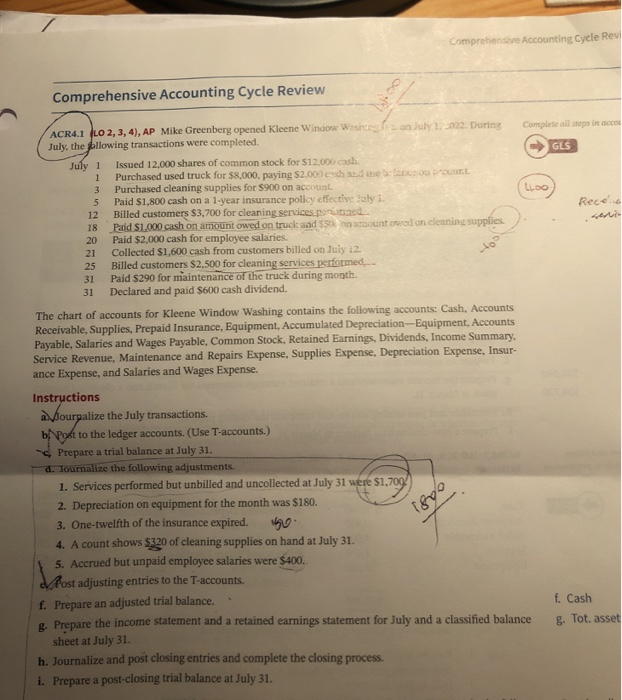

Comprehensive Accounting Cycle Revi Comprehensive Accounting Cycle Review Complete all steps in acco GLS Liloo Rece ACR4.1 (LO 2, 3, 4), AP Mike Greenberg opened Kleene Window Wash on July 1.-22. During July, the following transactions were completed. July 1 Issued 12,000 shares of common stock for $12,000 cash 1 Purchased used truck for $8.000, paying $2.001 ch e curt 3 Purchased cleaning supplies for $900 on account 5 Paid $1,800 cash on a 1-year insurance policy effective Baly i. 12 Billed customers $3,700 for cleaning services por 18 Paid $1.000 cash on amount owed on truck and 550 amguntoured on cleaning supplies. 20 Paid $2,000 cash for employee salaries. 21 Collected $1,600 cash from customers billed on July 12 25 Billed customers $2.500 for cleaning services performed 31 Paid S290 for maintenance of the truck during month. 31 Declared and paid $600 cash dividend. The chart of accounts for Kleene Window Washing contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Equipment, Accumulated Depreciation Equipment, Accounts Payable, Salaries and Wages Payable, Common Stock, Retained Earnings, Dividends, Income Summary Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation Expense, Insur- ance Expense, and Salaries and Wages Expense. Instructions amourpalize the July transactions. b! Post to the ledger accounts. (Use T-accounts.) Prepare a trial balance at July 31. d. Journalize the following adjustments 1. Services performed but unbilled and uncollected at July 31 were $1,709 2. Depreciation on equipment for the month was $180. 3. One-twelfth of the insurance expired. We 4. A count shows $320 of cleaning supplies on hand at July 31. 5. Accrued but unpaid employee salaries were $400. Post adjusting entries to the T-accounts. f. Prepare an adjusted trial balance. " . Prepare the income statement and a retained earnings statement for July and a classified balance sheet at July 31. h. Journalize and post closing entries and complete the closing process. i. Prepare a post-closing trial balance at July 31. f. Cash Tot. asset