Answered step by step

Verified Expert Solution

Question

1 Approved Answer

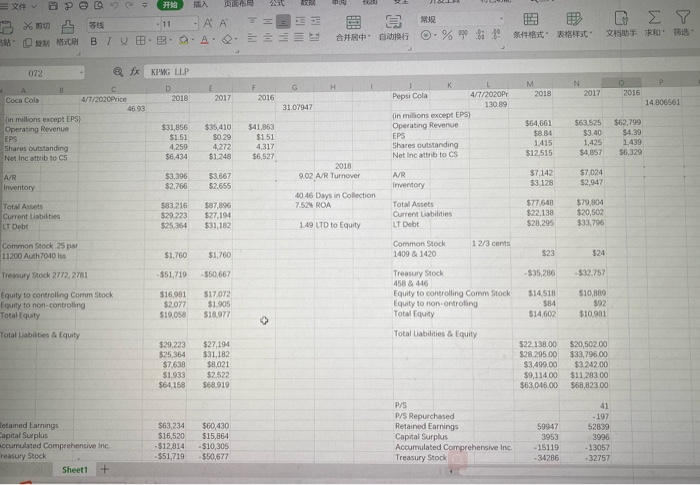

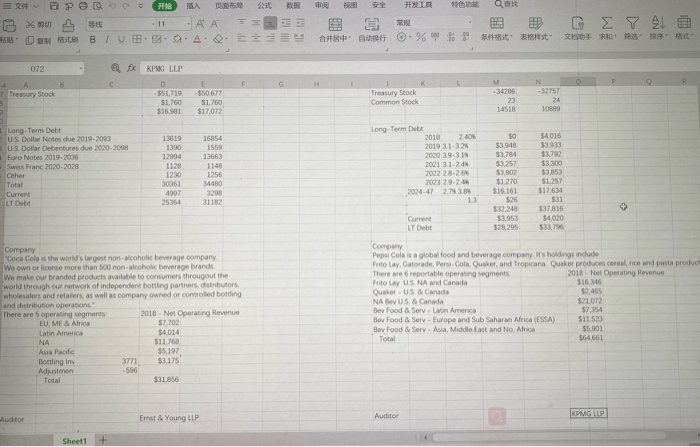

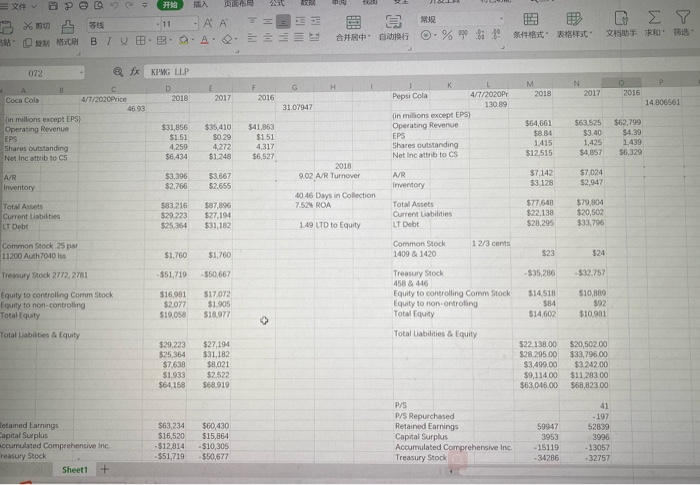

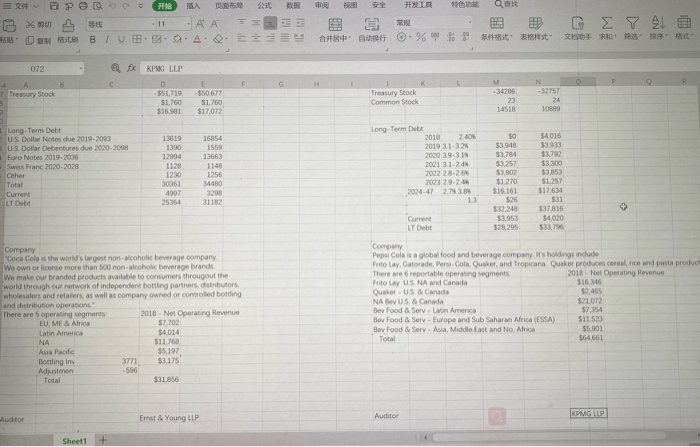

Complete the Word document through excel 2 = DPO F X 3 Xu 11 AA UIB TUBA OE T=2 3 A 3 2 0. %

Complete the Word document through excel

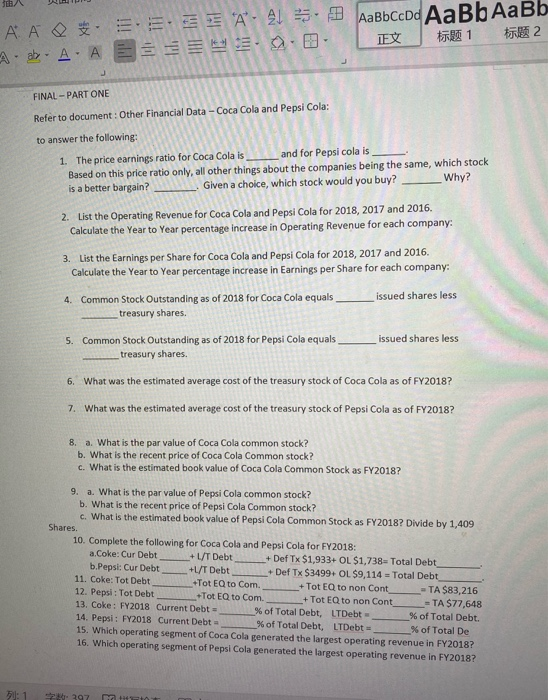

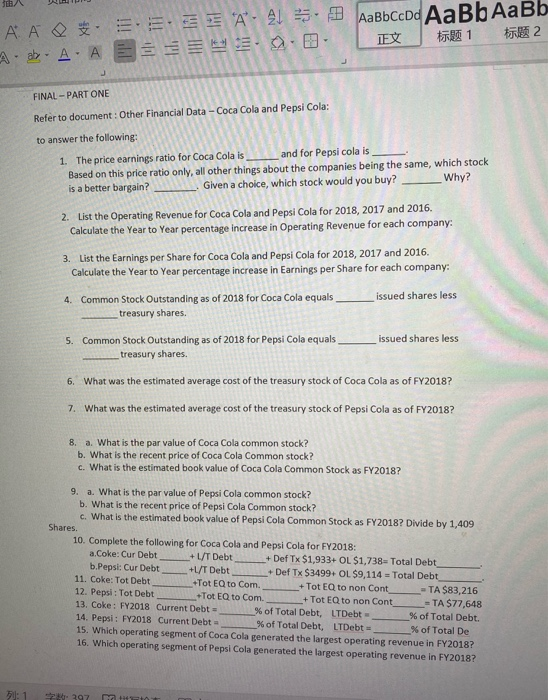

2 = DPO F X 3 Xu 11 AA UIB TUBA OE T=2 3 A 3 2 0. % TOOL . 0 :81:1 U SRO 072 - fx KPMG LLP 2018 2017 2016 14.306561 31.07947 Coca Cola 4/7/2020Price 46 93 in millions except EPS) Operating Revenue MNO Pepsi Cola 4/7/2020P 2018 2017 2016 130 89 in millions except EPS) Operating Revenue $64,661 $63.525 $62,799 $8.34 53.40 $4.39 Shares outstanding 1.415 1.425 1439 Net Inc attrib to CS $12.515 $4 857 $6,329 $31.056 $1.51 4.259 $6,434 341,863 $1.51 $35.410 90 29 4.272 $1,248 Shares outstanding Net Inc attrib to CS $6,527 2018 9.02 A/R Turnover $3396 $2.766 $3667 $2655 $7142 $3 128 $7024 $2.947 Inventory Inventory 40.46 Days in Collection 7.524 ROA Total Assets Current Liabilities LT Debt $83 216 $29 223 $25,364 $87 896 27.100 $31.182 Total Assets Current Lisbilities LT Debt 577648 $22,138 $20,295 $79.904 $20,502 $33,796 1.49 LTD to Equity 12/3 cents Common Stock 25 par 11200 Auth7010 Iss Common Stock 1409 & 1420 $1,760 $1,760 524 Treasury Stock 2772, 2781 $51,719 $50,667 -$35,200 $32.757 $14 518 Equity to controlling Comm Stock Equity to non-controlling Total Equity $10,000 Treasury Stock 458 & 446 Equity to controlling Comm Stock Equity to non-ontroling Total Equity $16.981 $2.077 $19.059 $17072 $1.905 $18.977 $84 $92 $14,602 $10,981 Total Liabilities & Equity Total Liabilities & Equity $29,223 $25,364 $7,638 51.933 $64 158 $27,194 $31,182 $8,021 $2.522 S68 919 $22 138.00 $28 295.00 $3,499.00 $9,114.00 $63,046.00 $20,502.00 $33.795.00 $3.242.00 $11.283.00 $68,823.00 - 197 52839 detained Earnings Capital Surplus accumulated Comprehensive Inc reasury Stock Sheet1 + $63,234 $16,520 -$12,814 -51,719 $60.430 $15,864 -$10,305 $50,677 P/S Repurchased Retained Earnings Capital Surplus Accumulated Comprehensive Inc. Treasury Stock 59947 3953 15119 -34286 3996 -13057 -32757 BBM SER B XU 5 11 AA = 2 KOMBI U BOA ETA % tot ESF - 88 13 072 - KPW LLP Treasury Stock -34206 -32757 $51.719 51.760 $16.901 $50677 51.760 $17,072 Treasury Stock Common Stock 14518 09 Long Term Date 12519 15854 54016 Long Term Debt US Do Notes de 2010-2008 US Dollar Debertures de 2000-2005 Euro Notes 2019-2035 Swiss Franc 2020-2028 Other Total Current LT Debt $3.300 12994 1128 1230 3061 2019 31-32 2030 1931 201112 2032 28.26 2033 2920 2004.47 213 34480 53.908 53.784 53.257 $390 $1270 5 16161 $26 $12248 1953 $28.295 517634 2536 31102 337816 Current LT Debt 4020 $33,79 Company Coca Cola is the world's largest non coholic beverage company We own or licence more than non alcoholic beverage brands We make our branded products available to come througout the world through our network of independent botting partners, distributors wholesalers and retailers as well as company owned or controlled boting Company Pepsi Cola is a global food and beverage company holding indude Frito Lay Gatorade Prsi Cola Qusker, and Tropicana Quske produces cereal nice and post produs There we reportatile operating segments 2013 Net Operating Revenge freo Lay US NA and Canada 116306 QUU S & Canada NA USC 1072 Bev Food & Servan America 5754 Bev Food & Ser - Europe and SubSaharan Africa ESSA) Bev Food Server Middle East and No Africa $5.901 364,651 There are 5 operating segments EU ME Arca Latin America 2018 Net Operating Revenue 57.702 $4014 $11.768 $5,197 53,175 Asia Pacific Bottling in Adjustmen Total 37 -506 $31.856 Rudtor Fint Young LLP Sheet + di WLIIN AAQS . 33A-21 5. A ab. AA EE 9 - AaBbccdd AaBb AaBb TEX 0 1 2 FINAL-PART ONE Refer to document: Other Financial Data - Coca Cola and Pepsi Cola: to answer the following: 1. The price earnings ratio for Coca Cola is ____ and for Pepsi cola is _ Based on this price ratio only, all other things about the companies being the same, which stock is a better bargain? . Given a choice, which stock would you buy?_ Why? 2. List the Operating Revenue for Coca Cola and Pepsi Cola for 2018, 2017 and 2016. Calculate the Year to Year percentage increase in Operating Revenue for each company: 3. List the Earnings per Share for Coca Cola and Pepsi Cola for 2018, 2017 and 2016 Calculate the Year to Year percentage increase in Earnings per Share for each company: issued shares less 4. Common Stock Outstanding as of 2018 for Coca Cola equals treasury shares. issued shares less 5. Common Stock Outstanding as of 2018 for Pepsi Cola equals _treasury shares. 6. What was the estimated average cost of the treasury stock of Coca Cola as of FY2018? 7. What was the estimated average cost of the treasury stock of Pepsi Cola as of FY2018? 8. a. What is the par value of Coca Cola common stock? b. What is the recent price of Coca Cola Common stock? c. What is the estimated book value of Coca Cola Common Stock as FY2018? 9. a. What is the par value of Pepsi Cola common stock? b. What is the recent price of Pepsi Cola Common stock? c. What is the estimated book value of Pepsi Cola Common Stock as FY2018? Divide by 1,409 Shares. 10. Complete the following for Coca Cola and Pepsi Cola for FY2018: a.Coke: Cur Debt +UT Debt + Def Tx $1,933+ OL $1,738- Total Debt b.Pepsi: Cur Debt +L/T Debt Def Tx $3499+ OL $9,114 = Total Debt 11. Coke: Tot Debt. Tot EQ to Com. + Tot EQ to non Cont -TA $83,216 12. Pepsi : Tot Debt Tot EQ to Com. + Tot EQ to non Cont_ =TA $77,648 13. Coke: FY2018 Current Debt = % of Total Debt, LTDebt - % of Total Debt. 14. Pepsi : FY2018 Current Debt % of Total Debt, LTDebt % of Total De 15. Which operating segment of Coca Cola generated the largest operating revenue in FY2018? 16. Which operating segment of Pepsi Cola generated the largest operating revenue in FY2018? : 1 397 ot

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started