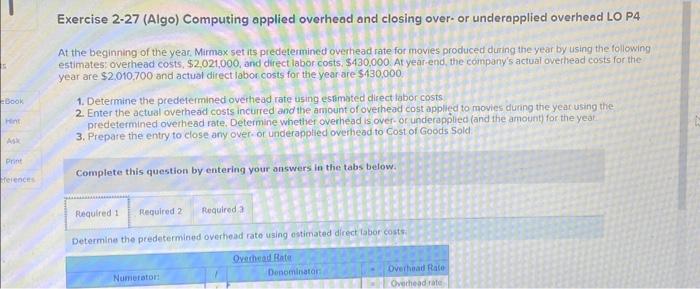

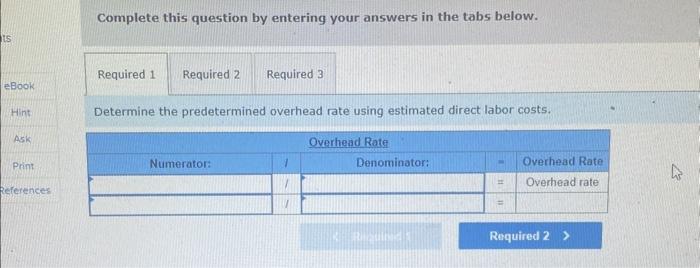

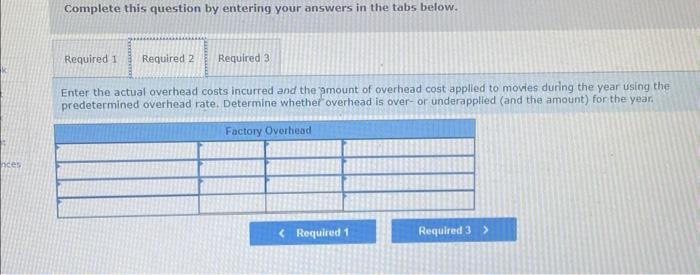

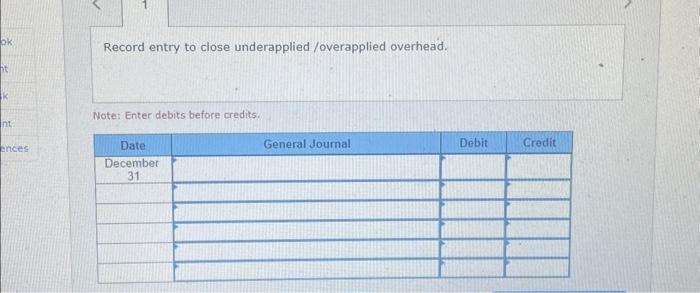

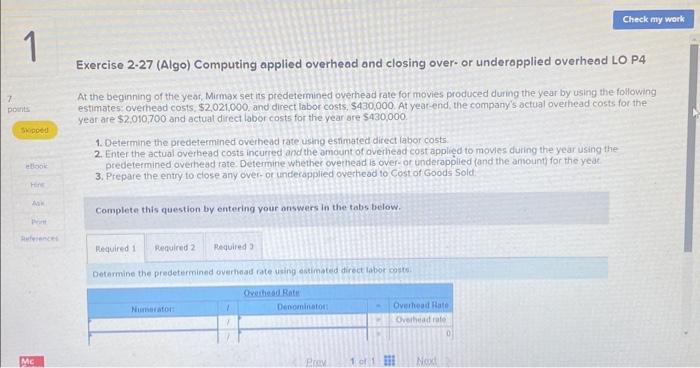

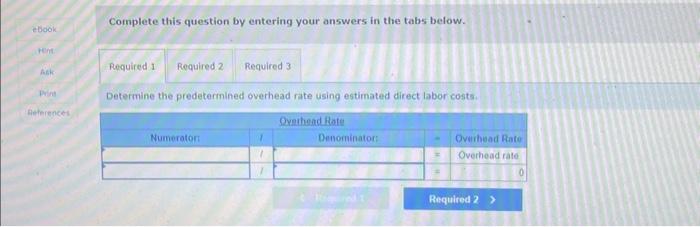

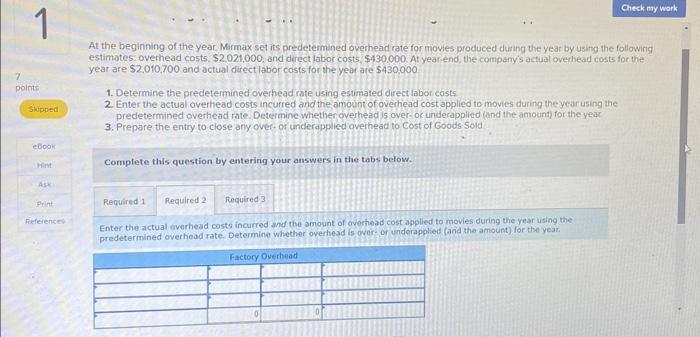

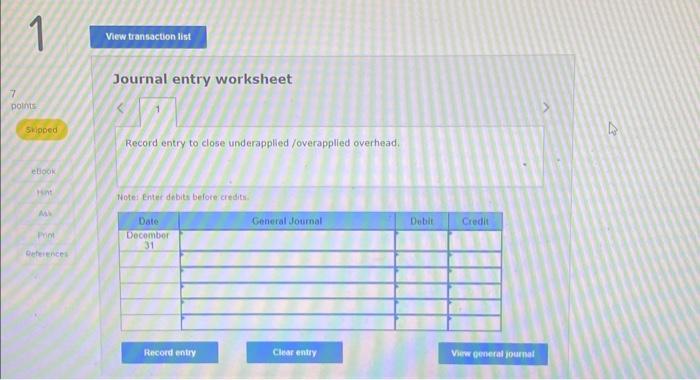

Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate using estimated direct labor costs. Exercise 2-27 (Algo) Computing applied overhead and closing over-or underopplied overhead LO P4 At the beginning of the year, Mirmax set its predetemined overhead rate for movies, produced during the year by using the following estimates overhead costs, $2,021,000. and direct labor costs, $430,000. At yeac-end, the company's actual overhead costs for the year are $2,010,700 and actual direct labor costs for the year are $430,000. 1. Determine the predetermined overhead rate using estimated direct labor costs: 2. Enter the actual overhead costs incurred and the amount of overhead cost applied to movies during the year using the predetermined overthead rate. Determine whether ovethead is over-or underapplied fand the anount) for the yeat. 3. Prepare the entry to close any over- or underapplied overtread to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Determine the predetermined overheas rate using estimated direct labor copte. Journal entry worksheet Record entry to close underapplied / overapplied overhead. Note: Enter dobits before creditr. Exercise 2-27 (Algo) Computing applied overhead and closing over- or underapplied overhead LO P4 At the beginning of the yeac. Mirmax set its predetermined overhead rate for movies produced during the year by using the following estimates: overhead costs, $2,021,000, and direct labor costs, $430,000. At year-end, the company's actual ovethead costs for the year are $2,010700 and actual direct labor costs for the year are $430,000. 1. Determine the predetermined overhead rate using estmated cliect labor costs 2. Enter the actual overhead costs incurred and the amount of overhead cost applied to movies during the year using the predetermined overhead rate, Determine whether overhead is over-or underapplied (and the amount) for the yeat 3. Prepare the entry to close any over-or underapplied overhead to Cost of Goods Sold Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rato using estimated direct iabor costs: Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate using estimated direct labor costs. Complete this question by entering your answers in the tabs below. Enter the actual overhead costs incurred and the amount of overhead cost applied to movies during the year using the predetermined overhead rate. Determine whether overhead is over-or underapplled (and the amount) for the year. At the beginning of the year, Mirmax set its predetermined overhead rate for movies produced during the year by using the followirg estimotes: overhead costs, $2,021,000, and direct labor costs, $430,000. At year-end, the company actual overhead costs for the year are $2,010,700 and actual direct labor costs for the yeor are $430,000 1. Determine the predetermined overhead rate using estimated direct labor costs 2. Enter the actual overhead costs incurred and the amount of overhead cost applied to movies during the year using the predetermined overhead rate. Determine whether overhead is over oc underapplited (and the amount) for the year 3. Prepare the entry to close any over- or underappled overhead to Cost of Goods Sold Complete this question by entering your answers in the tabs below. Enter the actual overhead costs incurred and the amount of overhead cost applied to movies during the year using the predetermined overhead rate. Determine whether overhead is over- or underapplied (and the amount) for the year. Record entry to close underapplied / overapplied overhead. Note: Enter debits before credits