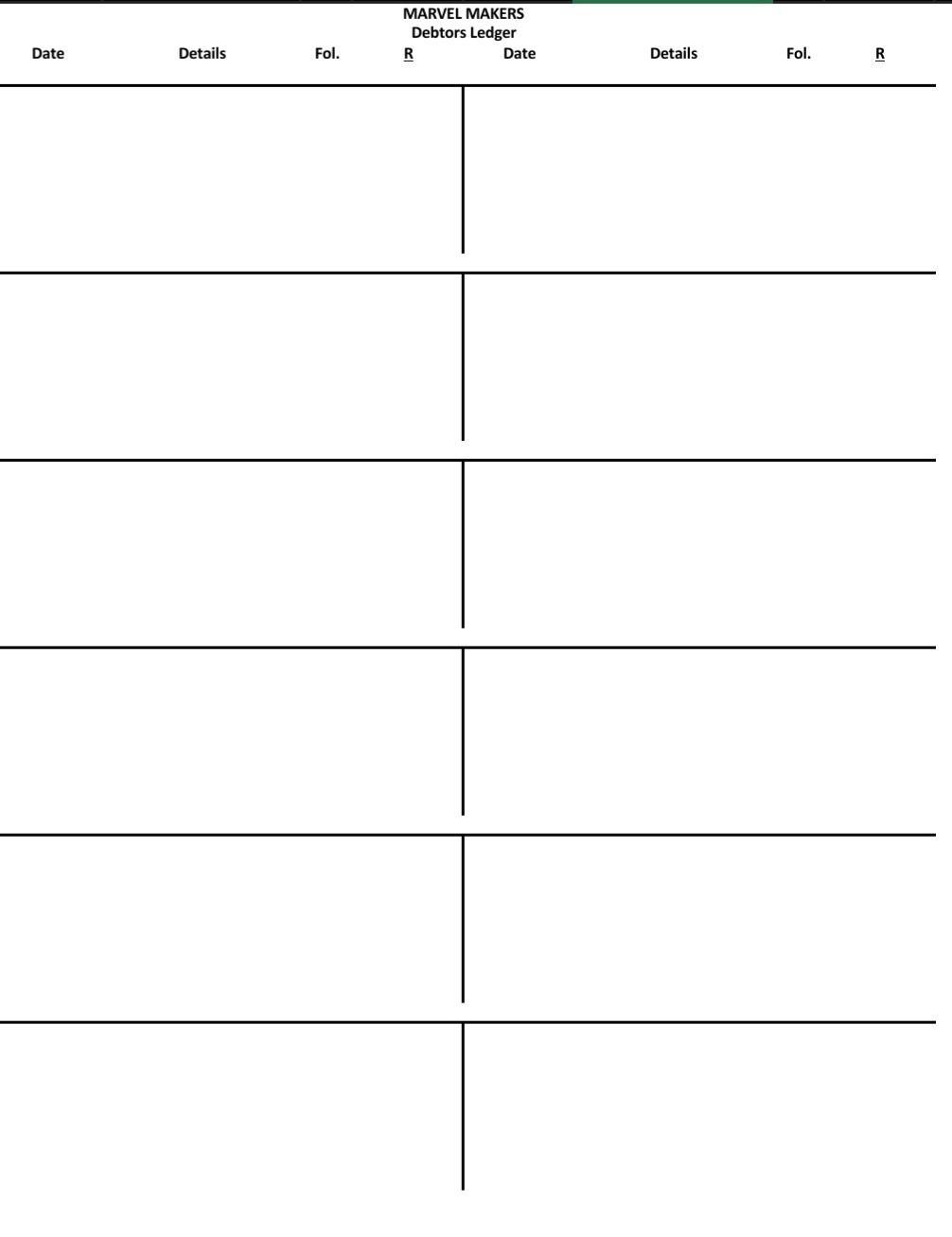

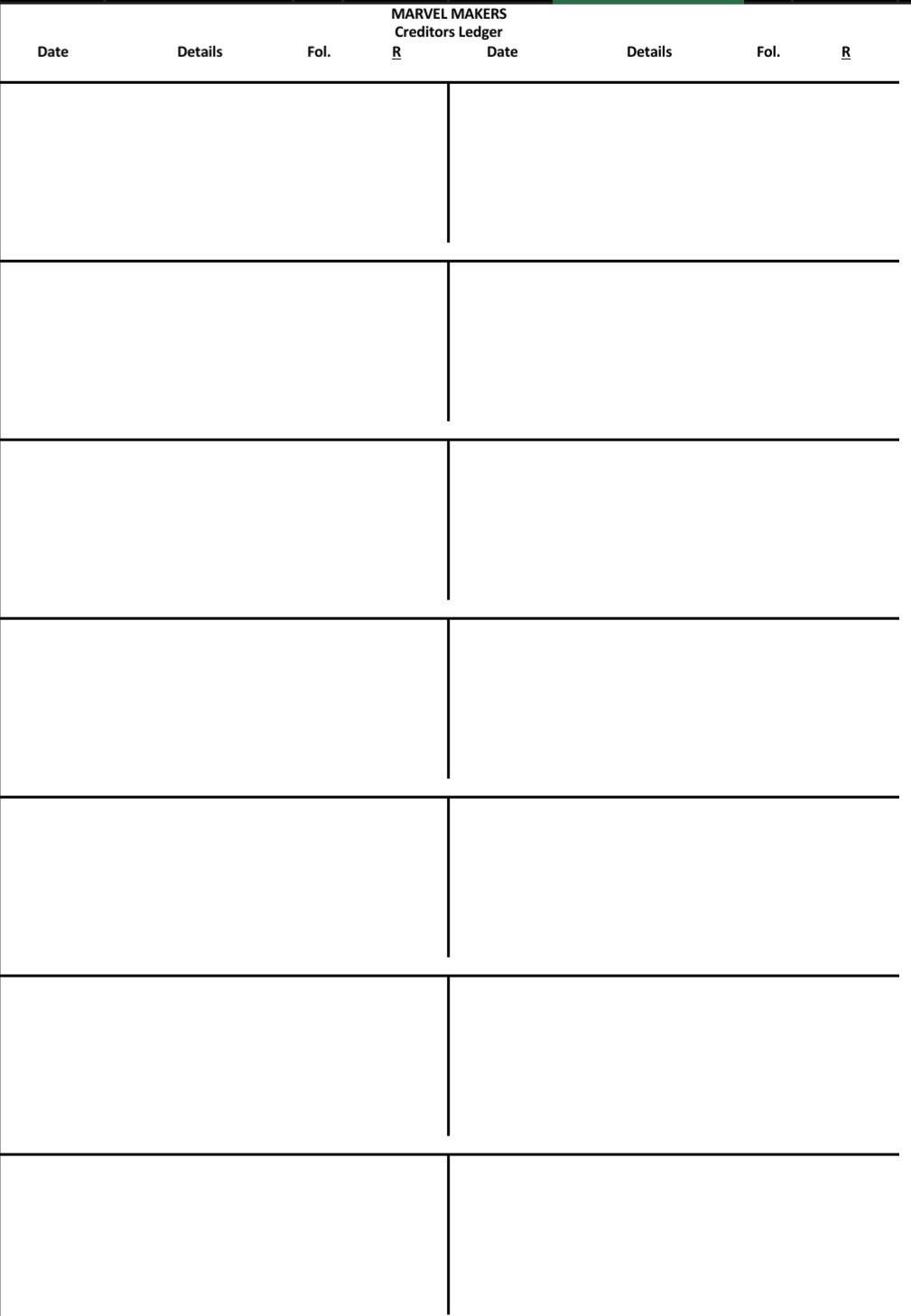

Complete the General Journal, Creditors ledger, and Debtors ledger using the transactions below. SHOW ALL WORKINGS, the format of the journal and ledgers are provided

Complete the General Journal, Creditors ledger, and Debtors ledger using the transactions below. SHOW ALL WORKINGS, the format of the journal and ledgers are provided below:

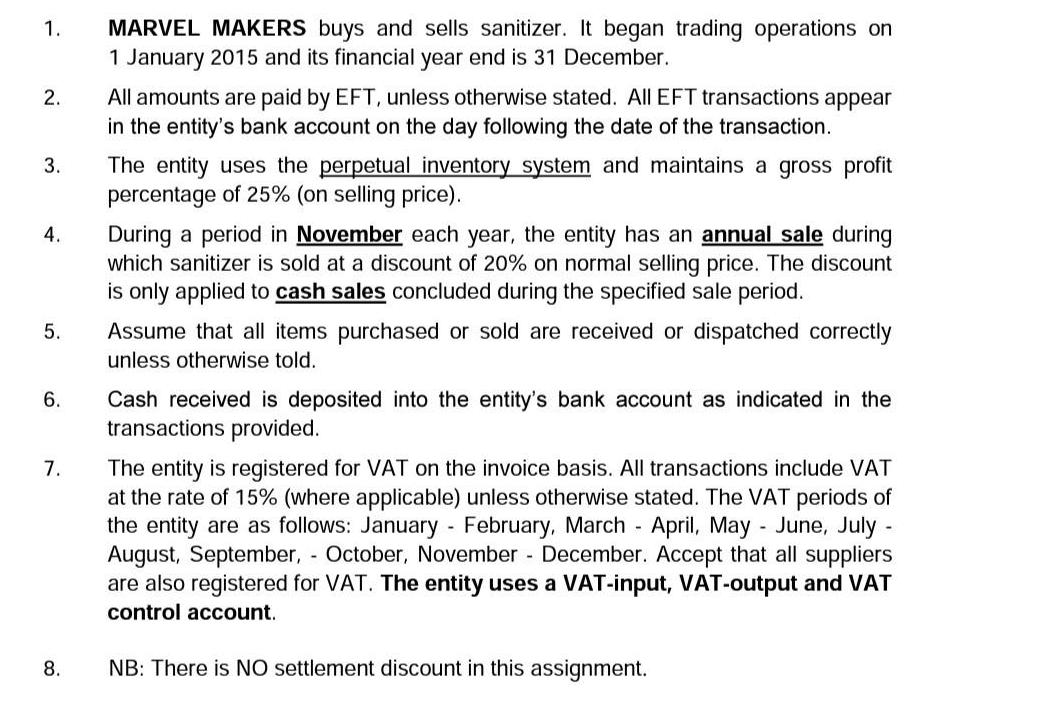

1. 2. 3. 4. 5. 6. 7. 8. MARVEL MAKERS buys and sells sanitizer. It began trading operations on 1 January 2015 and its financial year end is 31 December. All amounts are paid by EFT, unless otherwise stated. All EFT transactions appear in the entity's bank account on the day following the date of the transaction. The entity uses the perpetual inventory system and maintains a gross profit percentage of 25% (on selling price). During a period in November each year, the entity has an annual sale during which sanitizer is sold at a discount of 20% on normal selling price. The discount is only applied to cash sales concluded during the specified sale period. Assume that all items purchased or sold are received or dispatched correctly unless otherwise told. Cash received is deposited into the entity's bank account as indicated in the transactions provided. The entity is registered for VAT on the invoice basis. All transactions include VAT at the rate of 15% (where applicable) unless otherwise stated. The VAT periods of the entity are as follows: January - February, March April, May - June, July - August, September, - October, November December. Accept that all suppliers are also registered for VAT. The entity uses a VAT-input, VAT-output and VAT control account. NB: There is NO settlement discount in this assignment. -

Step by Step Solution

★★★★★

3.27 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The provided information outlines the financial details of Marvel Makers a company that buys and sel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started