Answered step by step

Verified Expert Solution

Question

1 Approved Answer

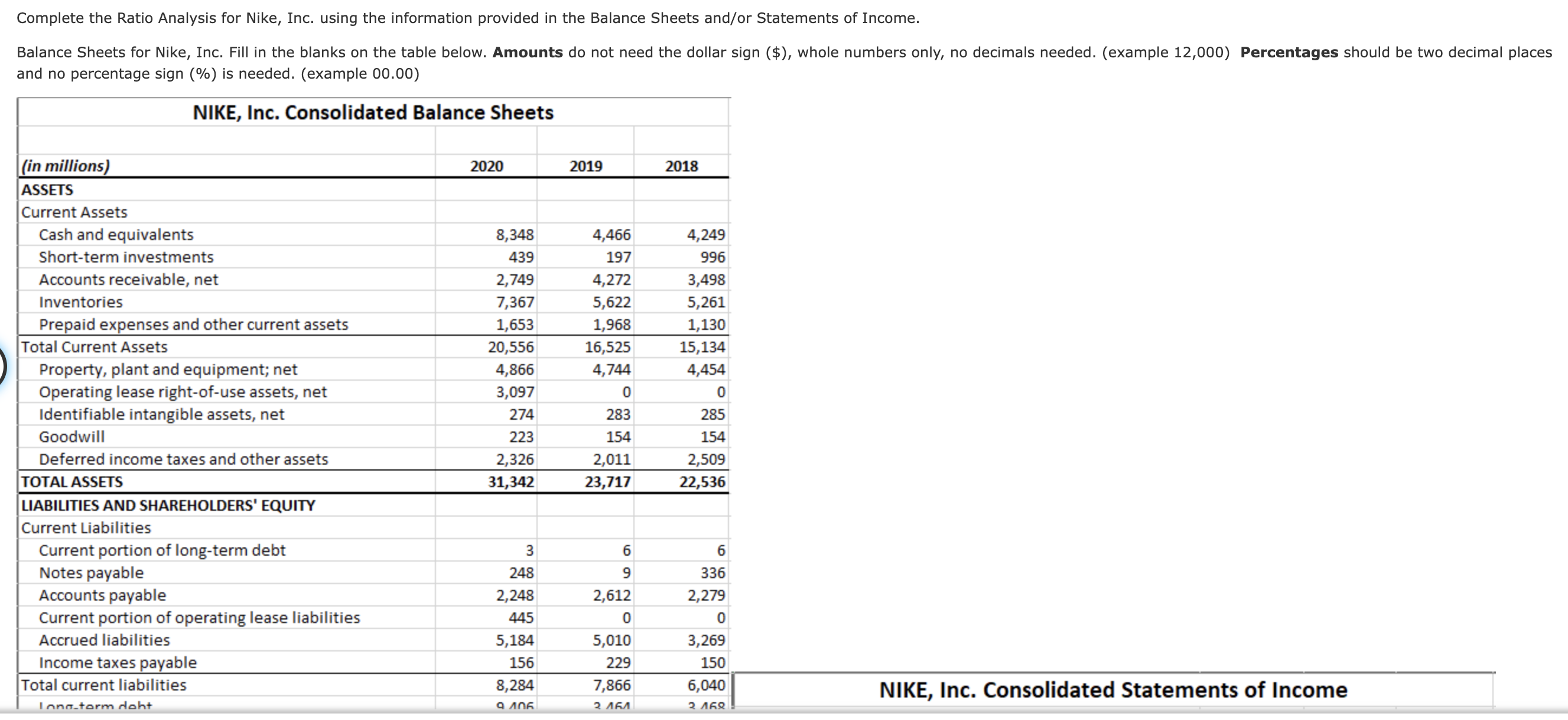

Complete the Ratio Analysis for Nike, Inc. using the information provided in the Balance Sheets and / or Statements of Income. and no percentage sign

Complete the Ratio Analysis for Nike, Inc. using the information provided in the Balance Sheets andor Statements of Income.

and no percentage sign is needed. example tableLiquidityWorking Capital,,Current raio,Quick ratio,,ProfitabilityAsset Turnover,,Return on total assets,,Return on Stocholders' Equity,,SolvencyRatio of fixed assets to longterm liabilities,,Ratio of liabilities to stocholders' equity,,Time interst earned, Complete the Ratio Analysis for Nike, Inc. using the information provided in the Balance Sheets andor Statements of Income.

Balance Sheets for Nike, Inc. Fill in the blanks on the table below. Amounts do not need the dollar sign $ whole numbers only, no decimals needed. example Percentages should be two decimal places and no percentage sign is needed. example

Liquidity

Working Capital fill in the blank

fill in the blank

Current raio fill in the blank

fill in the blank

Quick ratio fill in the blank

fill in the blank

Profitability

Asset Turnover fill in the blank

fill in the blank

Return on total assets fill in the blank

fill in the blank

Return on Stocholders' Equity fill in the blank

fill in the blank

Solvency

Ratio of fixed assets to longterm liabilities fill in the blank

fill in the blank

Ratio of liabilities to stocholders' equity fill in the blank

fill in the blank

Time interst earned fill in the blank

fill in the blank

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started