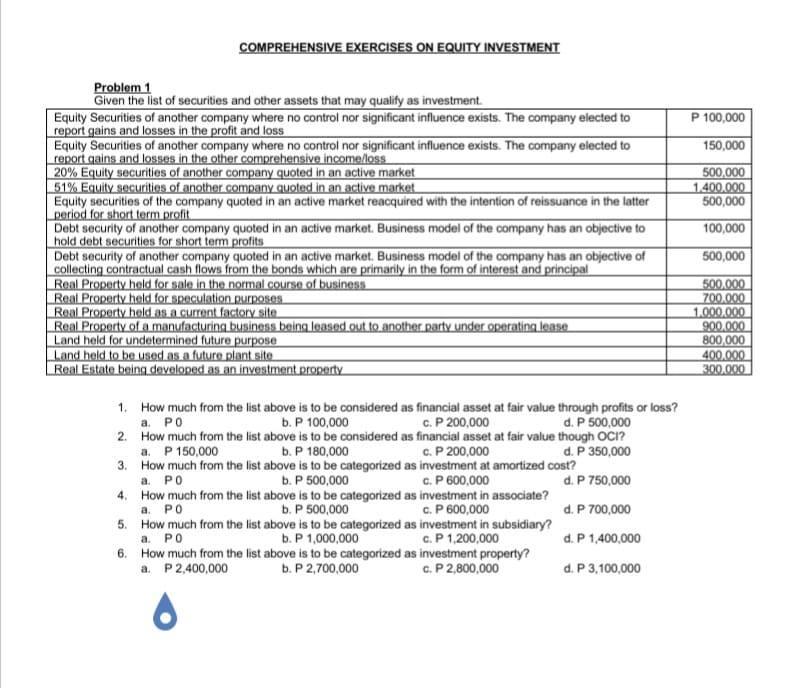

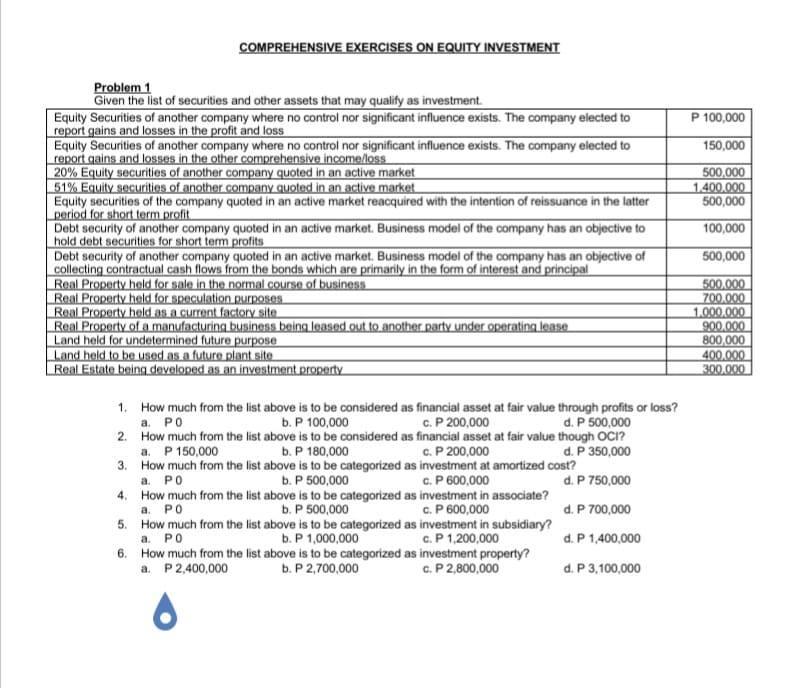

COMPREHENSIVE EXERCISES ON EQUITY INVESTMENT P 100,000 150,000 500,000 1.400.000 500,000 Problem 1 Given the list of securities and other assets that may qualify as investment Equity Securities of another company where no control nor significant influence exists. The company elected to report gains and losses in the profit and loss Equity Securities of another company where no control nor significant influence exists. The company elected to report cains and losses in the other comprehensive income/loss 20% Equity securities of another company quoted in an active market 51% Equity securities of another company quoted in an active market Equity securities of the company quoted in an active market reacquired with the intention of reissuance in the latter period for short term profit Debt security of another company quoted in an active market. Business model of the company has an objective to hold debt securities for short term profits Debt security of another company quoted in an active market. Business model of the company has an objective of collecting contractual cash flows from the bonds which are primarily in the form of interest and principal Real Property hold for sale in the normal course of business Real Property held for speculation purposes Real Property held as a current factory site Real Property of a manufacturing business being leased out to another party under operating lease Land held for undetermined future purpose Land hold to be used as a future plant site Real Estate being developed as an investment property 100,000 500,000 500.000 700.000 1.000.000 900.000 800.000 400.000 300.000 1. How much from the list above is to be considered as financial asset at fair value through profits or loss? a PO b. P 100,000 C. P 200,000 d. P 500,000 2. How much from the list above is to be considered as financial asset at fair value though OCI? a. P 150,000 b. P 180,000 C. P 200,000 d. P 350,000 3. How much from the list above is to be categorized as investment at amortized cost? a. PO b. P 500,000 C. P 600,000 d. P 750,000 4. How much from the list above is to be categorized as investment in associate? a. PO b. P 500,000 c. P 600,000 d. P 700,000 5. How much from the list above is to be categorized as investment in subsidiary? a. PO b.P 1,000,000 C.P 1.200,000 d. P 1.400,000 6. How much from the list above is to be categorized as investment property? a. P 2,400,000 b. P 2,700,000 C. P 2,800,000 d. P 3,100,000 COMPREHENSIVE EXERCISES ON EQUITY INVESTMENT P 100,000 150,000 500,000 1.400.000 500,000 Problem 1 Given the list of securities and other assets that may qualify as investment Equity Securities of another company where no control nor significant influence exists. The company elected to report gains and losses in the profit and loss Equity Securities of another company where no control nor significant influence exists. The company elected to report cains and losses in the other comprehensive income/loss 20% Equity securities of another company quoted in an active market 51% Equity securities of another company quoted in an active market Equity securities of the company quoted in an active market reacquired with the intention of reissuance in the latter period for short term profit Debt security of another company quoted in an active market. Business model of the company has an objective to hold debt securities for short term profits Debt security of another company quoted in an active market. Business model of the company has an objective of collecting contractual cash flows from the bonds which are primarily in the form of interest and principal Real Property hold for sale in the normal course of business Real Property held for speculation purposes Real Property held as a current factory site Real Property of a manufacturing business being leased out to another party under operating lease Land held for undetermined future purpose Land hold to be used as a future plant site Real Estate being developed as an investment property 100,000 500,000 500.000 700.000 1.000.000 900.000 800.000 400.000 300.000 1. How much from the list above is to be considered as financial asset at fair value through profits or loss? a PO b. P 100,000 C. P 200,000 d. P 500,000 2. How much from the list above is to be considered as financial asset at fair value though OCI? a. P 150,000 b. P 180,000 C. P 200,000 d. P 350,000 3. How much from the list above is to be categorized as investment at amortized cost? a. PO b. P 500,000 C. P 600,000 d. P 750,000 4. How much from the list above is to be categorized as investment in associate? a. PO b. P 500,000 c. P 600,000 d. P 700,000 5. How much from the list above is to be categorized as investment in subsidiary? a. PO b.P 1,000,000 C.P 1.200,000 d. P 1.400,000 6. How much from the list above is to be categorized as investment property? a. P 2,400,000 b. P 2,700,000 C. P 2,800,000 d. P 3,100,000