Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Completed most of it which i believe to be correct. - Would like a double check on everything and help finishing off the statement

- Completed most of it which i believe to be correct.

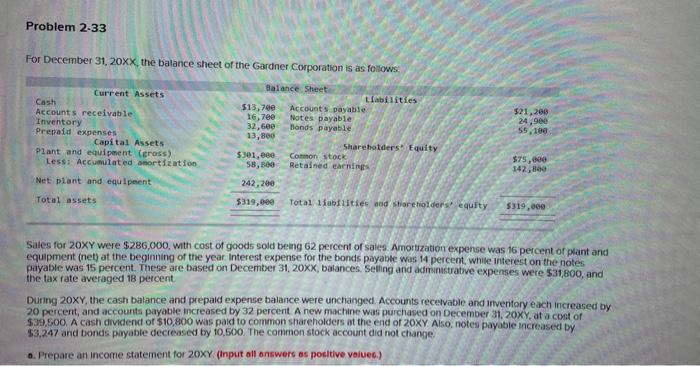

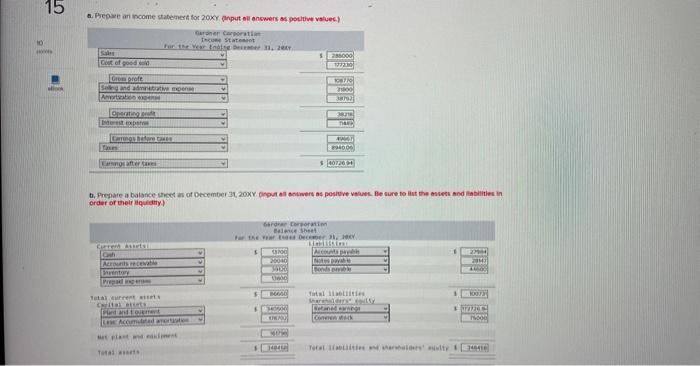

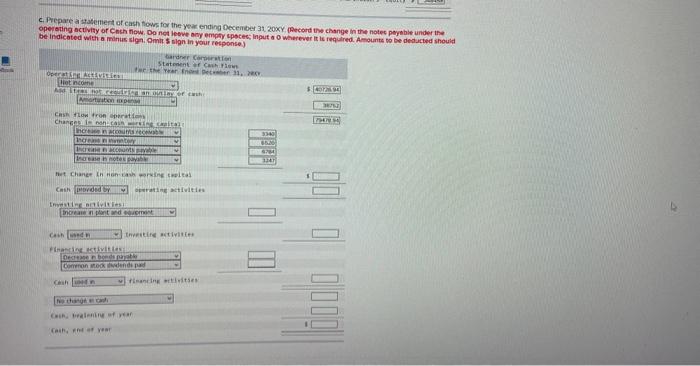

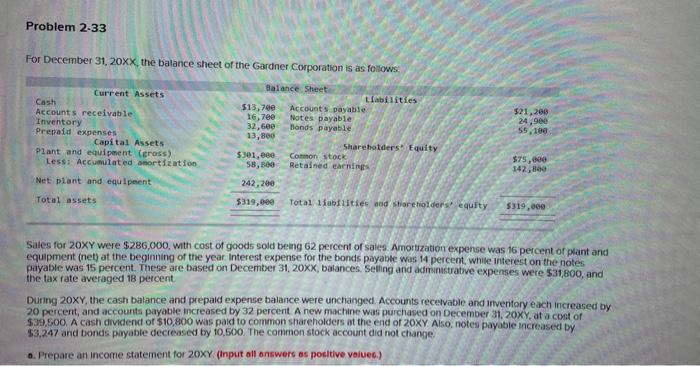

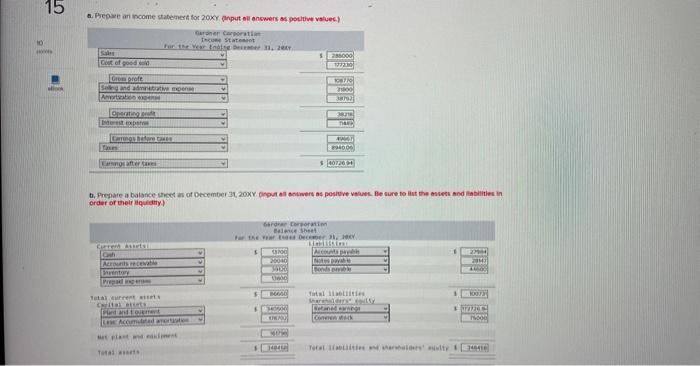

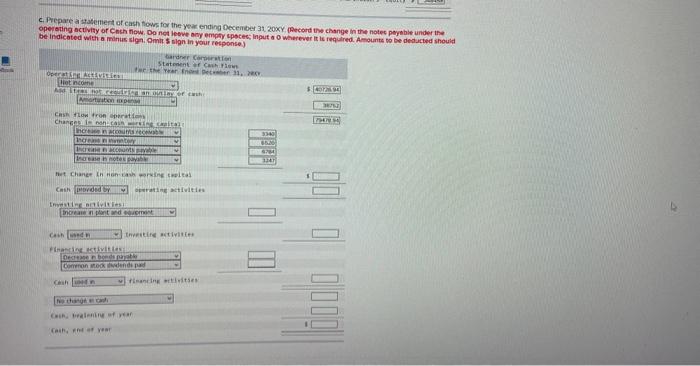

For December 31,20x, the balance sheet of the Gardner Corporation is as folows: Sales for 20XY were $286,000, with cost of goods sold being 62 percent of sales. Amortzation expense was 16 percent of plant and equipment (net) at the beginning of the year Interest expense for the bonds payable was 14 percent, while interest on the notes payable was 15 percent. There are based on December 31, 20xX, balances. Seting and admintriative expenses were 531,800 , and the tax rate averaged 18 percent. During 20XY, the cash balance and prepald expense balance were unchanged. Accounts recelvable and inventory each increased by 20 percent, and accounts payable increased by 32 percent. A new machine was purchased on December 31,20Y, at a cost of \$39,500. A cash divdend of $10,800 wos pald to common shareholders at the end of 20xy. Also. notes payable thcreased by \$3.247 and bonds payable decreosed by 10,500. The common stock account did not change. o. Prepare an income statement for 20Y, (input all onswers as positive vaivec.) a. Brepare an income stafedert for 20x, anput all ancwers as potutive valuec.) b. Prepare a balance ureet as of December 31, 200x, Grout al antwers as posiuve vatios. Be sure to liat the astest and liabilitios in order of their aqquatity.) c. Prepare a statertient af cash flowe for the year ending Decenbey 31 . 20xy, (Aecord tine change in the notec peyable under the be Indicated with a minus sign. Pmit s sign in your response.). For December 31,20x, the balance sheet of the Gardner Corporation is as folows: Sales for 20XY were $286,000, with cost of goods sold being 62 percent of sales. Amortzation expense was 16 percent of plant and equipment (net) at the beginning of the year Interest expense for the bonds payable was 14 percent, while interest on the notes payable was 15 percent. There are based on December 31, 20xX, balances. Seting and admintriative expenses were 531,800 , and the tax rate averaged 18 percent. During 20XY, the cash balance and prepald expense balance were unchanged. Accounts recelvable and inventory each increased by 20 percent, and accounts payable increased by 32 percent. A new machine was purchased on December 31,20Y, at a cost of \$39,500. A cash divdend of $10,800 wos pald to common shareholders at the end of 20xy. Also. notes payable thcreased by \$3.247 and bonds payable decreosed by 10,500. The common stock account did not change. o. Prepare an income statement for 20Y, (input all onswers as positive vaivec.) a. Brepare an income stafedert for 20x, anput all ancwers as potutive valuec.) b. Prepare a balance ureet as of December 31, 200x, Grout al antwers as posiuve vatios. Be sure to liat the astest and liabilitios in order of their aqquatity.) c. Prepare a statertient af cash flowe for the year ending Decenbey 31 . 20xy, (Aecord tine change in the notec peyable under the be Indicated with a minus sign. Pmit s sign in your response.) - Would like a double check on everything and help finishing off the statement or cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started