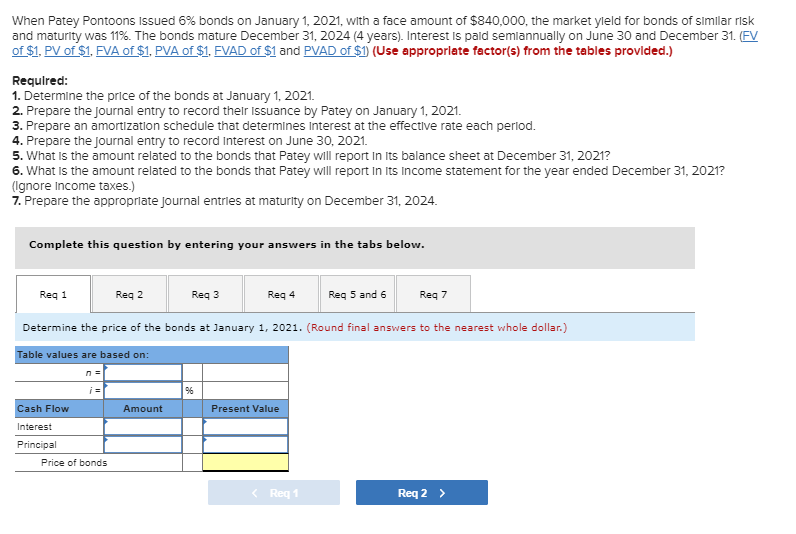

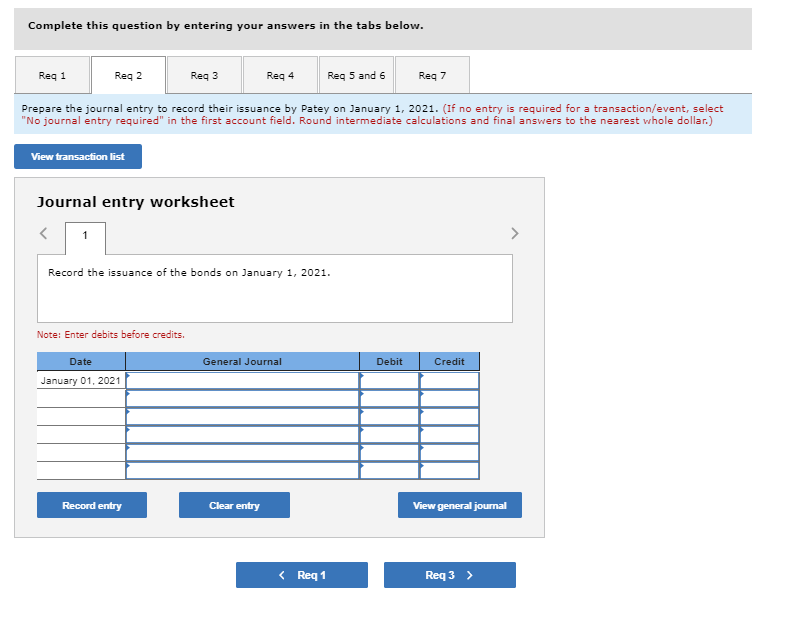

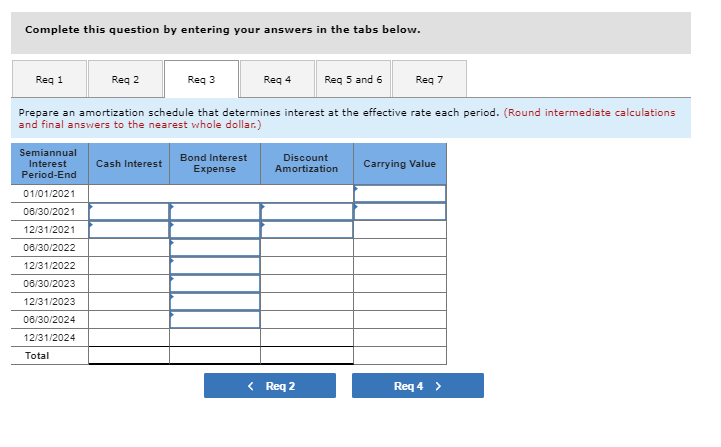

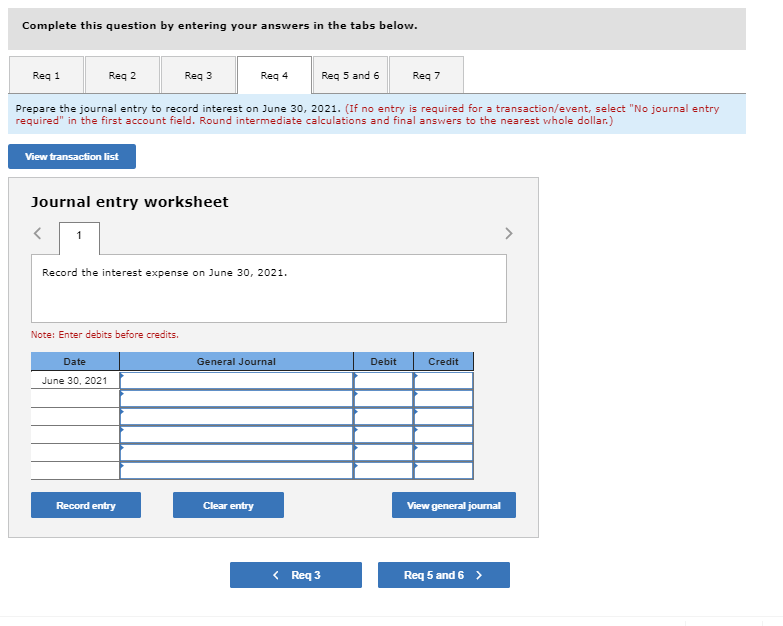

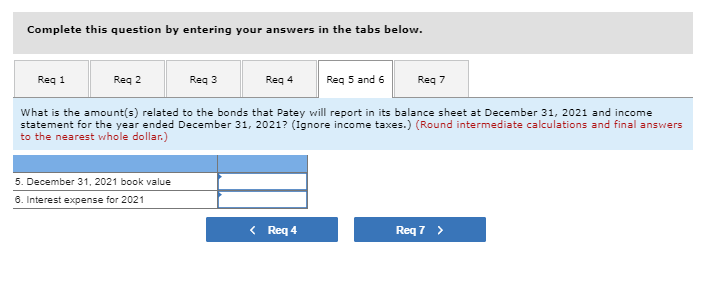

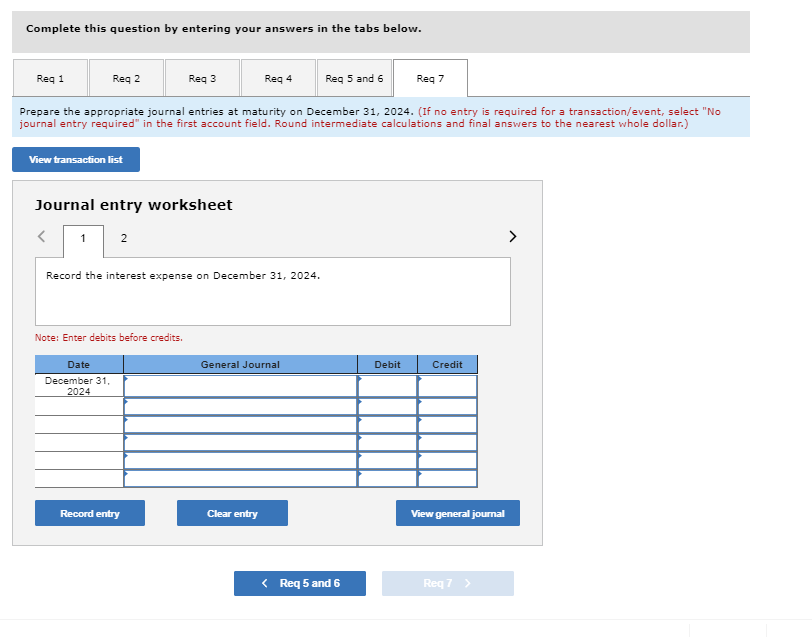

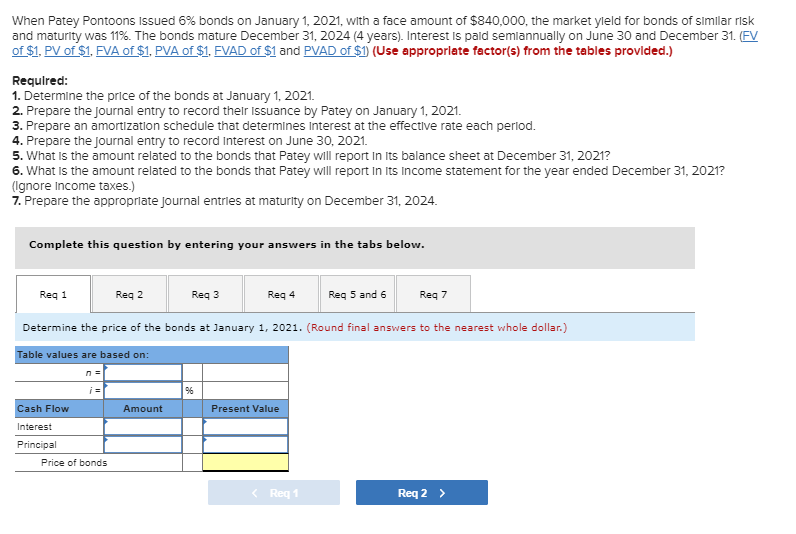

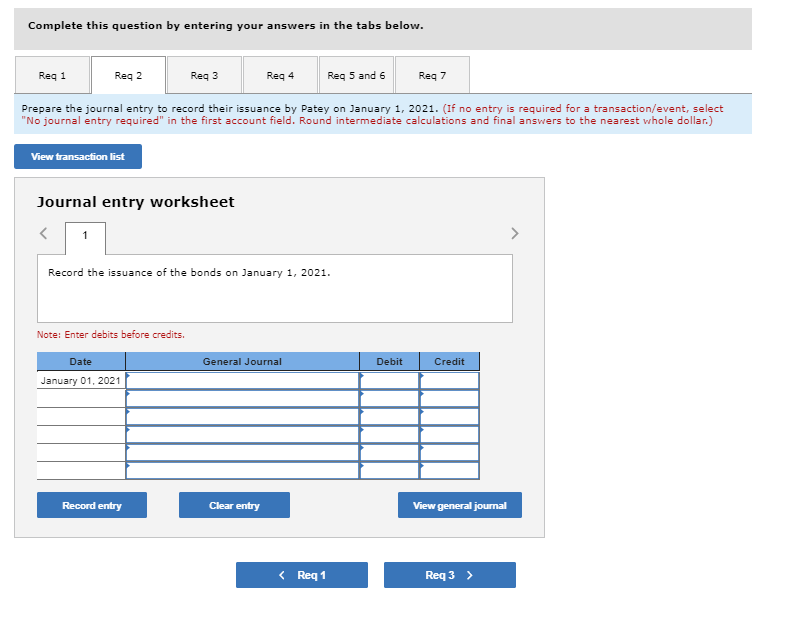

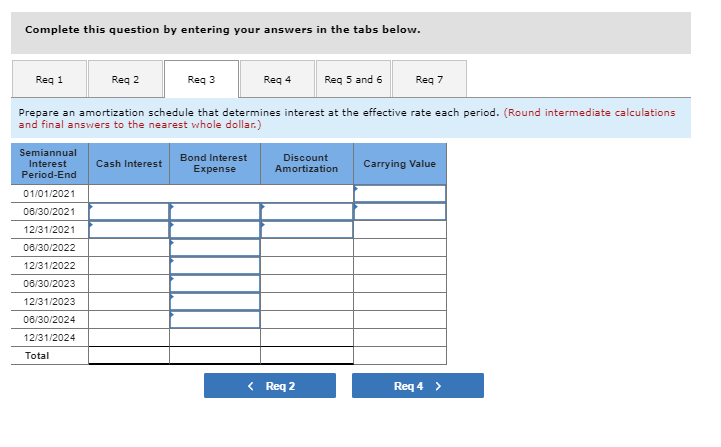

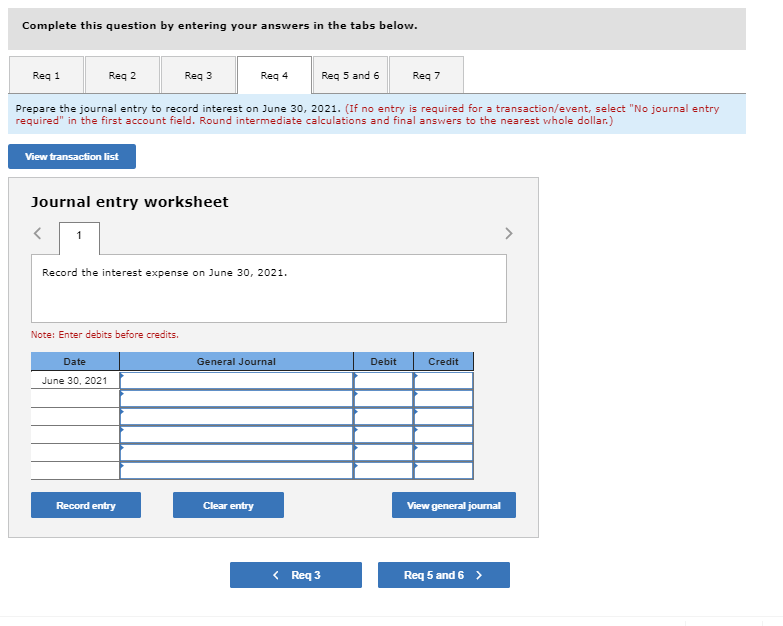

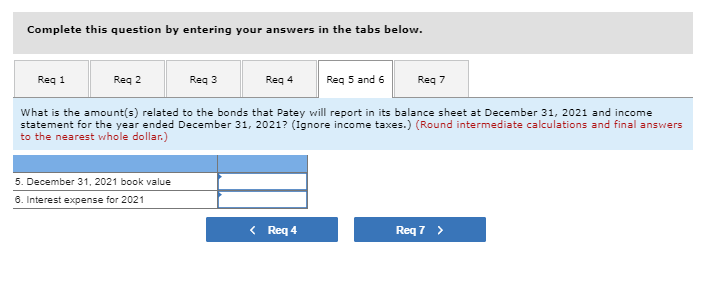

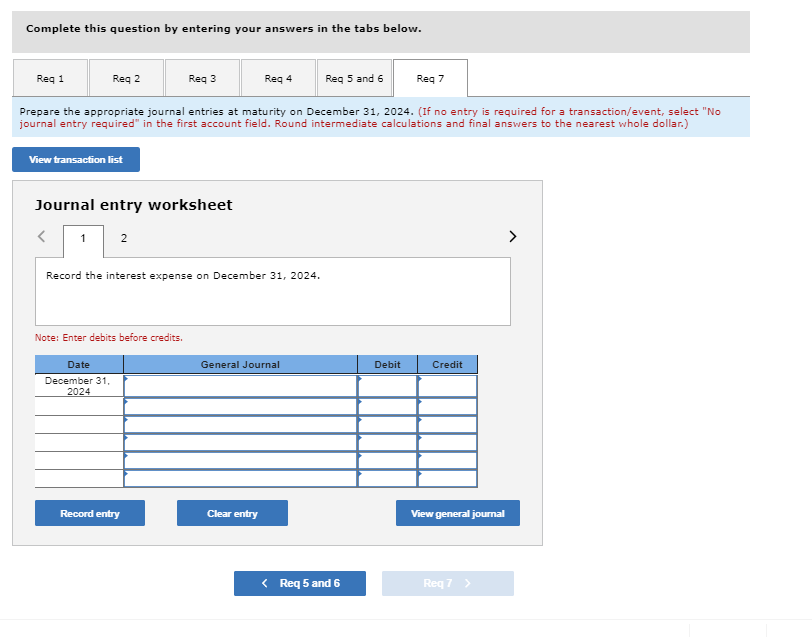

Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req3 Reg 4 Reg 5 and 6 Reg 7 Prepare the journal entry to record their issuance by Patey on January 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record the issuance of the bonds on January 1, 2021. Note: Enter debits before credits. General Journal Debit Credit Date January 01, 2021 Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 Reg 4 Reg 5 and 6 Req 7 Prepare an amortization schedule that determines interest at the effective rate each period. (Round intermediate calculations and final answers to the nearest whole dollar.) Semiannual Interest Period-End Cash Interest Bond Interest Expense Discount Amortization Carrying Value 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 Total Complete this question by entering your answers in the tabs below. Req 1 Reg 2 Reg 3 Reg 4 Reg 5 and 6 Req 7 Prepare the journal entry to record interest on June 30, 2021. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round intermediate calculations and final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record the interest expense on June 30, 2021. Note: Enter debits before credits. General Journal Debit Credit Date June 30, 2021 Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req3 Reg 4 Reg 5 and 6 Req 7 What is the amount(s) related to the bonds that Patey will report in its balance sheet at December 31, 2021 and income statement for the year ended December 31, 2021? (Ignore income taxes.) (Round intermediate calculations and final answers to the nearest whole dollar.) 5. December 31, 2021 book value 6. Interest expense for 2021 Reg4 Req7 > Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 2 Reg 3 Reg3 Req 4 Reg4 Reg 5 and 6 Reg 7 Reg 7 Prepare the appropriate journal entries at maturity on December 31, 2024. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round intermediate calculations and final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record the interest expense on December 31, 2024. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2024 Record entry Clear entry View general journal Reg 5 and 6 Req7 >