Question

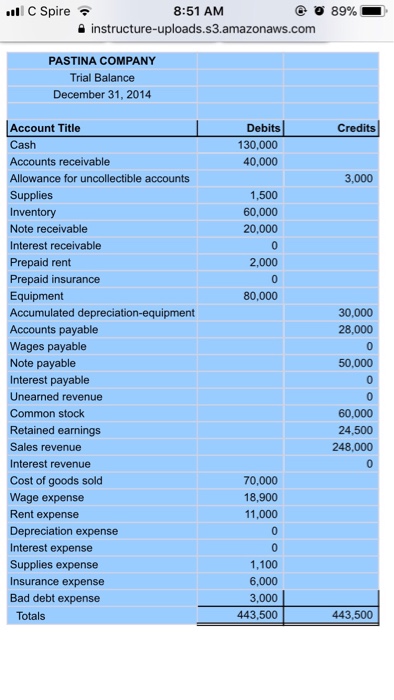

Complete the Materiality worksheet using the trial balance provided. ASB-CX-2.1: Financial Statement Materiality Worksheet for Planning Purposes Instructions. The purpose of this form is to

Complete the Materiality worksheet using the trial balance provided.

ASB-CX-2.1: Financial Statement Materiality Worksheet for Planning Purposes

Instructions. The purpose of this form is to determine and document the materiality amount that will be considered suitable for audit planning purposes. Review the guidance beginning at section 306 before completing this form. When determining planning materiality:

1. Use amounts from the financial statements to be audited or the trial balance from which those financial statements will be prepared. If not available, use annualized amounts from the most recent interim financial statements. For revenue, use an annualized amount even if the audit period is shorter than a year.

2. When current amounts are unavailable, significant audit adjustments are expected, or significant changes in the entity's circumstances indicate that current amounts are not representative of the entity's results of operations or financial position, use historical averages based on the past two or three years. (Attach the calculation on a separate page.)

3. Choose a benchmark that you think is most appropriate to the entity. Section 306 provides a list of factors to consider in selecting a benchmark. The following tables may be used as guidelines.

| Table 1-Benchmark is Total Assets or Total Revenue | |||||

| If the Benchmark Amount (total assets or total revenue) is: | Planning Materiality is: | ||||

| Over | But Not Over | Base Amount + (Percent x Benchmark) | |||

| $0 | $100,000 | 0 + 4.0% | |||

| $100,000 | $500,000 | 2,000 + 2.0% | |||

| $500,000 | $1,000,000 | 7,000 + 1.0% | |||

| $1,000,000 | $5,000,000 | 8,000 + 0.9% | |||

| $5,000,000 | $10,000,000 | 13,000 + 0.8% | |||

| $10,000,000 | $50,000,000 | 23,000 + 0.7% | |||

| $50,000,000 | $100,000,000 | 73,000 + 0.6% | |||

| $100,000,000 | $500,000,000 | 153,000 + 0.52% | |||

| $500,000,000 |

| 503,000 + 0.45% | |||

Example: If the benchmark amount were $3.5 million, then the planning materiality amount using Table 1 would be as follows: $8,000 + (.009 x $3,500,000) = $39,500, rounded down to $39,000

| Table 2-Other Benchmarks and Illustrative Percentages | |

| Benchmark | Illustrative Percentage |

| Total revenue/total assets | 1/2% - 1% |

| Gross profit | 1% - 2% |

| Pretax income | 5% - 10% |

| Net income | 3% - 5% |

| Equity | 1% - 2% |

Decisions and Calculations

1. Basis for Materiality Amounts. Considering the needs and expectations of financial statement users, describe the rationale for the selection of the benchmark and percentages in steps 24.

2. Planning Materiality. (Complete a. and b.)

a. BENCHMARK and AMOUNT. (Select the benchmark you wish to use.)

Total Revenue (Annualize if interim amount is used.)

Total Assets

Other Benchmark (specify)

b. PLANNING MATERIALITY CALCULATION (Note: If an Other Benchmark amount is used, a suitable percentage should be manually entered.)

| Base Amount from Table 1 + | (Percentage from Table or Suitable Percentage for Chosen Benchmark | x Benchmark Amount) = | Planning Materiality |

| $0 | 0.00% | $0 | $0 |

3. Performance Materiality/Tolerable Misstatement. Tolerable misstatement is the application of performance materiality to a particular audit sampling procedure and may be the same as performance materiality (see section 702). Tolerable misstatement is used in computing sample sizes (see ASB-CX-8.2) and in making other scope decisions (see ASB-CX-8.1). As a rule of thumb, performance materiality/tolerable misstatement can be computed as follows:

| Planning Materiality Amount from Line 2b | x Factor = | Performance Materiality/TolerableMisstatement |

| $0 |

| $0 |

4. Lower Level of Planning Materiality for Particular Items. Identify any financial statement accounts, transaction classes, or disclosures for which a lower level of materiality should be used and apply professional judgment to determine an appropriate planning materiality and performance materiality/tolerable misstatement amount for those items. See section 306.

| Financial Statement Item | PlanningMateriality | x Factor = | Performance Materiality/Tolerable Misstatement |

|

|

|

| $0 |

|

|

|

| $0 |

5. Clearly Trivial Misstatements. Consider and document the amount of misstatements that will be passed at the workpaper level. Clearly trivial misstatements are discussed in section 306.

6. Changes in Planning Materiality Amounts. Document any changes in planning materiality or performance materiality/tolerable misstatement levels that occur during the audit and how they were determined.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started