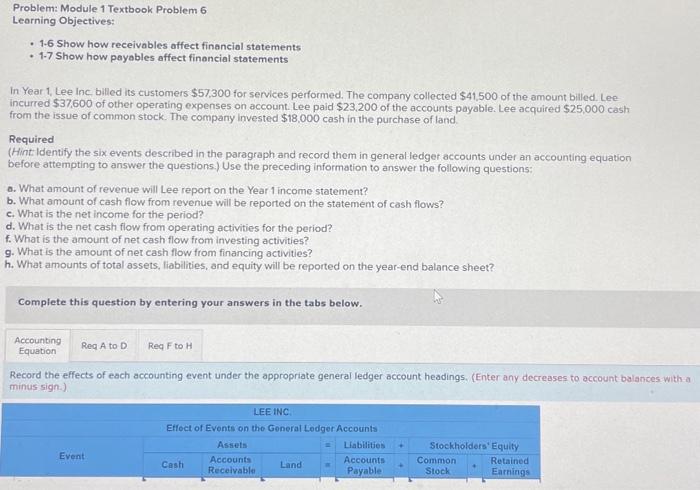

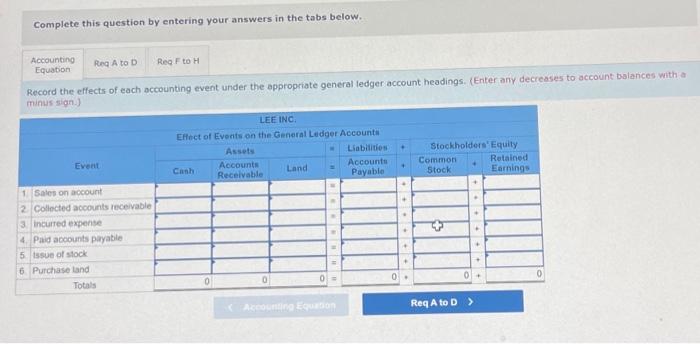

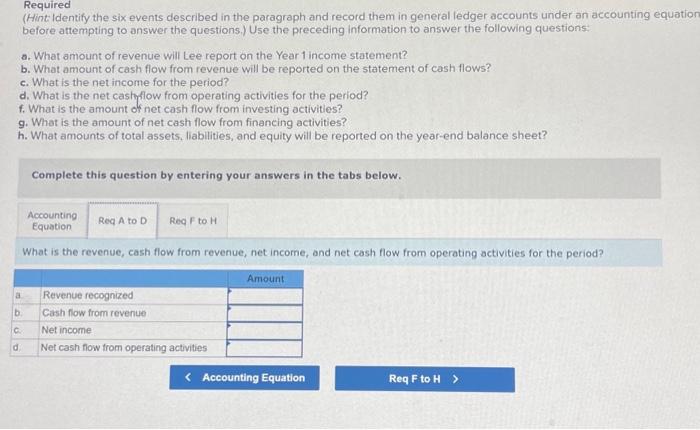

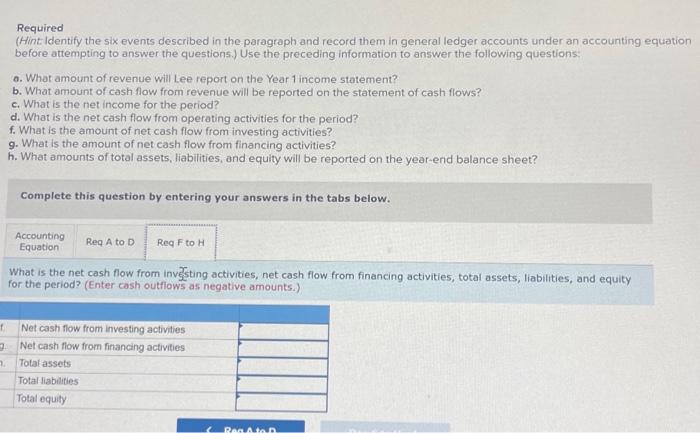

Complete this question by entering your answers in the tabs below. Record the effects of each accounting event under the appropriate general fedger account headings. (Enter any decreases to account balarices with a minus sion (Hint Identify the six events described in the paragraph and record them in general ledger accounts under an accounting equation before attempting to answer the questions.) Use the preceding information to answer the following questions a. What amount of revenue will Lee report on the Year 1 income statement? b. What amount of cash flow from revenue will be reported on the statement of cash flows? c. What is the net income for the period? d. What is the net castyflow from operating activities for the period? f. What is the amount of net cash flow from investing activities? g. What is the amount of net cash flow from financing activities? h. What amounts of total assets, liabilities, and equity will be reported on the year-end balance sheet? Complete this question by entering your answers in the tabs below. What is the revenue, cash flow from revenue, net income, and net cash flow from operating activities for the period? Required (Hint: Identify the six events described in the paragraph and record them in general ledger accounts under an accounting equation before attempting to answer the questions.) Use the preceding information to answer the following questions: o. What amount of revenue will Lee report on the Year 1 income statement? b. What amount of cash flow from revenue will be reported on the statement of cash flows? c. What is the net income for the period? d. What is the net cash flow from operating activities for the period? f. What is the amount of net cash flow from investing activities? 9. What is the amount of net cash flow from financing activities? h. What amounts of total assets, liabilities, and equity will be reported on the year-end balance sheet? Complete this question by entering your answers in the tabs below. for the period? (Enter cash outflows as negative amounts.) Problem: Module 1 Textbook Problem 6 Learning Objectives: - 1.6 Show how receivables affect financial statements -1.7 Show how payables affect financial statements In Year 1, Lee Inc, billed its customers $57,300 for services performed. The company collected $41,500 of the amount billed. Lee incurred $37,600 of other operating expenses on account. Lee paid $23,200 of the accounts payable. Lee acquired $25,000 cash from the issue of common stock. The company invested $18,000 cash in the purchase of land. Required (Hint: Identify the six events described in the paragraph and record them in general ledget accounts under an accounting equation before attempting to answer the questions.) Use the preceding information to answer the following questions: a. What amount of revenue will Lee report on the Year 1 income statement? b. What amount of cash flow from revenue will be reported on the statement of cash flows? c. What is the net income for the period? d. What is the net cash flow from operating activities for the period? f. What is the amount of net cash flow from investing activities? 9. What is the amount of net cash flow from financing activities? h. What amounts of total assets, liabilities, and equity will be reported on the year-end balance sheet? Complete this question by entering your answers in the tabs below. Record the effects of each accounting event under the appropriate general ledger account headings. (Enter any decreases to account balances with a minus sign.)