Question

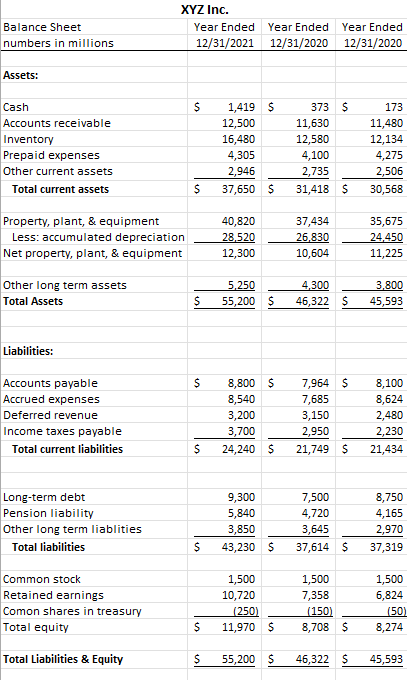

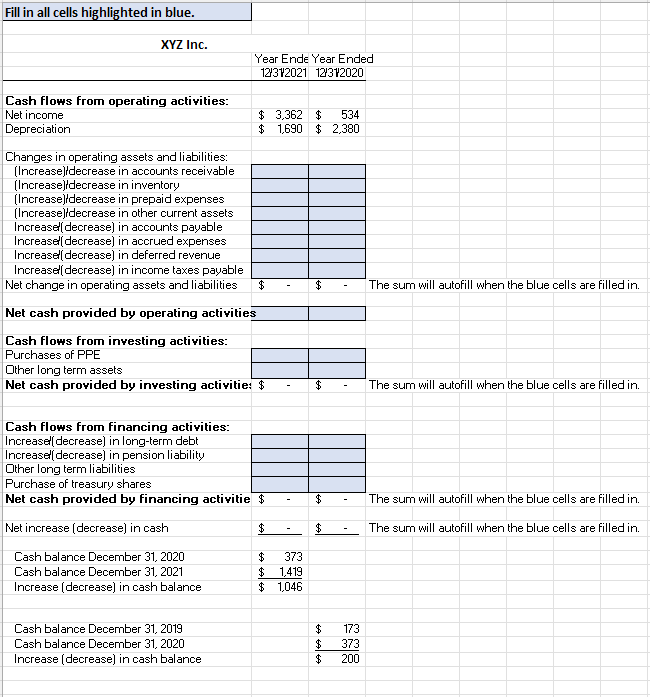

Complete the statement of cash flow for XYZ Inc. while using the indirect method and the XYZ Inc. Statement of Cash Flows Statement of

Complete the statement of cash flow for XYZ Inc. while using the indirect method and the XYZ Inc. Statement of Cash Flows Statement of Cash FlowsExcel spreadsheet.

The XYZ Inc. Statement of Cash Flows spreadsheet has two tabs: the Balance Sheets tab and the Statement of Cash Flow tab.

Explain XYZ Inc.'s net increase or decrease in cash based on the changes in operating, investing, and financing cash flows. Which category created the most cash flow? Which used the most cash flow?

Describe the specific categories in investing and financing activity that used the most cash in 2020 and 2021.

Describe a challenge you have in understanding the statement of cash flows or completing the statement of cash flows for XYZ Inc.

Explain how the statement of cash flows illustrates the change in cash on the balance sheet.

Explain how the statement of cash flows is useful when evaluating a company for investment.

Balance Sheet numbers in millions Assets: XYZ Inc. Year Ended Year Ended Year Ended 12/31/2021 12/31/2020 12/31/2020 Cash 1,419 $ 373 $ 173 Accounts receivable Inventory Prepaid expenses 12,500 11,630 11,480 16,480 12,580 12,134 4,305 4,100 4,275 Other current assets 2,946 2,735 2,506 Total current assets $ 37,650 $ 31,418 $ 30,568 Property, plant, & equipment 40,820 37,434 35,675 Less: accumulated depreciation 28,520 26,830 24,450 Net property, plant, & equipment 12,300 10,604 11,225 Other long term assets 5,250 4,300 3,800 Total Assets $ 55,200 $ 46,322 $ 45,593 Liabilities: Accounts payable 8,800 $ 7,964 $ 8,100 Accrued expenses Deferred revenue 8,540 7,685 8,624 3,200 3,150 2,480 Income taxes payable 3,700 2,950 2,230 Total current liabilities $ 24,240 $ 21,749 $ 21,434 Long-term debt 9,300 7,500 8,750 Pension liability 5,840 4,720 4,165 Other long term liablities 3,850 3,645 2,970 Total liabilities $ 43,230 $ 37,614 $ 37,319 Common stock 1,500 1,500 1,500 Retained earnings 10,720 7,358 6,824 Comon shares in treasury (250) (150) (50) Total equity $ 11,970 $ 8,708 $ 8,274 Total Liabilities & Equity $ 55,200 $ 46,322 $ 45,593

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started