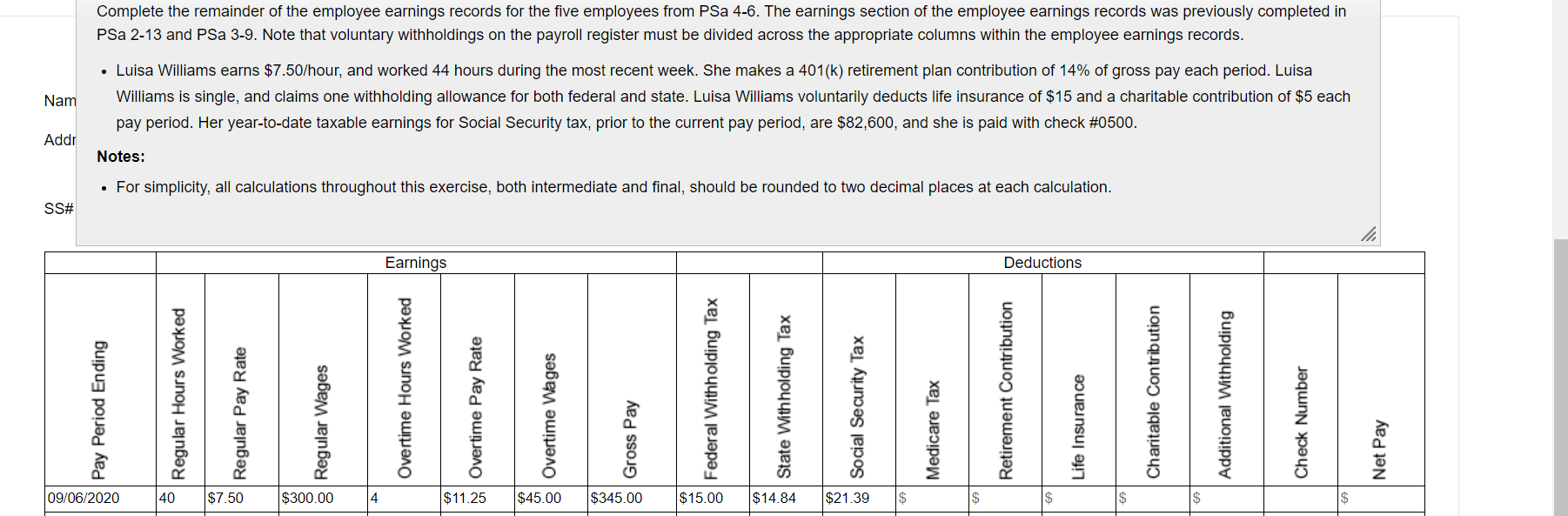

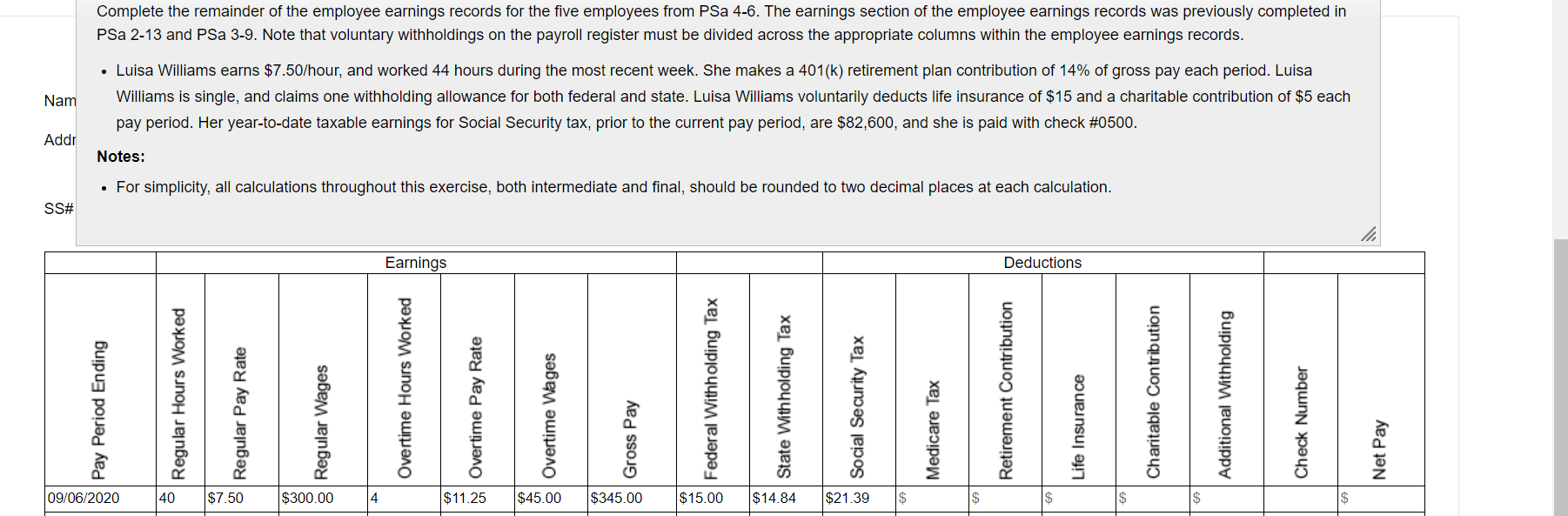

Complete the remainder of the employee earnings records for the five employees from PSa 4-6. The earnings section of the employee earnings records was previously completed in PSa 2-13 and PSa 3-9. Note that voluntary withholdings on the payroll register must be divided across the appropriate columns within the employee earnings records. Nam Luisa Williams earns $7.50/hour, and worked 44 hours during the most recent week. She makes a 401(k) retirement plan contribution of 14% of gross pay each period. Luisa Williams is single, and claims one withholding allowance for both federal and state. Luisa Williams voluntarily deducts life insurance of $15 and a charitable contribution of $5 each pay period. Her year-to-date taxable earnings for Social Security tax, prior to the current pay period, are $82,600, and she is paid with check #0500. Addr Notes: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. SS# Earnings Deductions 09/06/2020 40 $7.50 $300.00 $11.25 $45.00 $345.00 $15.00 $14.84 $21.39 Complete the remainder of the employee earnings records for the five employees from PSa 4-6. The earnings section of the employee earnings records was previously completed in PSa 2-13 and PSa 3-9. Note that voluntary withholdings on the payroll register must be divided across the appropriate columns within the employee earnings records. Nam Luisa Williams earns $7.50/hour, and worked 44 hours during the most recent week. She makes a 401(k) retirement plan contribution of 14% of gross pay each period. Luisa Williams is single, and claims one withholding allowance for both federal and state. Luisa Williams voluntarily deducts life insurance of $15 and a charitable contribution of $5 each pay period. Her year-to-date taxable earnings for Social Security tax, prior to the current pay period, are $82,600, and she is paid with check #0500. Addr Notes: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. SS# Earnings Deductions 09/06/2020 40 $7.50 $300.00 $11.25 $45.00 $345.00 $15.00 $14.84 $21.39