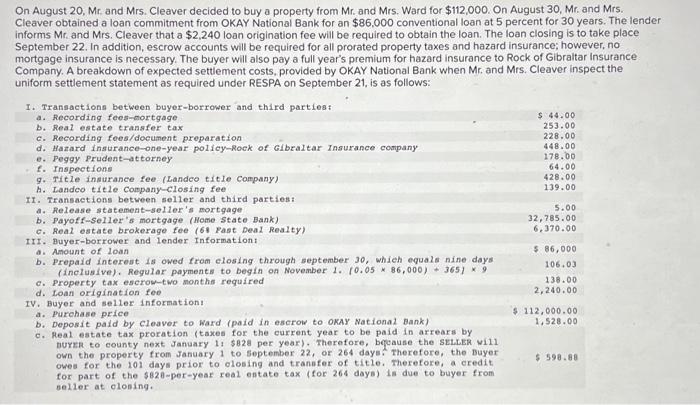

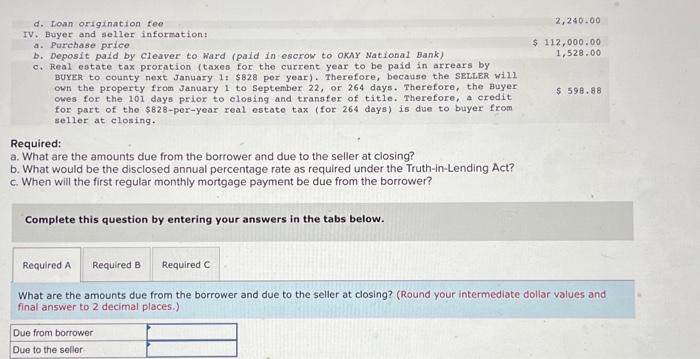

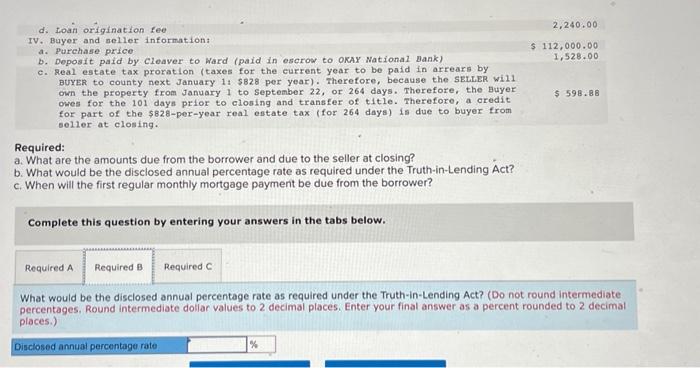

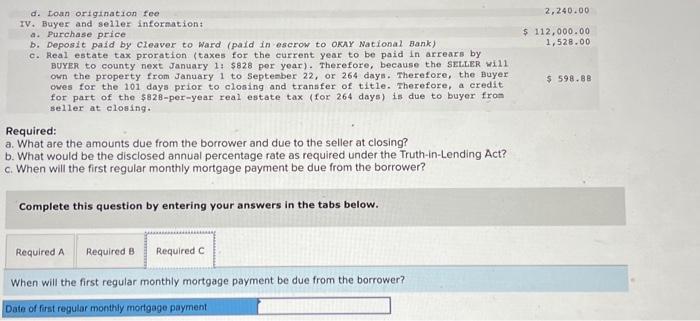

Complete this question by entering your answers in the tabs below. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? (Do not round intermediate percentages. Round intermediate dollar values to 2 decimal places. Enter your final answer as a percent rounded to 2 decimal places.) d. Loan origination fee rV. Buyer and seller information: a. Purchase price b. Deposit paid by cleaver to Ward (paid in escrow to okAY National Bank) 2,240.00 c. Real estate tax proration (taxes for the current year to be paid in arrears by buYzR to county next January 1 i $828 per year). Therefore, because the SELLER will own the property from January 1 to September 22 , or 264 days. Therefore, the Buyer owes for the 101 days prior to elosing and transfor of title. Therefore, a credit $112,000.00 1,528.00 for part of the $828-per-year real estate tax (for 264 days) is due to buyer from seller at closing. Required: What are the amounts due from the borrower and due to the seller at closing? What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? When will the first regular monthly mortgage payment be due from the borrower? Complete this question by entering your answers in the tabs below. What are the amounts due from the borrower and due to the seller at closing? (Round your intermediate dollar values and final answer to 2 decimal places.) On August 20, Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs. Ward for $112,000. On August 30, Mr. and Mrs. Cleaver obtained a loan commitment from OKAY National Bank for an $86,000 conventional loan at 5 percent for 30 years. The lender informs Mr. and Mrs. Cleaver that a $2,240 loan origination fee will be required to obtain the loan. The loan closing is to take place September 22 . In addition, escrow accounts will be required for all prorated property taxes and hazard insurance; however, no mortgage insurance is necessary. The buyer will also pay a full year's premium for hazard insurance to Rock of Gibraltar Insurance Company. A breakdown of expected settlement costs, provided by OKAY National Bank when Mr. and Mrs. Cleaver inspect the d. Loan orfgination fee TV. Buyer and seller information: a. Purchase price b. Deposit paid by cleaver to Ward (paid in escrow to oknY National Bank) 2,240.005112,000.001,528.00 c. Real estate tax proration (taxes for the current year to be paid in arrears by BUYER to county next January 1: $828 per year). Therefore, because the SEthIRR will own the property from January 1 to septenber 22, or 264 days. Therefore, the Buyer cwes for the 101 days prior to closing and tranifer of title. Therefore, a eredit $112,000.00 112,000.00 1,528,00 for part of the $828-per-year real estate tax (for 264 days) is due to buyer from seller at elosing. Required: What are the amounts due from the borrower and due to the seller at closing? What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? When will the first regular monthly mortgage payment be due from the borrower? Complete this question by entering your answers in the tabs below. When will the first regular monthly mortgage payment be due from the borrower