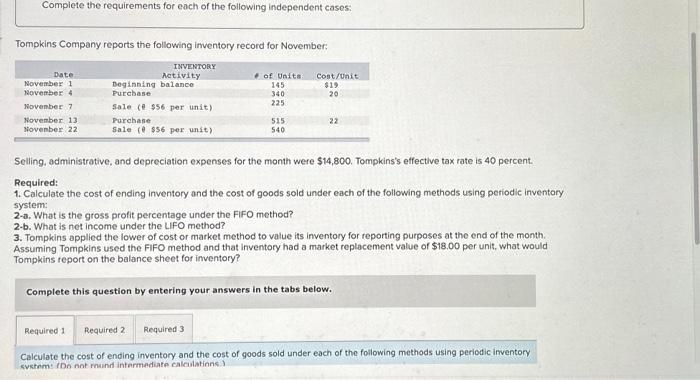

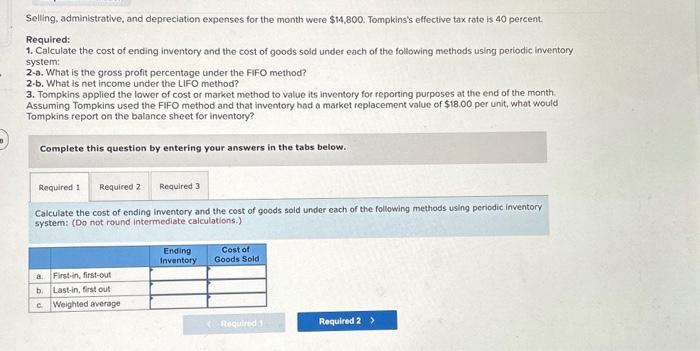

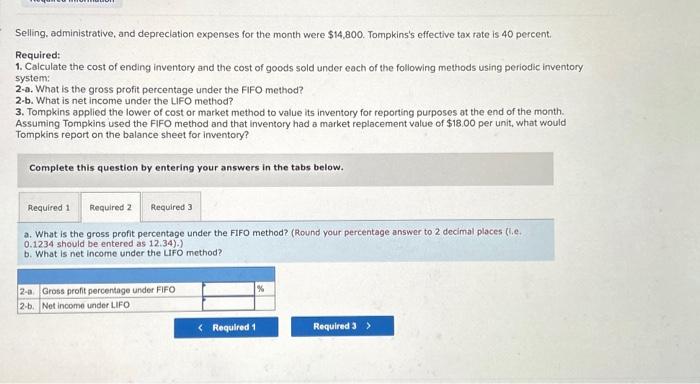

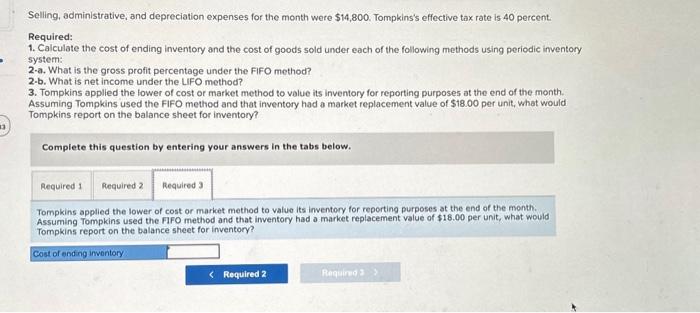

Complete the requirements for each of the following independent cases: Tompkins Company reports the following inventory record for November: Selling, administrative, and depreciation expenses for the month were $14,800. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: 2-3. What is the gross profit percentage under the FIFO method? 2-b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $18.00 per unit, what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic irventory svetem: (Do not mund intarmadiate calcailations). Selling, administrative, and depreciation expenses for the month were $14,800. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: 2-a. What is the gross profit percentage under the FIFO method? 2.b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $18.00 per unit, what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: (Do not round intermediate calculations.) Selling, administrative, and depreclation expenses for the month were $14,800. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: 2-a. What is the gross profit percentage under the FIFO method? 2.b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $18.00 per unit, what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. a. What is the gross profit percentage under the FIFO method? (Round your percentage answer to 2 decimal places (lie. 0.1234 should be entered as 12.34).) b. What is net income under the LifO method? Selling, administrative, and depreciation expenses for the month were $14,800. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory System: 2-a. What is the gross profit percentage under the FFFO method? 2-b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to volue its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $18.00 per unit, what would Tompkins report on the balance sheet for imventory? Complete this question by entering your answers in the tabs below. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of \$18.00 per unit, what would Tompkins report on the balance sheet for inventory? Complete the requirements for each of the following independent cases: Tompkins Company reports the following inventory record for November: Selling, administrative, and depreciation expenses for the month were $14,800. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: 2-3. What is the gross profit percentage under the FIFO method? 2-b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $18.00 per unit, what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic irventory svetem: (Do not mund intarmadiate calcailations). Selling, administrative, and depreciation expenses for the month were $14,800. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: 2-a. What is the gross profit percentage under the FIFO method? 2.b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $18.00 per unit, what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: (Do not round intermediate calculations.) Selling, administrative, and depreclation expenses for the month were $14,800. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: 2-a. What is the gross profit percentage under the FIFO method? 2.b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $18.00 per unit, what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. a. What is the gross profit percentage under the FIFO method? (Round your percentage answer to 2 decimal places (lie. 0.1234 should be entered as 12.34).) b. What is net income under the LifO method? Selling, administrative, and depreciation expenses for the month were $14,800. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory System: 2-a. What is the gross profit percentage under the FFFO method? 2-b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to volue its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $18.00 per unit, what would Tompkins report on the balance sheet for imventory? Complete this question by entering your answers in the tabs below. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of \$18.00 per unit, what would Tompkins report on the balance sheet for inventory