Question

Complete the Payroll Table below: Weekly Payroll Register Gross Pay Employee A $2,000.00 El Rate = CPP Rate = CPP Exemption= Income Tax Rate

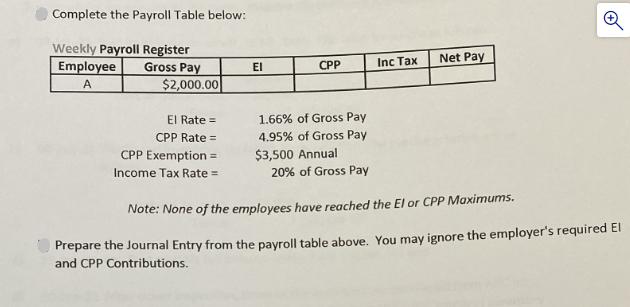

Complete the Payroll Table below: Weekly Payroll Register Gross Pay Employee A $2,000.00 El Rate = CPP Rate = CPP Exemption= Income Tax Rate = EI CPP 1.66% of Gross Pay 4.95% of Gross Pay $3,500 Annual 20% of Gross Pay Inc Tax Net Pay o Note: None of the employees have reached the El or CPP Maximums. Prepare the Journal Entry from the payroll table above. You may ignore the employer's required El and CPP Contributions.

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the journal entry from the given payroll table we need to record the expenses re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles Volume 1

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

8th Canadian Edition

111950242X, 1-119-50242-5, 978-1119502425

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App