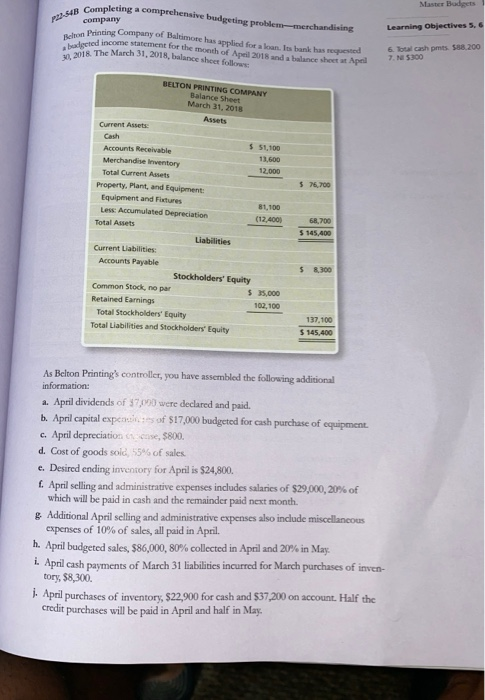

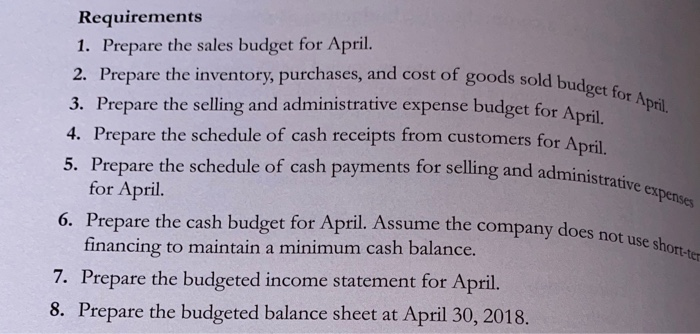

Completing a comprehensive budgeting problem PERSIB G company merchandising Learning Objectives 5.6 e Printing Company of Baltimore has applied for akan Is bank has requested d income statement for the month of April 2018 and balance sheet Apel s. The March 31, 2018, balance sheet follow budgcted income Its bank has requested balance sheet at Apel 6 local cash pts. 588.200 7. 5300 BELTON PRINTING COMPANY Balance Sheet March 31, 2018 Assets Current Assets Cash $ 51,100 Accounts Receivable 13,600 Merchandise Inventory 12,000 Total Current Assets Property. Plant, and Equipment: Equipment and Fixtures 81.100 Less: Accumulated Depreciation (12.400 Total Assets Liabilities Current Liabilities: Accounts Payable Stockholders' Equity Common Stock, no par $35.000 Retained Earnings 102,100 Total Stockholders' Equity Total Liabilities and Stockholders' Equity 68.700 $ 145.40 137.100 $ 145.400 As Belton Printing's controller, you have assembled the following additional information: a. April dividends of $7,000 were declared and paid. b. April capital expects of $17,000 budgeted for cash purchase of equipment c. April depreciation crise, $800. d. Cost of goods sold, 55% of sales. e. Desired ending inventory for April is $24,800. f. April selling and administrative expenses includes salaries of $29,000, 20% of which will be paid in cash and the remainder paid next month. g. Additional April selling and administrative expenses also include miscellaneous expenses of 10% of sales, all paid in April. h. April budgeted sales, $86,000, 80% collected in April and 20% in May. i. April cash payments of March 31 liabilities incurred for March purchases of inven- tory, $8,300. 1. April purchases of inventory, $22,900 for cash and $37,200 on account. Half the credit purchases will be paid in April and half in May. ods sold budget for April. Requirements 1. Prepare the sales budget for April. 2. Prepare the inventory, purchases, and cost of goods sold bud 3. Prepare the selling and administrative expense budget for April 4. Prepare the schedule of cash receipts from customers for April 5. Prepare the schedule of cash payments for selling and administ for April. 6. Prepare the cash budget for April. Assume the company does no financing to maintain a minimum cash balance. 7. Prepare the budgeted income statement for April. 8. Prepare the budgeted balance sheet at April 30, 2018. dministrative expenses any does not use short-ter