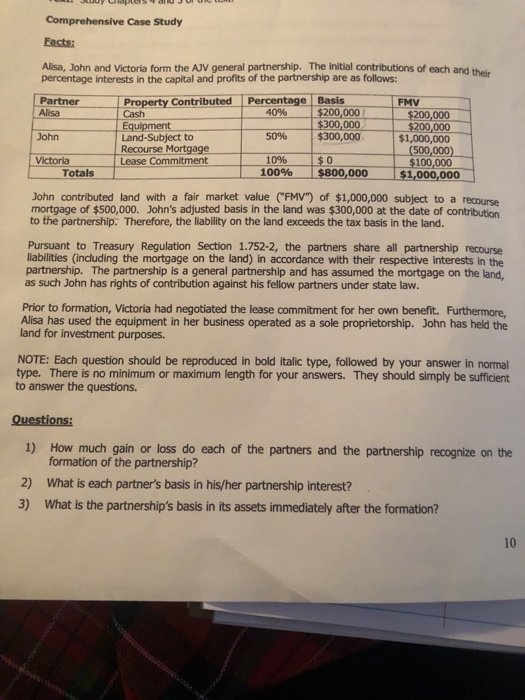

Comprehensive Case Study Facts: Alisa, John and Victoria form the AJV general partnership. The initial contributions of each and the percentage interests in the capital and profits of the partnership are as follows: Partner Alisa Property Contributed Cash Equipment Land-Subject to Recourse Mortgage Lease Commitment Percentage Basis 40% $200,000 $300,000 50% $300,000 John FMV $200,000 $200,000 $1,000,000 (500,000) $100,000 $1,000,000 Victoria Totals 10% 100% $0 $800,000 John contributed and with a fair market value CFMV) of $1,000,000 subject to a recurs mortgage of $500,000. John's adjusted basis in the land was $300,000 at the date of contribution to the partnership. Therefore, the liability on the land exceeds the tax basis in the land. Pursuant to Treasury Regulation Section 1.752-2, the partners share all partnership recourse liabilities (including the mortgage on the land) in accordance with their respective interests in the partnership. The partnership is a general partnership and has assumed the mortgage on the land, as such John has rights of contribution against his fellow partners under state law. Prior to formation, Victoria had negotiated the lease commitment for her own benefit. Furthermore, Alisa has used the equipment in her business operated as a sole proprietorship. John has held the land for investment purposes. NOTE: Each question should be reproduced in bold Italic type, followed by your answer in normal type. There is no minimum or maximum length for your answers. They should simply be sufficient to answer the questions. Questions: 1) How much gain or loss do each of the partners and the partnership recognize on the formation of the partnership? 2) What is each partner's basis in his/her partnership interest? 3) What is the partnership's basis in its assets immediately after the formation? Course Syllabus 4) When does each of the partner's holding periods for their partnership interests begin? 5) If Alisa had contributed inventory, instead of equipment, when would her holding period in her partnership interest begin? 6) When does the partnership's holding period begin with respect to the equipment and the land? 7) If the land is sold by the partnership for its fair market value how should such gain be allocated? 8) What are the tax consequences to John if the land is distributed to Alisa or Victoria? 9) What are the methods the partnership may adopt for allocating the depreciation expense on the equipment? 10) If Alisa had contributed the inventory of her sole proprietorship instead of equipment and the partnership sold the inventory within five years, what is the character of such gain or loss